Published: 2024-10-30T14:47:36.000Z

Preview: Due October 31 - U.S. Q3 Employment Cost Index - Matching Q2, trend slowing only gradually

1

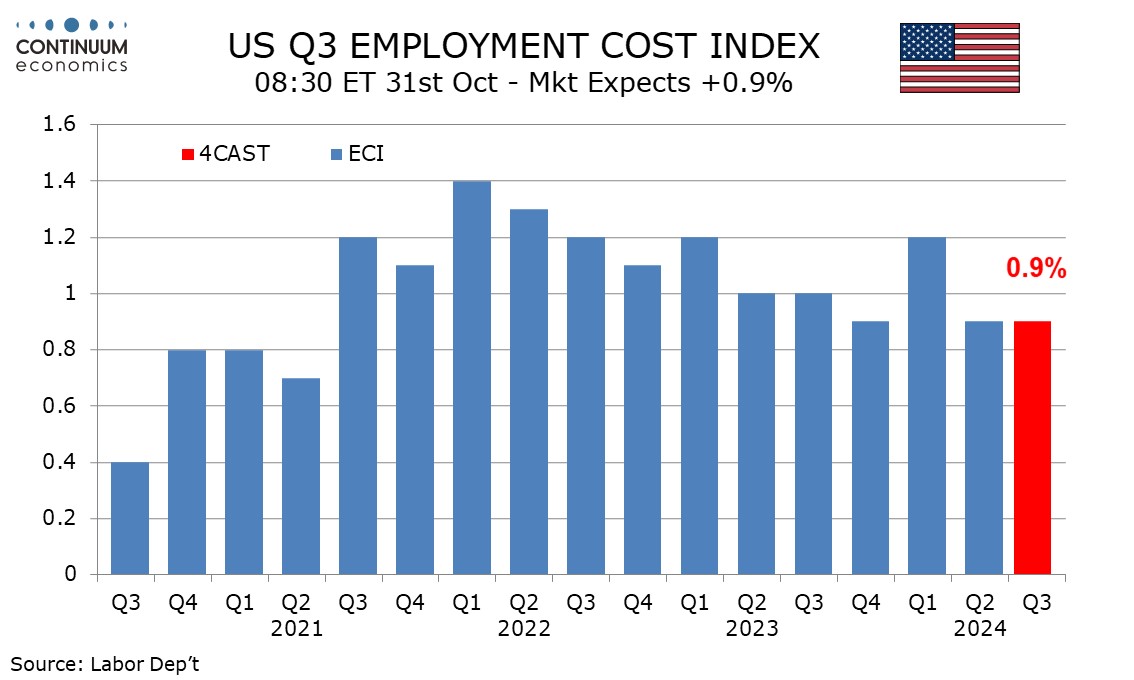

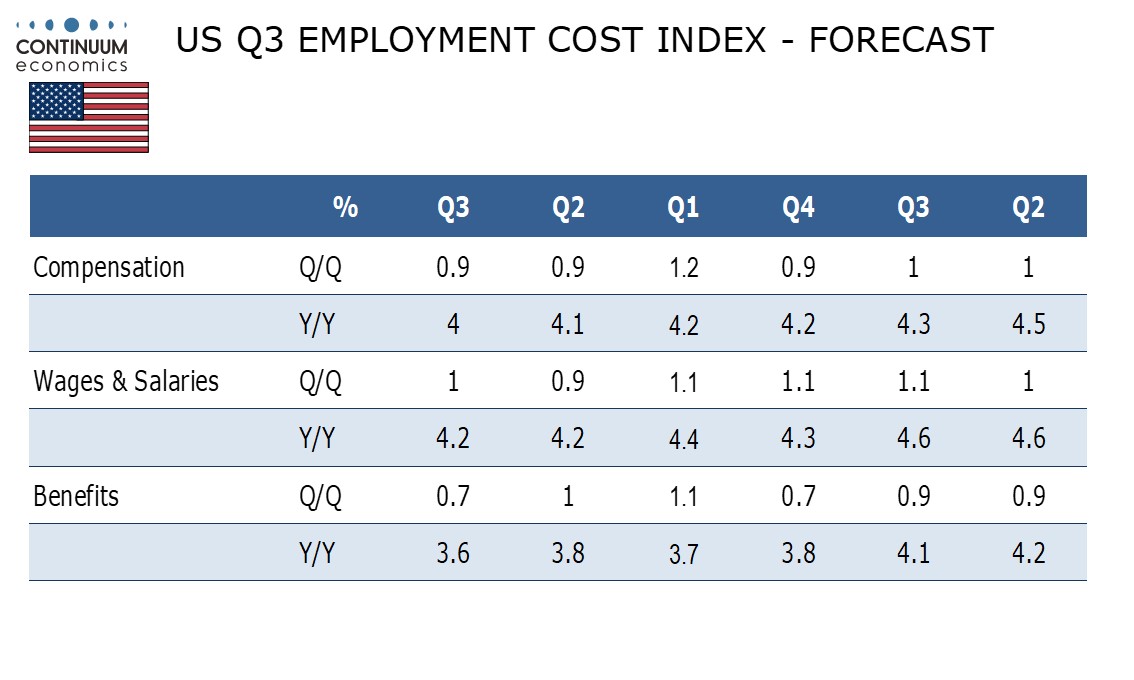

We look for the Q3 employment cost index (ECI) to increase by 0.9%, matching the gain of Q2, though with slightly firmer growth in wages and salaries offset by a slowing in benefit costs.

We expect wages and salaries to increase by 1.0% after a 0.9% rise in Q2, and this is consistent with wages and salaries data in the Q3 non-farm payroll. It would still mark a softening from three straight quarterly gains of 1.1% ending in Q1 2024.

