FX Daily Strategy: N America, September 18th

FOMC the main focus on Wednesday

Market sees 50bp hike as most likely so scope for USD gains on a 25bp cut

GBP slightly firmer after UK CPI

FOMC the main focus on Wednesday

Market sees 50bp hike as most likely so scope for USD gains on a 25bp cut

GBP slightly firmer after UK CPI

Most of the focus on a busy Wednesday will be on the FOMC decision. According to Nick Timiraos, the WSJ journo widely seen as the Fed mouthpiece “The Fed faces a finely balanced set of considerations over whether to cut by 25 or 50 basis points…The case for 50 comes down to what Fed officials call risk management but what might be thought of as regret minimization. If you cut 50 here and you think the Fed will need to cut again after that, you are unlikely to regret such a cut even if the economy chugs along between now and your next meeting. But if you cut 25 and things worsen a lot in the coming weeks, you'll feel bigger regret as you'll be behind the curve. The case for 25 boils down to some combination of 1) process issues (i.e., 50 will signal something more urgent; there's an election soon; communications were not explicit enough about 50 in the run-up to this meeting), 2) a view that the economy is doing just fine and will continue to do so with more gradual reductions, and 3) that because financial conditions are easy (in part because markets expect the Fed to deliver a string of cuts), igniting risk assets could make it harder to finish the inflation fight.”

