USD/JPY, EUR/JPY flows: JPY weak as BoJ comments play down risks of rate hike

Bloomberg reports indicate BoJ sees little need to end negative rates in December, pushing JPY lower. Bigger picture JPY gains still likely, but may have to wait until next week

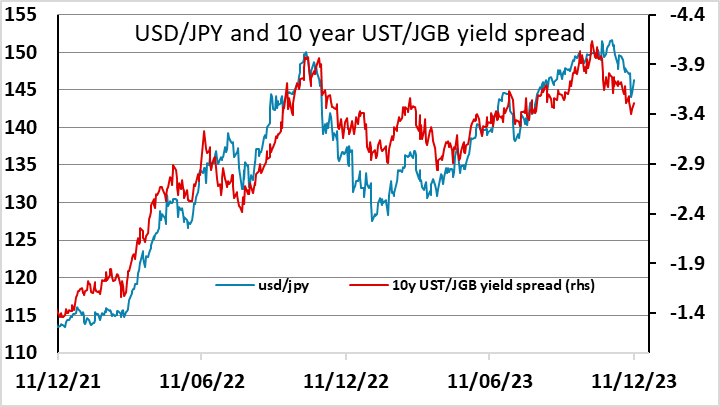

USD/JPY has gained a figure this morning on a Bloomberg report that the BoJ sees little need to end negative rates in December. Having surged strongly on the comments from BoJ governor Ueda last week, there were no doubt a few short term short positions in the market, although a lot of the JPY gains after Ueda were likely due to unwinding of JPY shorts. However, this morning’s comments don’t really contradict anything Ueda said. His comments also didn’t suggest there would be a rise in the policy rate this month, but focused on the likely need for an exit from ultra-easy policy next year. The statement at next week’s BoJ meeting may therefore re-ignite JPY gains.

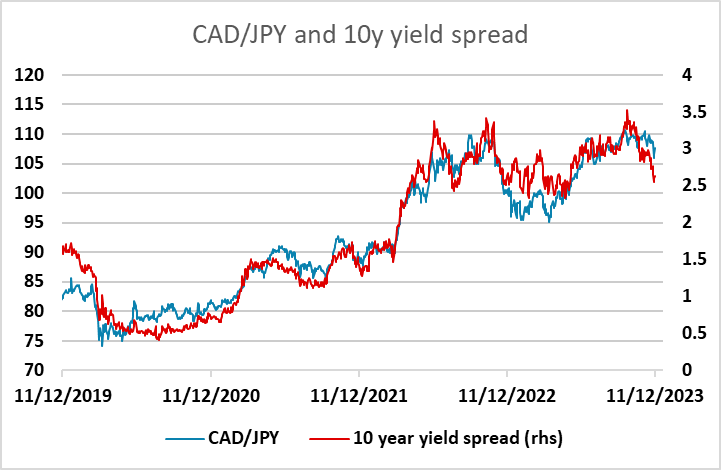

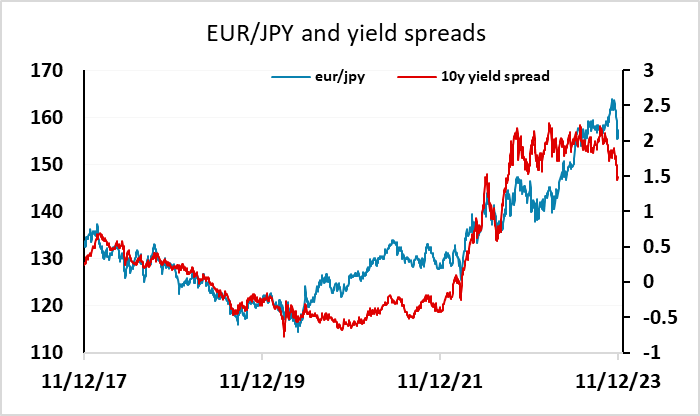

However, the focus is on central bank meetings, and the risk in this week’s meetings in the US and Europe may be to pare down the expected rate cuts. So although the JPY decline this morning looks overdone, and yield spreads still suggests potential for significant JPY gains, we may have to wait until next week for renewed JPY strength.