FX Daily Strategy: Asia, March 8th

US employment report the focus, some risks of higher USD on higher earnings growth

Canadian employment report may also see a focus on wages

EUR/USD gains look unlikely to extend far

EUR/SEK to hold steady, but upside risks for NOK/SEK

US employment report the focus, some risks of higher USD on higher earnings growth

Canadian employment report may also see a focus on wages

EUR/USD gains look unlikely to extend far

EUR/SEK to hold steady, but upside risks for NOK/SEK

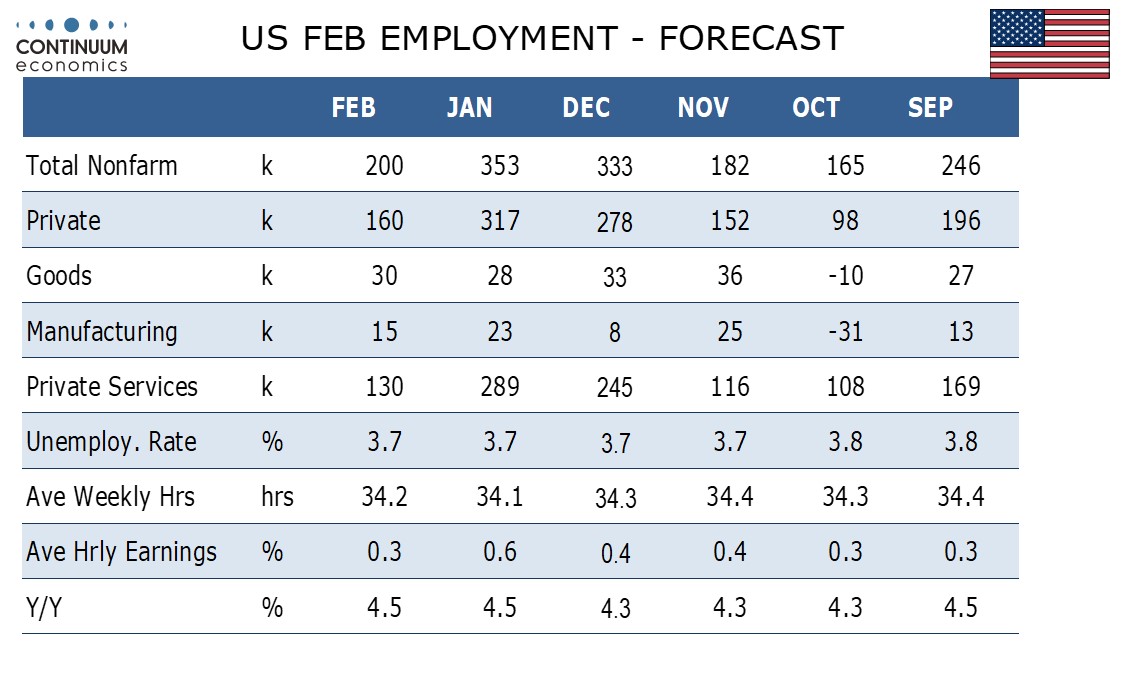

Friday sees US and Canadian employment reports, with the US obviously taking centre stage. After two straight very strong non-farm payroll gains exceeding 300k we expect a 200k increase in February’s non-farm payroll, which is where trend was before the recent acceleration. We expect an unchanged unemployment rate of 3.7% to show the labor market remains tight, but average hourly earnings to slow to a 0.3% increase after an unusually strong 0.6% increase in January. Given the strength of the previous two reports, this would still have to be seen as a strong report. If the strength of the previous reports was erratic, there would be an increased risk of a much weaker report this time around. Mild weather in December and supportive seasonal adjustments in January may have flattered the last two months so there are downside risks to the February data. However, although the initial and continued claims 4-week averages have moved a little higher after falling in January, initial claims were very low in the February payroll survey week.

Our forecasts are in line with the market consensus on payrolls and the unemployment rate, but slightly above the consensus on average hourly earnings. We still believe that the market interpretation of the Powell testimony this week was a little too dovish, and there should be scope for some of the decline in US yields and the USD seen since Powell spoke to be reversed on data that is in line with our forecasts, given our slightly higher average earnings projection.

