FX Weekly Strategy: N America, June 9th-13th

Risk positive market tone keeping the JPY under pressure

Risk premia look too low, but no obvious trigger for near term rise

GBP should start to weaken against EUR as UK earnings growth declines

AUD and NOK have potential to extend gains in risk positive market

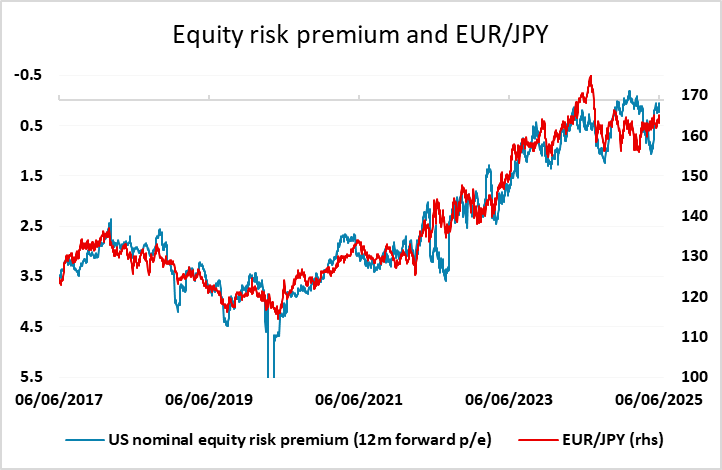

The market greeted the US employment report last week positively, even though it was objectively no better than neutral, with downward revisions to March and April employment data offsetting the slightly stronger May numbers. The slightly stronger than expected average earnings rise provided some minor justification for the positive market reaction, but we continue to see the equity market to be pricing in an overoptimistic view of the world, with the US equity risk premium still close to the lows seen in the early 2000s. Such a positive view would be hard to justify even if there was no threat of a slowdown due to the imposition of tariffs, as it is hard to see above trend growth when the economy is starting at full employment. But given the risks related to tariffs, the implied expectation of superior earnings growth looks extremely unrealistic.

