FX Daily Strategy: N America, January 8th

USD focus on Friday’s employment report and Supreme Court ruling

Risks are tow way, but nerves around the Supreme Court could weigh initially

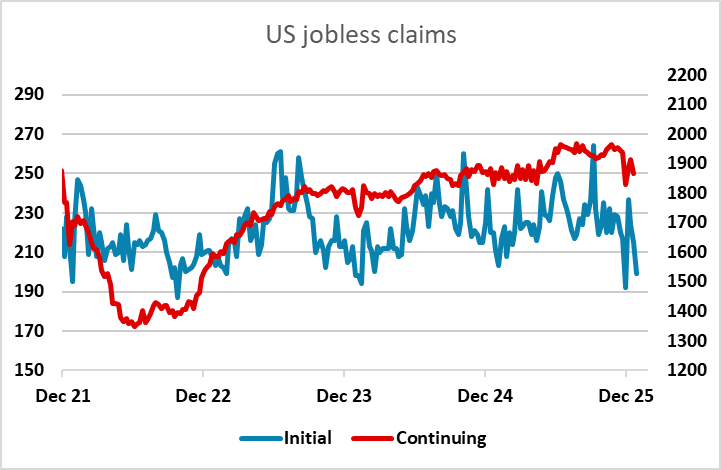

Jobless claims data unlikely to support a USD negative picture

EUR starting to look vulnerable

USD focus on Friday’s employment report and Supreme Court ruling

Risks are tow way, but nerves around the Supreme Court could weigh initially

Jobless claims data unlikely to support a USD negative picture

EUR starting to look vulnerable

Cumulative Tariff Revenue (USD Blns)

Source: U.S. Treasury

Thursday will likely see generally quiet markets ahead of the US employment report on Friday. There is also a Supreme Court decision on reciprocal tariffs due on Friday, so the market may also position for that. Supreme Court hearings in 2025 prompted a view in the market that a high risk exists of the court rejecting part or all of the Trump administration’s reciprocal and fentanyl tariffs. We would attach a 70% probability to this scenario which is in line with betting markets. The Trump administration could argue that the ruling only applies to companies that brought the original lawsuit, rather than the whole U.S. economy, but even a partial ruling against reciprocal and fentanyl tariffs would likely cause some short-term volatility. A full rejection of reciprocal and fentanyl tariffs would be more difficult to fully replace, which would worsen the 2026 budget deficit by around 0.5% of GDP to 6.5%. This would reduce Trump’s negotiating leverage with China and India and to a lesser degree Mexico and Canada, so the risks around the decision do seem likely to be USD negative.

