Brazil CPI Review: Inflation at 0.3% (m/m) in November

In November, the Brazilian National Statistics Institute (IBGE) reported a 0.3% (m/m) increase in the CPI, meeting market expectations. Consequently, Y/Y inflation dropped to 4.7% from October's 4.8%. Food and Beverages CPI accelerated to 0.6% (m/m), with onions and meat prices contributing. Transport group growth was driven by a 29% surge in airfare tickets, while fuel prices decreased. Services CPI increased 0.7%, raising Y/Y inflation to 6.0%. Despite concerns, we view this as transitory, linked to airfare tickets. The lagged effects of monetary policy are evident, with November's moderate CPI numbers reflecting weaker demand. This is likely to bolster the Brazilian Central Bank's (BCB) confidence in continuing the gradual 50bps interest rate cut. Looking ahead to 2024, current market expectations align with a 4% increase, surpassing the BCB target. However, if inflation continues to fall, inertia for 2024 may diminish, and expectations could converge closer to the 3% BCB target.

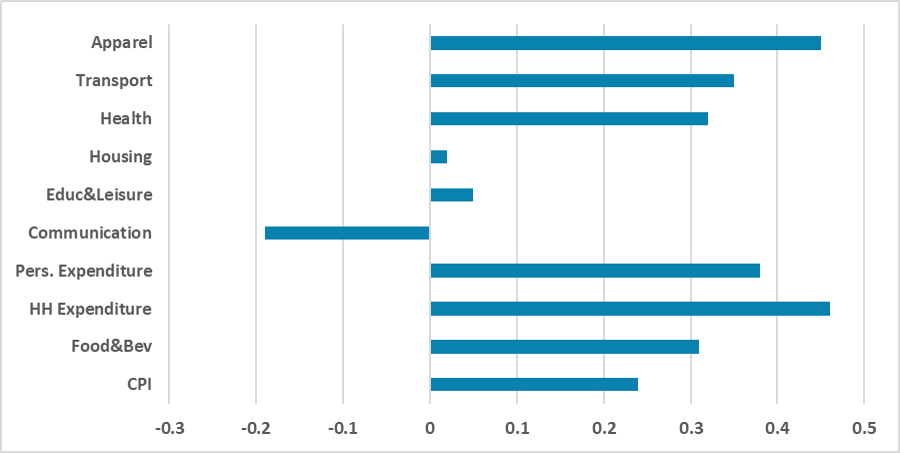

Figure 1: Brazil CPI by Groups (%, m/m)

Source: IBGE

The Brazilian National Statistics Institute (IBGE) has release the CPI figure for November. The figures show a 0.3% (m/m) increase, in line with market expectations (0.3%). Therefore, Y/Y inflation has fell to 4.7% from 4.8% on October. Food and Beverages CPI have grown 0.6% (m/m) accelerating from October (0.3%). The biggest contribution for this increase is the price of onions, which grew 26% in the month, and the price of meat, which increase 1.2% in the month. At the moment, Y/Y Food and Beverage CPI stands at only 0.5%.

The growth in the Transport group was a consequence of the increase on airfares tickets which registered a 29% increase on October, due to stronger demand. Fuel prices have decreased in line with lower distribution prices from Petrobras. Gasoline prices have decreased 1.6% in the month while ethanol has decreased 1.9%. Diesel oil prices have increased 0.9% in the month. Electricity prices has decreased 1.1% in the month, influencing the Housing CPI (0.4% m/m).

Services CPI has grown 0.7% during the month but has been influenced by the airfare tickets. Services inflation have been showing some persistence and registered a rise on its Y/Y index to 6.0%. This rise will cause some concern on the BCB which monitors closely services CPI number. We believe that this rise was transitory, mainly affected by the airfare tickets which will be reverted as we pass the vacations period.

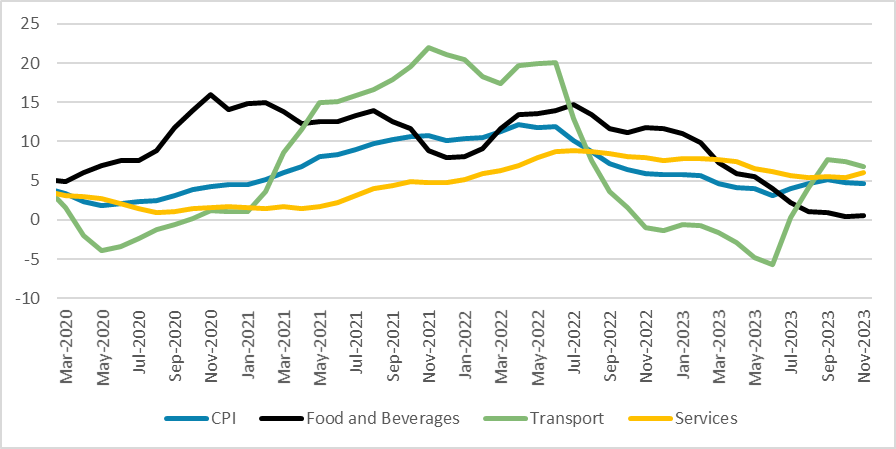

Figure 2: Brazil CPI by Groups (%, m/m)

Source: IBGE

The lagged effects of the monetary policy are starting to affect both activity and the CPI numbers. We believe the moderate numbers registered by the CPI in November is a consequence of weaker demand. This numbers will boost the confidence of the Brazilian Central Bank (BCB) to keep cutting the interest rate in the next meetings, although we do not see them deviating from the current 50bps pace. It will be interesting to see how the CPI number behave during 2024. At the moment, market expectations are aligned with a 4% increase which is higher than the BCB target, but if inflation keep falling, inertia for 2024 will diminish and expectations should fall closer to the 3% BCB target.