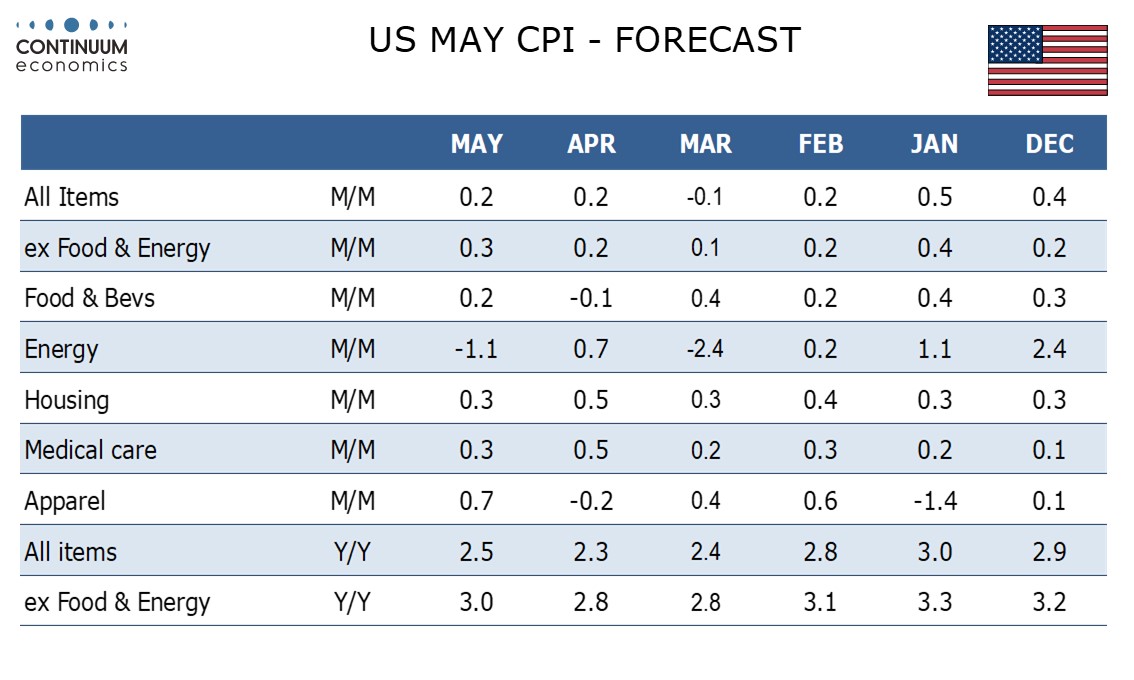

Having said this, it looks like it will require clear evidence of US economic weakness if we are to see rising risk premia and lower equities. In the absence of such news, the positive risk tone seen on Friday may extend, with the JPY being the biggest casualty in the FX market. The (inverse) correlation of EUR/JPY with the US equity risk premium is well established, and the decline in the risk premium on Friday triggered a break to new EUR/JPY highs for the year. We may yet see a break through the October 2024 high at 166.70, with a technical target around 167.40. However, we would regard these moves as unsustainable and likely to see a sharp reversal if and when evidence of US slowdown emerges. A significant increase in US CPI this week due to tariffs could trigger a reversal in sentiment, but our forecast of a relatively modest 0.2% rise is unlikely to disturb things unduly, even though it does imply some tariff impact. So for now it remains hard to oppose the risk positive market tone, and the JPY still looks likely to struggle on the crosses.

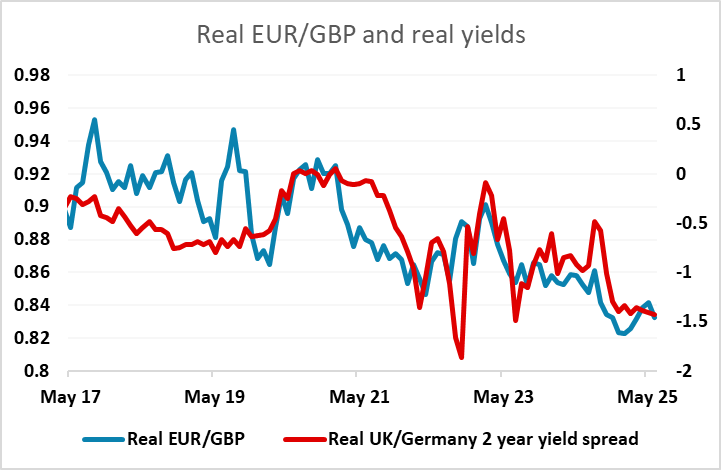

Other than the US CPI this week sees some significant UK numbers in the form of labour market and April GDP data. Concern about wage growth has been one of the major factors behind the reluctance of the UK MPC hawks to cut rates more aggressively, but this week’s data could some evidence of a sharper slowdown in wages. GBP has remained well supported in the more risk friendly environment of recent weeks, but EUR/GBP has shied away from a clear break below 0.84, and this week’s data could trigger a move back up towards 0.85. The less dovish tone to the ECB statement and press conference last week combined with some hopes of more aggressive easing from the UK MPC would certainly justify some weakening in the pound, which is trading at historically expensive levels in real terms. There is also some risk to UK confidence form the spending review due this week, so risks for GBP look to be on the downside.