We expect a 0.7% increase in benefit costs, significantly below a 1.0% increase in Q2 and a 1.1% increase in Q1 but matching the outcome of Q4 2023. Slower growth in medical care CPI in Q3 implies some restraint to benefit costs.

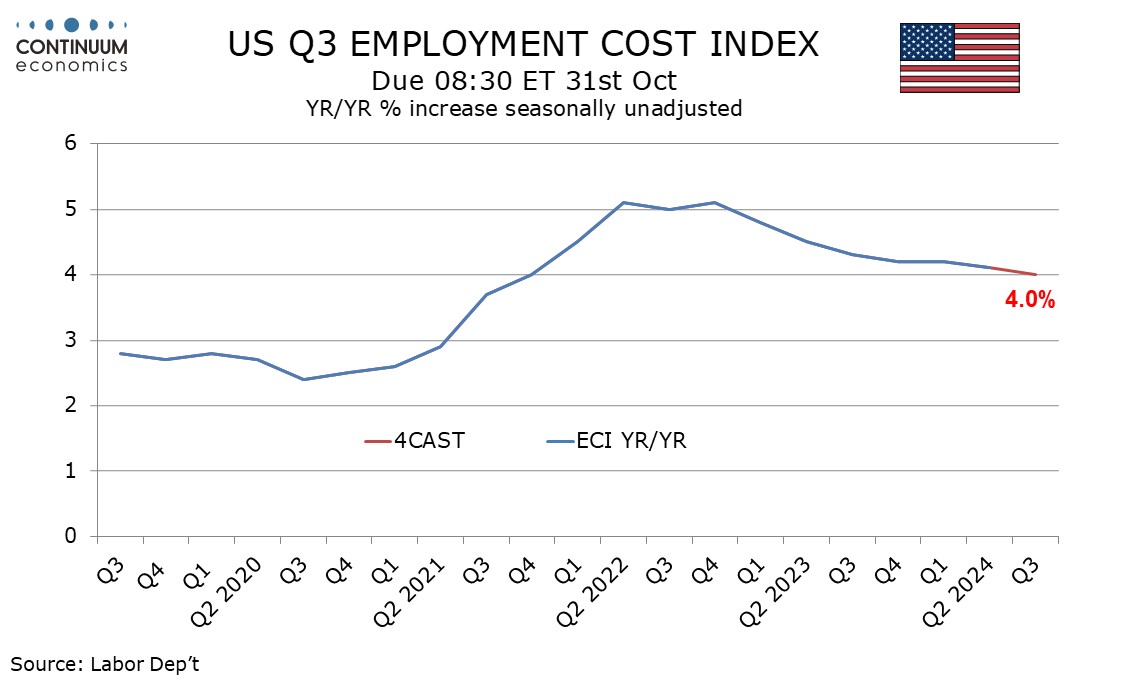

We expect yr/yr ECI growth to continue a gradual slowing, to 4.0% from 4.1% in Q2, which would be the slowest since a matching Q4 2021. This would however remain well above the pre-pandemic trend which was running slightly below 3.0% yr/yr.