GBP, EUR, CAD flows: GBP softer after weak May GDP

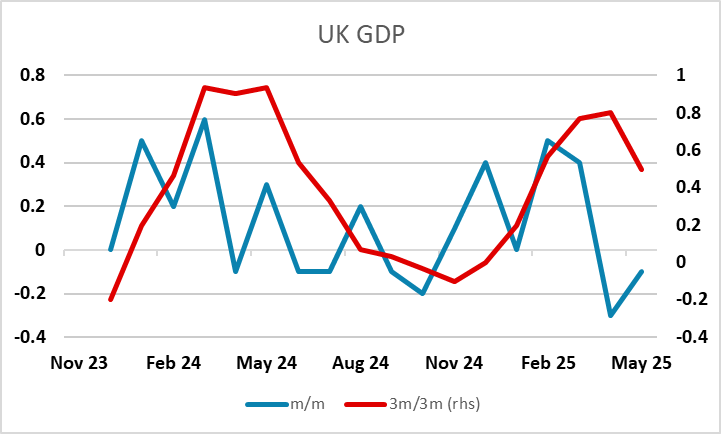

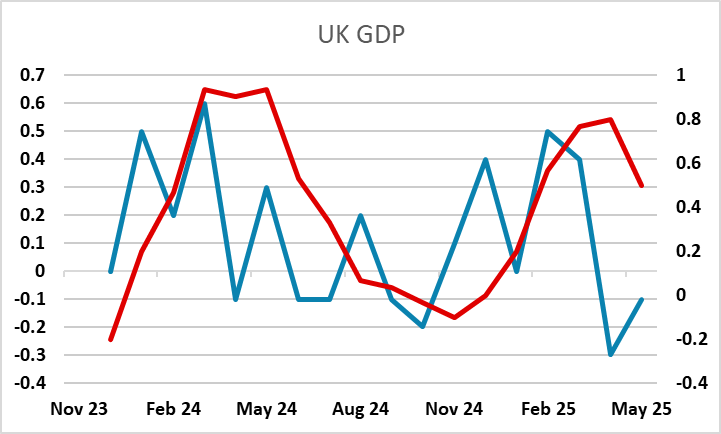

GBP weakens as May shows another drop in GDP. Trend is weakening although latest 3m/3m number is flattered by upward revision to March

EUR/GBP has gained 10 pips after the May GDP data came in at -0.1%, well below the consensus 0.1% gains. However, the weaker May number was offset slightly by an upward revision to the March data to 0.4% from 0.2%, while the April decline of 0.3% was unrevised. This means that the 3m/3m gain was a little stronger than expected at 0.5% in May, but this is somewhat illusory, as the strength is based entirely on Q1 gains. A flat number in June would mean Q2 would likely record 0.1% growth, but the prospects for Q3 would be poor with a weak base in Q2.

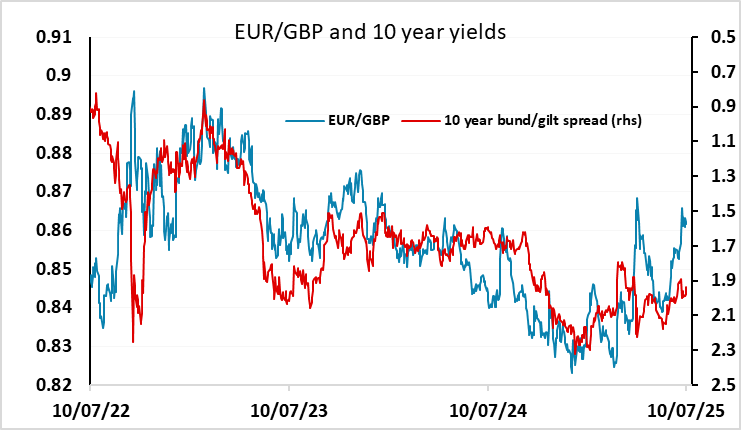

So despite the March revisions, the forward looking prospects for UK GDP are poor, especially since the Budget in the autumn is likely to introduce some fairly major tax increases to deal with the current budget shortfalls. All this means easier monetary policy is likely over the next year. As it stands, there are two rate cuts priced in over the rest of the year, and three by this time next year. The risk looks to be clearly towards the downside, particularly in 2026, so there is scope for declines in UK front end yields from here. Real yields seem likely to converge on Eurozone levels in the next couple of years, suggesting scope for EUR/GBP to move above 0.90, but without major shocks this is still likely to be a slow process.

Short term, much will depend on the decision from the Trump administration on tariffs, particularly on the EU. After the overnight announcement of a 35% tariff on imports from Canada overnight, the risk is that a similar number is announced for the EU. While these may all be negotiated away, the risks for the short term may be to the CAD and EUR downside, and this could prevent much of a EUR/GBP gain near term. While the tariff announcement in early April actually led to USD losses, markets now seem more focused on the risks elsewhere and we would expect the USD to perform better in the short run, at least until or unless evidence emerges of damage to the US economy.