EUR, GBP, AUD flows: EUR risks lower as French inflation eases

EUR edges slightly lower after French CPI, riskier currencies well supported by equity strength

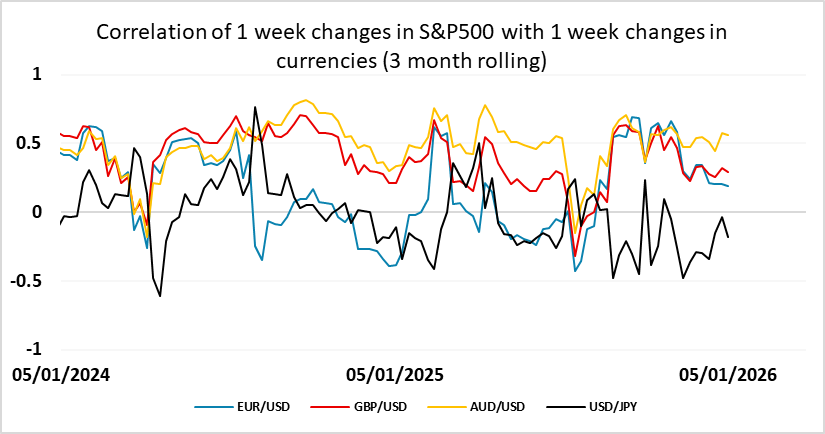

French preliminary December CPI has come in a little weaker than expected at 0.1% m/m, 0.7% y/y (HICP basis), adding to our suspicion that the ECB still has scope to ease further due to declining inflation pressures. Obviously this is just one month and one country, and the German data later this morning will be more significant but also far from conclusive in guiding ECB policy. Even so, our impression is that the inflation risks are on the downside, and the risk for ECB rates similarly, so that with the current flat EUR curve the risks for the EUR are also lower. The EUR has edged slightly lower after the data. The positive tone to equity markets continues to be mildly supportive for the EUR and particularly the riskier currencies. AUD and GBP are particularly strong performers so far this week. But we see more limited upside for equities as the S&P500 once again comes close to new record highs.