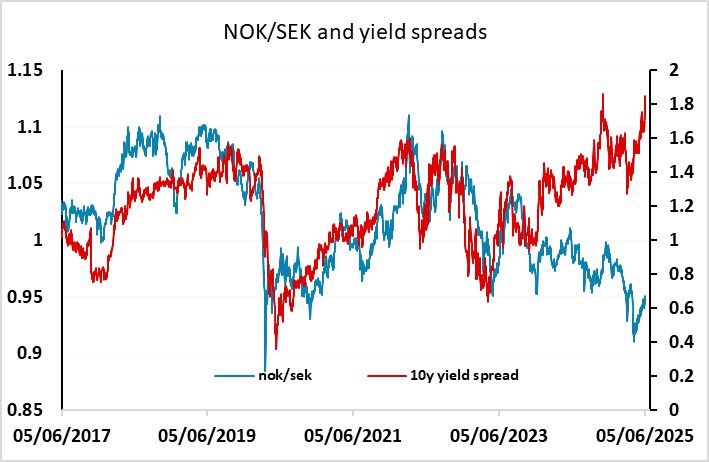

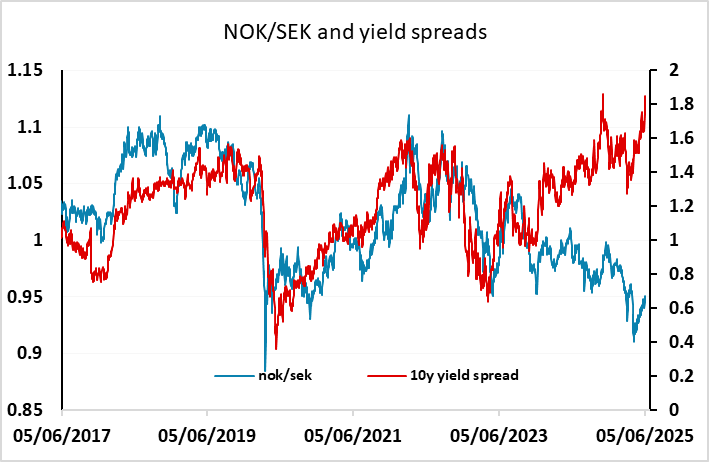

In a more risk positive environment the currencies that have most potential to outperform are the AUD and the NOK, both of which have dramatically underperformed their historic yield spread relationships over the past year. However, AUD/USD now looks well established above 0.64, and we see particular scope for AUD/CAD gains from here, with the AUD also less at risk from tariffs and US slowdown.

NOK/SEK has yet to fully reverse the move lower seen after the reciprocal tariff announcement in April, but looks even more undervalued after last week’s weaker than expected Swedish CPI data which increased the chances of a Riksbank rate cut at the June 18 meeting.

Data and events for the week ahead

USA

US focus will be on inflation data, with May CPI due on Tuesday and May PPI due on Thursday. We expect gains of 0.2% overall in each series, with both seeing 0.3% gains ex food and energy. This would show the impact from tariffs remaining limited, but picking up from April.

April wholesale trade is due on Monday, and May’s NFIB small business optimism index follows on Tuesday. Wednesday sees May budget data. On Thursday weekly initial claims will be watched closely to see if recent gains are sustained, as will Friday’s preliminary Michigan CSI for June. That May’s final reading was stronger than its preliminary hints at a further recovery in June.

Canada

Canada releases April building permits on Wednesday and Q1 capacity utilization on Friday. Friday also sees April manufacturing and wholesale sales, for which preliminary estimates were for declines of 2.0% and 0.6% respectively.

UK

Tuesday sees the next set of labor market numbers where apparent wage resilience has perturbed some MPC members. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data) is likely to see clear drops in the official earnings data of up to 0.5 ppt at least for regular pay. Otherwise, the HMRC numbers are likely to show that employment is continuing to contract and maybe more broadly so.

Thursday sees GDP data for April. After two successive upside surprises, a correction back in monthly GDP could be expected, especially as Q1 numbers may have been boosted by added production destined for the U.S in anticipation of tariffs. In addition, real estate activity seems to have slumped after the raising of effective stamp duty in April. But we already know that retail sales rose clearly in the month and it is hard to see GDP moving dramatically in the opposite direction as a result. Moreover, activity (at least outside of utilities) may have been boosted elsewhere by record sunshine and temperatures during April, this the likely reason behind the retail sales jump. Combining these factors, we see a flat m/m April GDP outcome, enough to pull the 3-mth rate t0 an 11-month high of 0.8% (Figure 1) and where it may be difficult for Q2 GDP to be negative. Friday sees the BoE household inflation expectations survey and more labor insights from the REC survey.

There is also the Government Spending Review (Wed) where politics rather than economics come to the fore. The Review will allocate more than already agreed £600 bn each year and where average y/y growth is seen at around 1.25%, but with a clear slowing occurring toward the end of the 5-year outlook, in which capital spending growth may even turn negative. Key decisions include allocating more on health and defence spending and where to squeeze elsewhere – and how?

Eurozone

After this month’s conventional policy update from the ECB, financial policy comes onto the radar screen with the annual Conference on Financial Stability and Macroprudential Policy (Tue/Wed). There are also a series of individual ECB Council speakers, with Holzmann and Villeroy offering likely contrasting views on Tuesday. The ECB may also produce more wage data with its wage tracker -- tentatively due on Wednesday. There is little data wise with construction and trade data (both Fri) likely to show weakness

Rest of Western Europe

There are few key events in Sweden, most notably monthly production and the April GDP indicator on Tuesday, albeit the latter having provided inaccurate signs of actual official activity. There is also May CPI details arriving Friday. Elsewhere, Tuesday sees consumer confidence data from Switzerland while CPI data are due from Norway too on the same day and where we see an undershoot of the Norges Bank’s 3.1% y/y for the CPI-ATE measure. The Norges Bank also releases its closely watched regional survey on Thursday.

Japan

Kick starts the week with official GDP. The preliminary came in as a contraction and we are unlikely seeing a positive revision, but only a deep negative revision will be market moving. The other interesting data are PPI on Wednesday and Industrial Production on Friday.

Australia

Consumer inflation expectation on Thursday will be the most important release for Aussie next week. There is also consumer confidence and business confidence on Tuesday.

NZ

Only Business PMI on Thursday for NZ.