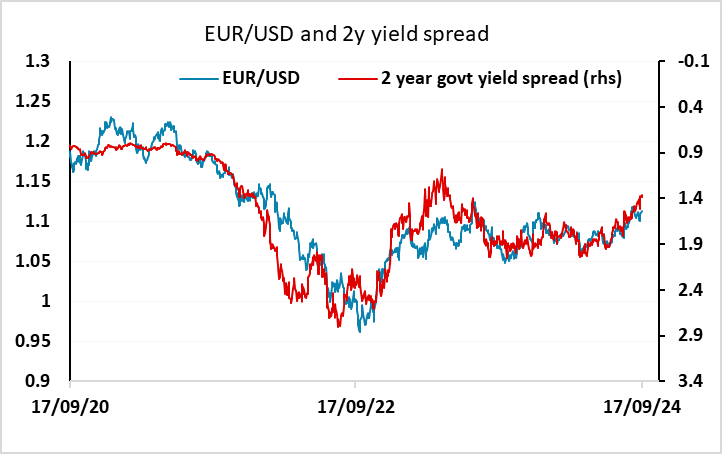

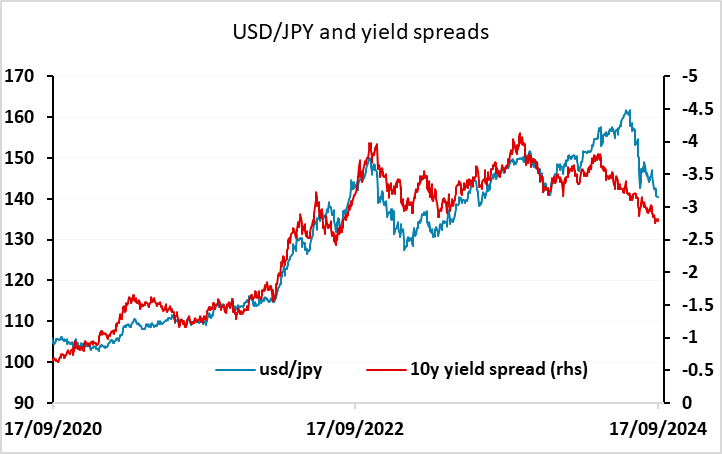

The tone of this sounds as if 50 should be favoured, and the market is priced for a 65% chance of a 50bp cut. The reaction would therefore be greater to a 25bp cut, even if the impact is moderated by comparatively dovish comments from Fed chair Powell. The USD has been weakening through the last week as the market has moved towards pricing in a 50bp cut, although it did manage a modest rally on Tuesday in the wake of stronger than expected retail sales and industrial production data. We see the call as a close one between 25bps and 50bps, but the press reports aren’t enough to persuade us to change our call from 25bps. This suggests we will see a USD rally on the news. A 25bp cut will also be seen as disappointing for risk assets. Initially, expect USD gains to be fairly even across the board, but if equities prove resilient to higher yields, the JPY should be expected to suffer more. However the message of the reports is that the slightly disappointing August CPI does not exclude a 50bps move, and that whichever option the Fed does choose for September, markets should not assume a string of moves of equal magnitude. Bigger picture, we still expect the USD to soften over the course of the year, with the JPY likely to be the biggest beneficiary.

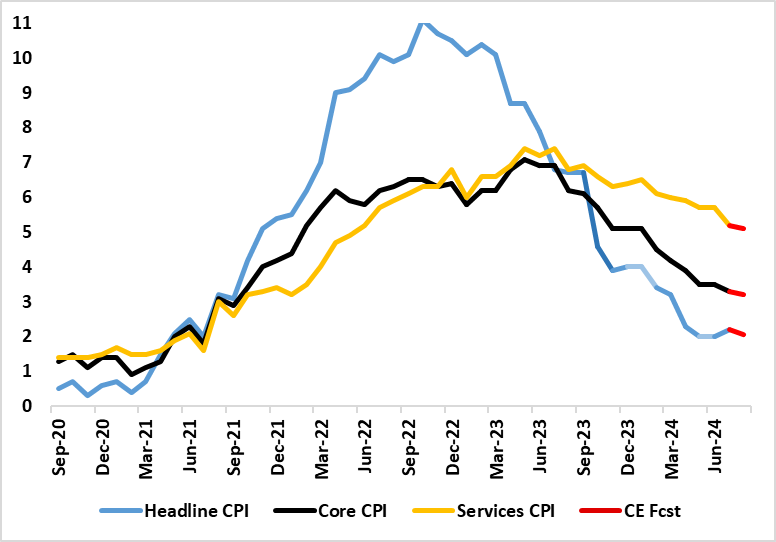

UK CPI forecasts

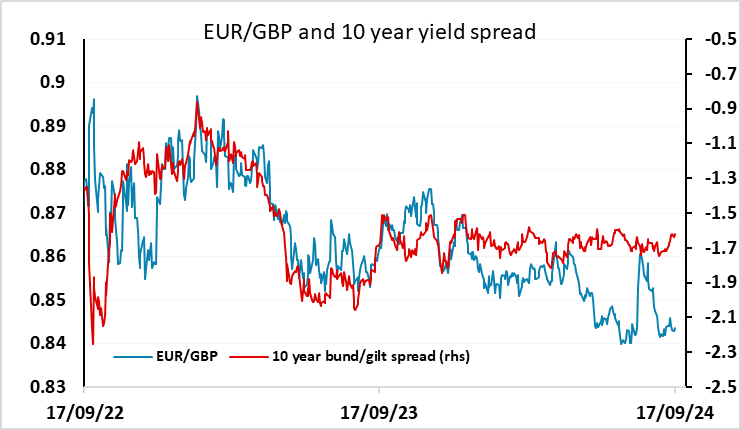

UK CPI has come in in line with expectations, and GBP has risen modestly in response. The reaction probably reflects the view that the rise in core CPI to 3.6% y/y in August from 3.3% in July will prevent the BoE MPC from cutting rates tomorrow. While the CPI data was as expected, the risks were on the downside, and a weaker than expected number might have increased the chances of a rate cut tomorrow. EUR/GBP had in any case struggled to recover above 0.8450. However, the market may still reconsider if the FOMC decide to cut rates 50bps this evening, but with risk sentiment also slightly improving, GBP looks likely to remain well supported near term. Even so, it is getting expensive here, and some more convincing evidence of strength in the UK economy in H2 looks necessary if EUR/GBP is to break below 0.84.