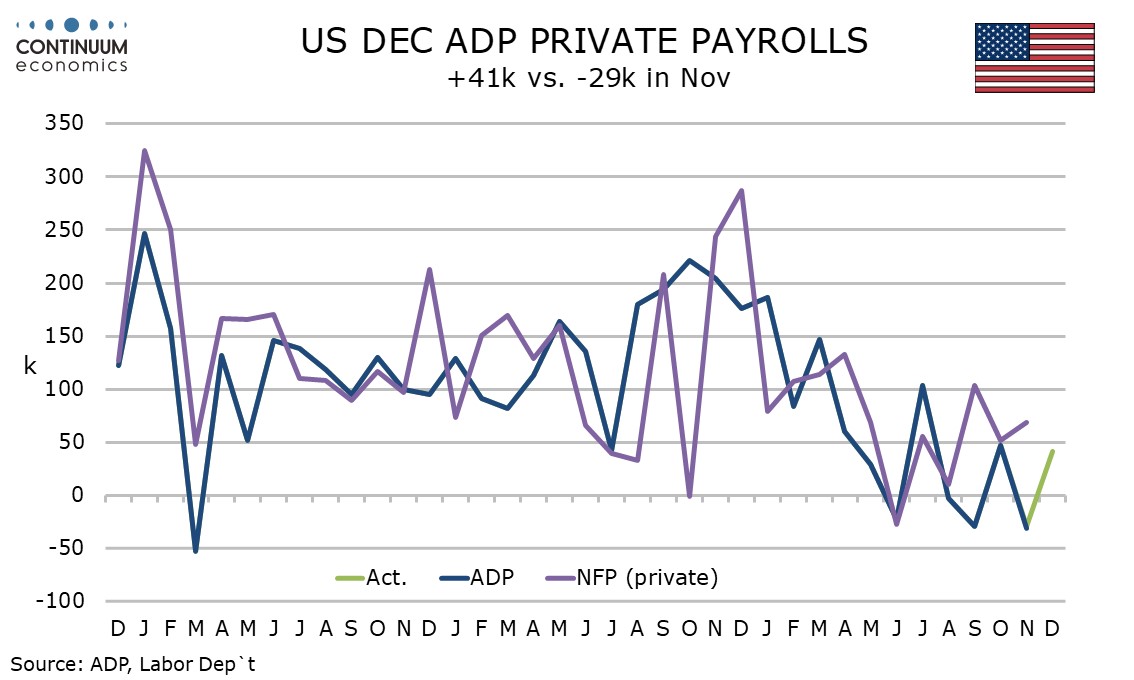

However, we have a mildly positive view of the employment data due Friday relative to the market consensus, and the ISM data on Wednesday was strong enough to suggest that the US economy continues to perform solidly. With the Eurozone data coming in on the soft side of late, we still favour some USD upside risk against the EUR and other European currencies, notably GBP. There is less scope for USD gains against the AUD and JPY where yield spreads have moved sharply against the USD, but EUR/USD is looking a little toppy technically and recent GBP strength is hard to justify given generally soft UK data of late.

The usual US jobless claims data will be a focus as will the Challenger jobs data ahead of the employment report, although neither will specifically relate to this month’s report. But it remains difficult to be too negative about the US labour market as long as initial claims continue to hover near the lows.

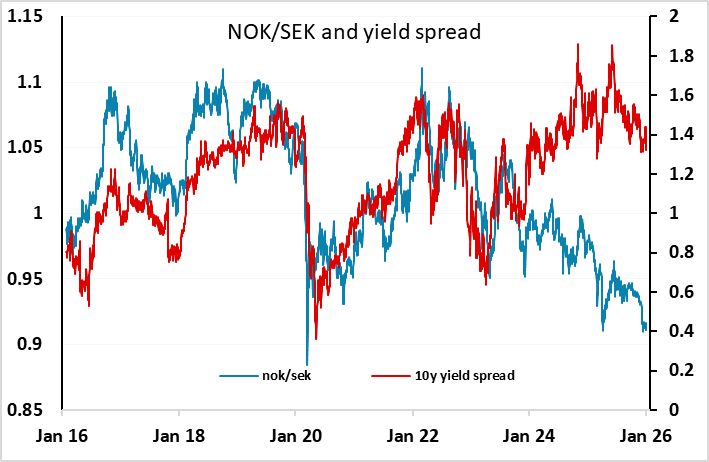

Swedish CPI

Preliminary Swedish CPI has come in well below consensus for December triggering a modest rise in EUR/SEK, but the gain is only around a figure and with EUR/SEK having been soft so far this week it barely makes a dent in the decline we have seen. While the trend in CPI does appear to be softening, the Riksbank is likely to require a lot more evidence to consider easing policy, especially since the preliminary CPI data has been revised in the past. For those looking for a weaker SEK, we see NOK/SEK as much the best trade, with attractive yield spreads and the drop to 0.91 seen yesterday representing excellent long term value.

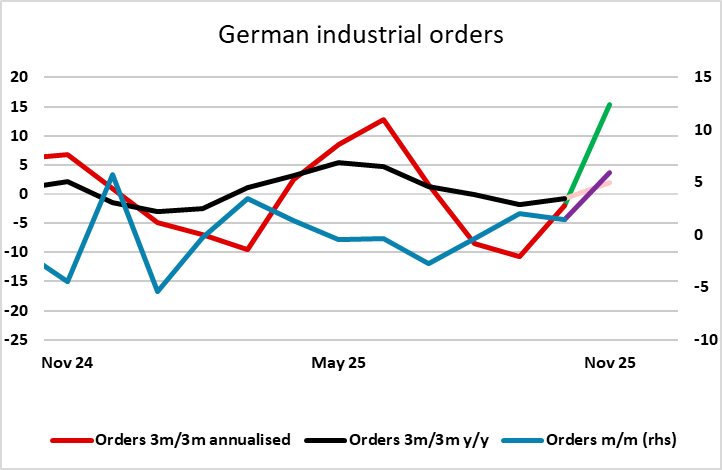

German factory orders have also been released this morning, and have shown a huge 5.6% gain on the month. The data can be very erratic from month to month, so we would be wary of drawing conclusions at this stage. There has been no noticeable impact on the EUR, but given the softer tone to the European data of late, and the softer EUR tone the numbers may help to stabilise EUR/USD above support at 1.1650.