Published: 2024-11-06T13:23:37.000Z

Preview: Due November 22 - U.S. November S&P PMIs - Manufacturing slightly weaker, Services still strong

4

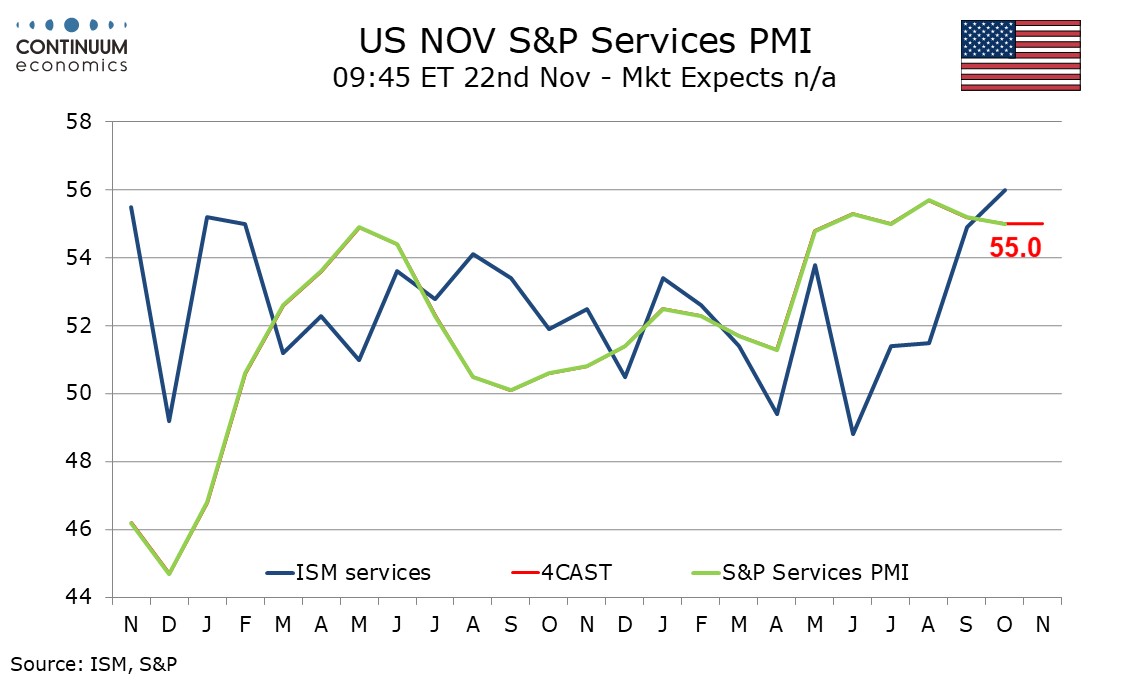

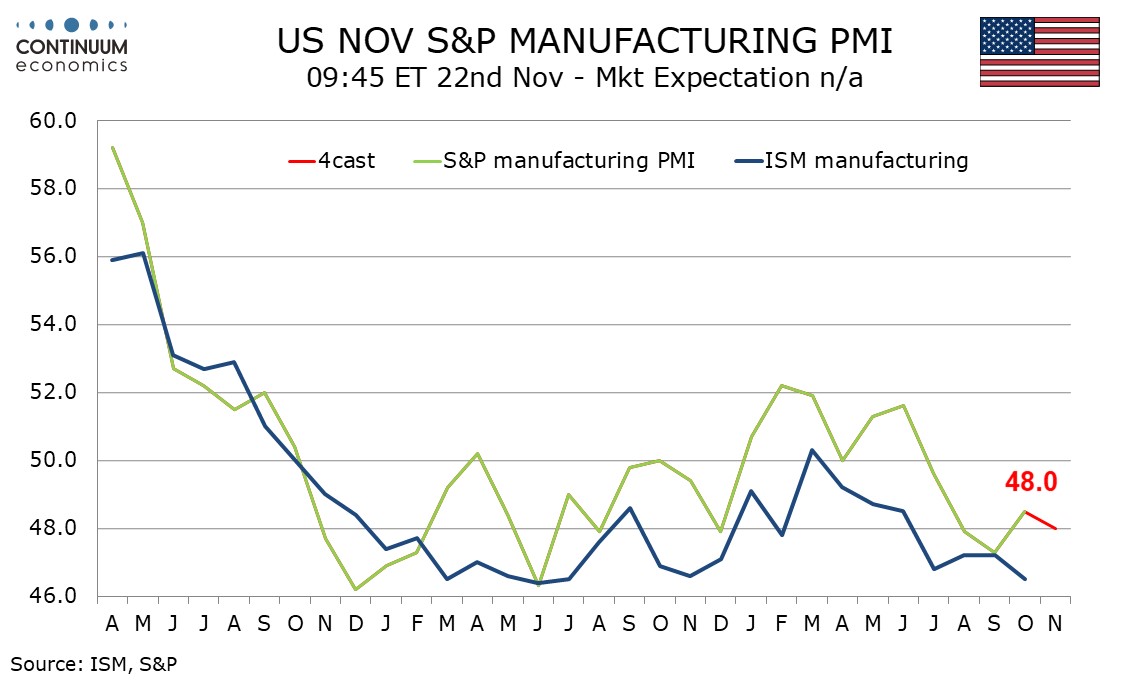

We expect November’s S and P PMIs to show a marginal slippage in manufacturing to a still weak 48.0 from 48.5 but with services unchanged at a healthy 55.0.

The manufacturing index would still be above the preliminary October reading of 47.8, but down from the final 48.5. While the improvement in the second half of October is supportive for further recovery in November a softer October ISM manufacturing index argues in the opposite direction.

The S and P service indices has now been stable around 55 for six straight months and we do not expect much change in October. ISM services data has recently been more volatile, moving above the S and P index in October, though this rise, led by a sharp bounce in delivery times, may prove difficult to sustain and is probably not a signal for November’s S and P services PMI.