Published: 2025-04-01T14:16:07.000Z

USD, EUR, JPY flows: USD lower on ISM

2

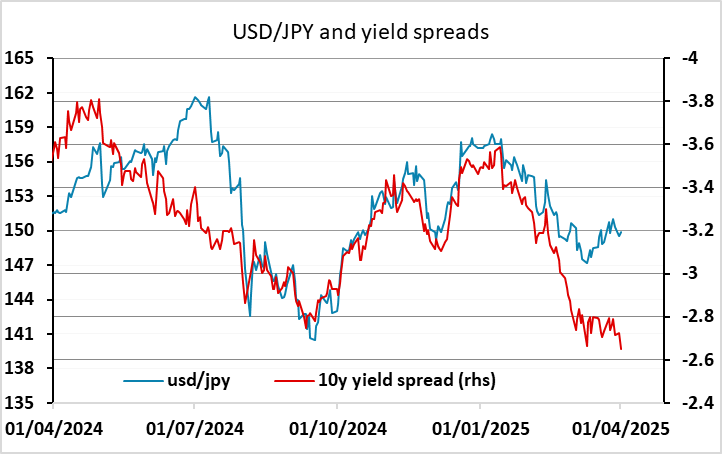

A weak ISM survey pulling the USD lower against the JPY in particular

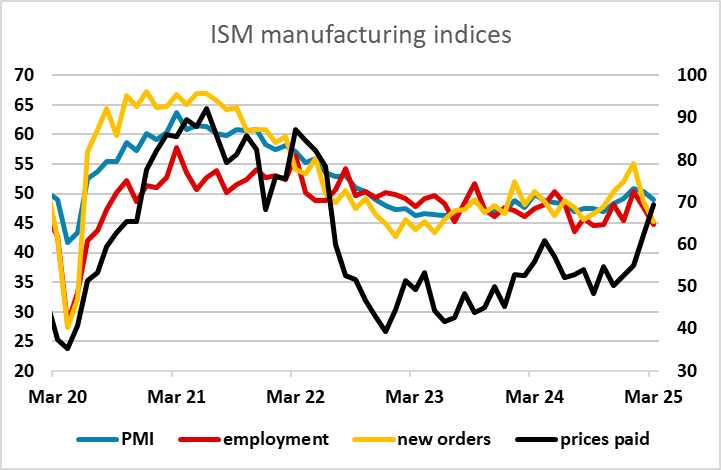

US ISM manufacturing survey has come in generally weak but with the prices paid index at its highest since July 2022. The employment and new orders indices are at their lowest since September 2024 and May 2023 respectively, suggesting downside risks going forward. Equities US yields and USD/JPY are all lower on the news, and the reaction suggests the USD is unlikely to benefit from aggressive tariff increases tomorrow, with the survey data suggesting that the manufacturing sector is already struggling and tariff increases will create further pressure. The USD is a touch weaker against the EUR as well but USD/JPY continues to look to have much the most downside scope.