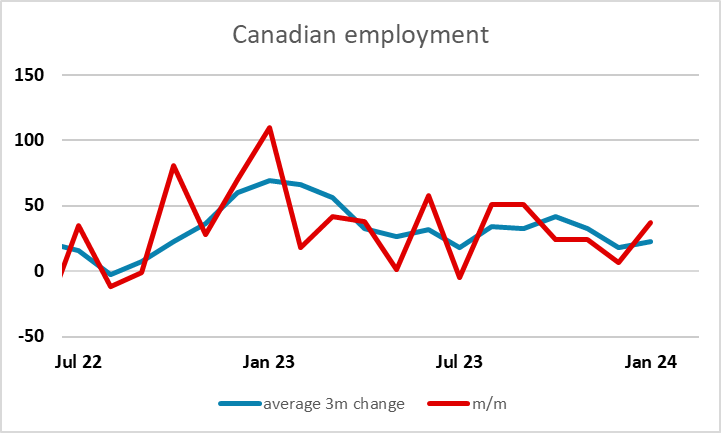

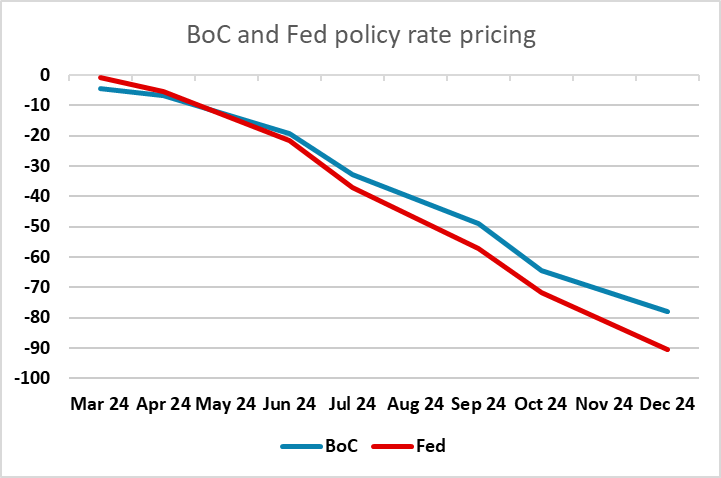

In the Canadian data, the market expectation of a 21k gain is essentially in line with the current trend. But the employment data can be quite choppy from month to month, so there is potential for some reaction to the numbers. But there may be more interest in the wage data. Given the hawkish tone from the BoC this week, some decline in hourly wage growth for the full employed, which was running at 5.3% y/y in January, looks necessary to loosen up BoC policy. The market now has BoC rate cuts essentially aligned with the Fed, and front end yield spreads suggests USD/CAD near 1.35 is fair, but it may require evidence of weakening inflation pressures if the BoC are to cut in line with the Fed, even though the US economy looks stronger.

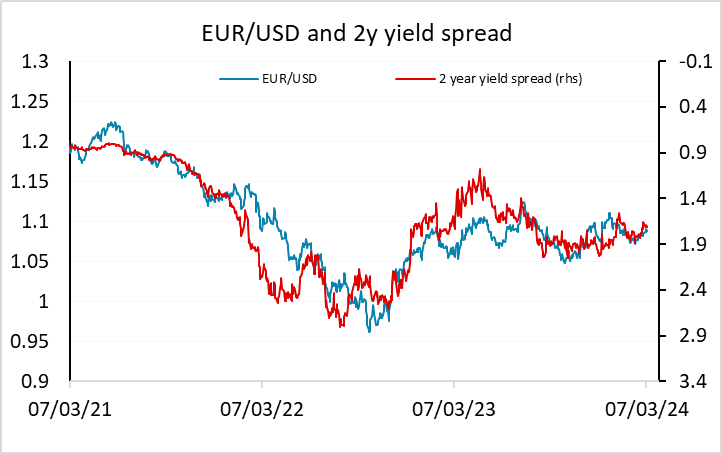

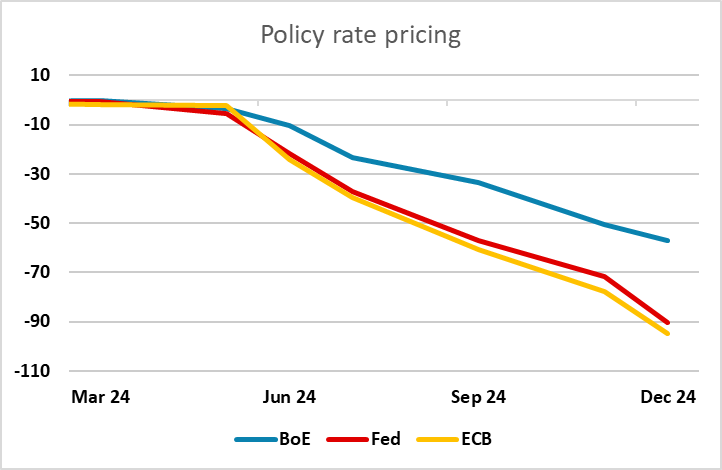

After an initial dip on the ECB meeting EUR/USD finished the day stronger on Thursday as EUR yields recovered most of the decline seen on the initial statement. We certainly didn’t see the statement as being particularly dovish, and our models do suggests a mild upside bias for EUR/USD based on current yields. Even so, we doubt there is scope up to 1.10 as the pricing of ECB cuts being in line with the Fed looks likely to shift in favour of a more dovish ECB rather than a more dovish Fed.

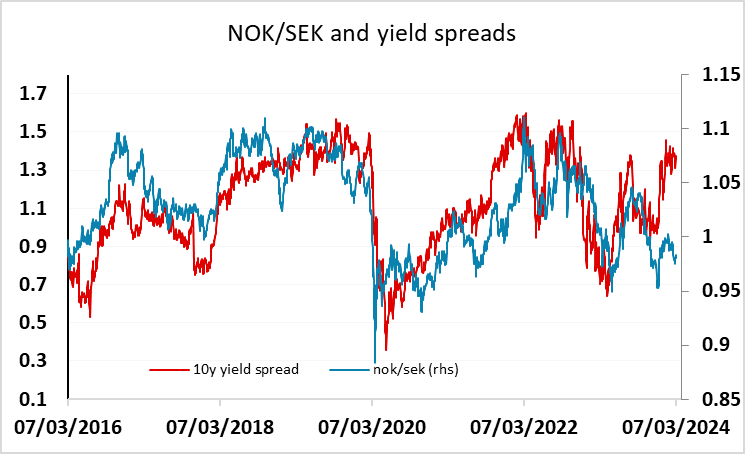

Before the US and Canadian data, Friday sees January data on GDP and confidence from Sweden. EUR/SEK has been reasonably steady near 11.20 since the currency moved back in line with yield spreads at the end of last year, and we wouldn’t expect much movement in EUR/SEK from here without some obvious divergence between the Swedish and Eurozone economies. But there is still scope for the SEK to fall against the NOK, with EUR/NOK still looking too high, and NOK/SEK out of line with the usual yield spread correlation.