Published: 2024-04-08T06:52:31.000Z

EUR, JPY, CHF flows: Better risk tone, EUR has scope for recovery

Senior FX Strategist

1

Risk appetite reocverign, EUR may get support from better German production

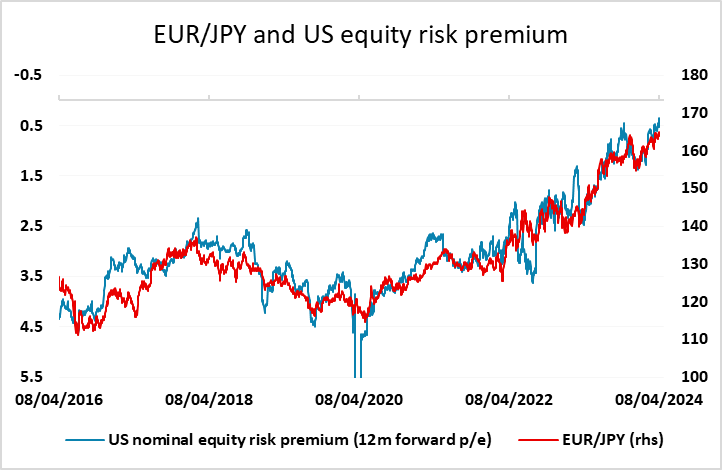

Risk sentiment recovered by the end of Friday’s session after the dip on Middle East concerns. The nominal US equity risk premium has reached another new low for this cycle this morning, as US yields have risen and equities remain resilient. This has triggered some recovery in the risk sensitive currencies, and the JPY is softer again on the crosses, with EUR/CHF also retracing some of Friday’s losses. There may now be further to go unless we see some Iranian action against Israel, with new highs achievable in EUR/JPY and EUR/CHF.

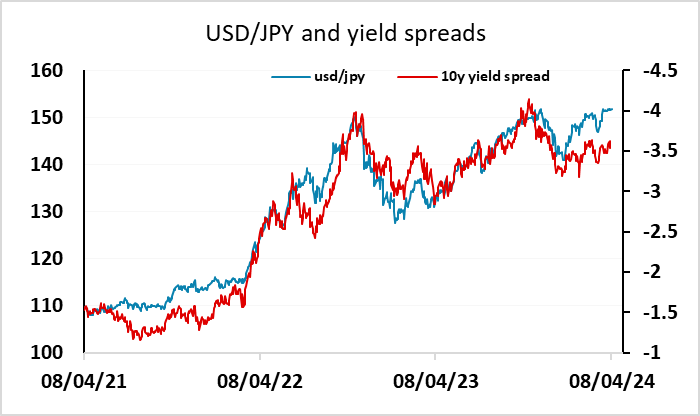

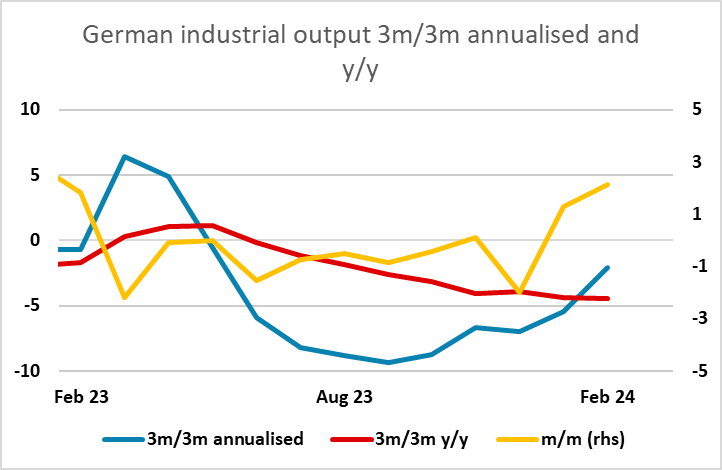

There isn’t a great deal on the calendar today, with the German industrial production data already released the only data of significance. This was very much on the strong side of expectations, and signs of a mild recovery in the trend are starting to emerge. This will also tend to support the recovery in EUR/JPY and EUR/CHF. With USD/JPY close to intervention levels, and gains not really supported by yield spreads, the upside risks may be greater in EUR/USD.