FX Daily Strategy: N America, June 4th

CHF briefly dips after CPI, but decline short lived

CHF may still have further to rise and positioning looks very short

JPY still has scope to benefit from declining yields in the US and Europe

Scandis look attractive but NOK may be the better bet

CHF briefly dips after CPI, but decline short lived

CHF may still have further to rise and positioning looks very short

JPY still has scope to benefit from declining yields in the US and Europe

Scandis look attractive but NOK may be the better bet

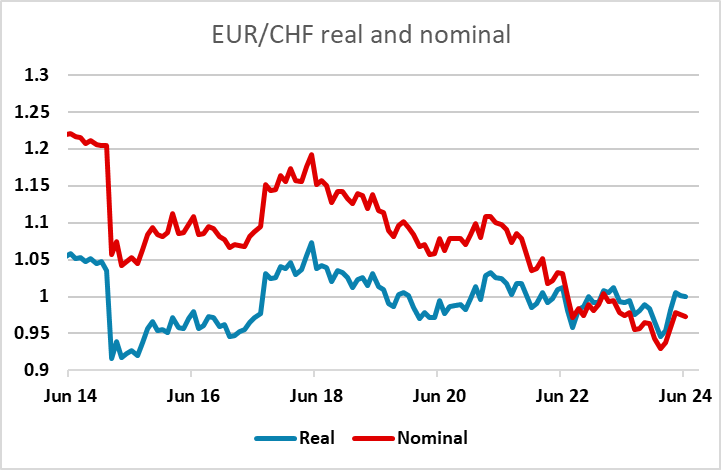

Swiss CPI came in in line with expectations, but initially there was a rise in EUR/CHF, although this only reversed the decline of around 25 pips seen in lateAsia/early Europe. The underlying tone remains quite CHF positive, as other central banks look towards easing over the rest of the year. The SNB were the first to ease, but don't have a lot more scope, while there is likely to be a substantial decline in rates elsewhere over the next year or two. While it looks as though the CHF is strong, after hitting a new all time high (excluding the 2015 spike) at the end of 2023, in real terms EUR/CHF is essentially in the middle of the range seen since 2015 due to the low level of Swiss inflation. The case for CHF weakness is therefore hard to make as the ECB cut rates this week and look towards further cuts.

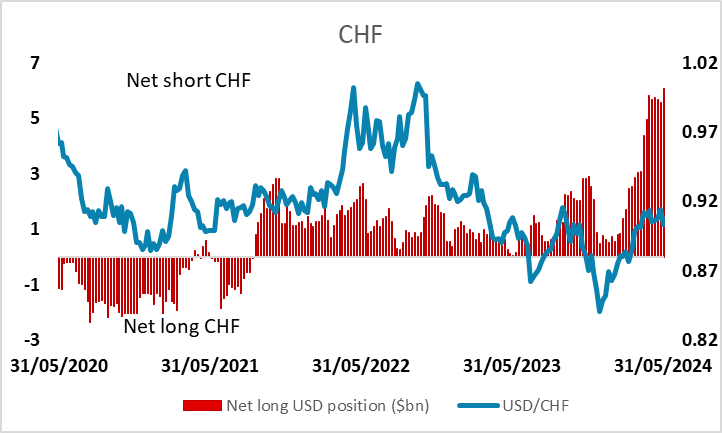

Another factor suggesting upside risks for the CHF is positioning, with the latest CFTC data showing the larger net short speculative CHF position on record. Many of these positions will be held against the USD, but could be pressured by the USD/CHF break below 0.90.

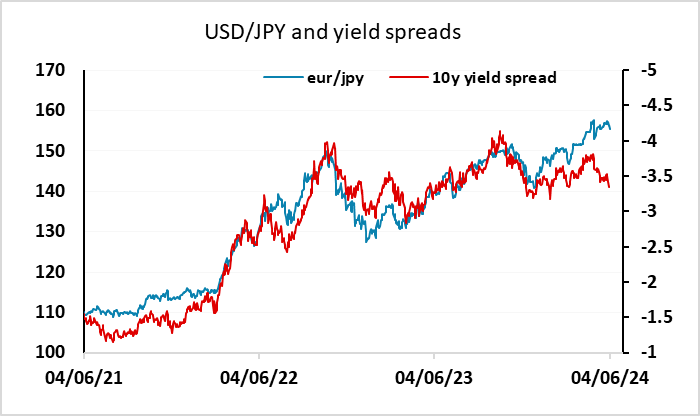

Otherwise, there isn’t a lot on the calendar to move markets, although there will be some interest in the IBD/TIPP economic optimism index and the JOLTS data, in view of the upcoming US employment report and the soft ISM manufacturing index reported on Monday. The USD came under pressure after the ISM, and USD/JPY in particular looks vulnerable if US yields stay lower and the ECB cut rates this week as expected, particularly if the equity market fails to benefit as it did on Monday. USD/JPY risks remain heavily weighted to the downside given current yield spreads, and we have seen significan JPY gains through the European morning, helped by a more risk negative market.

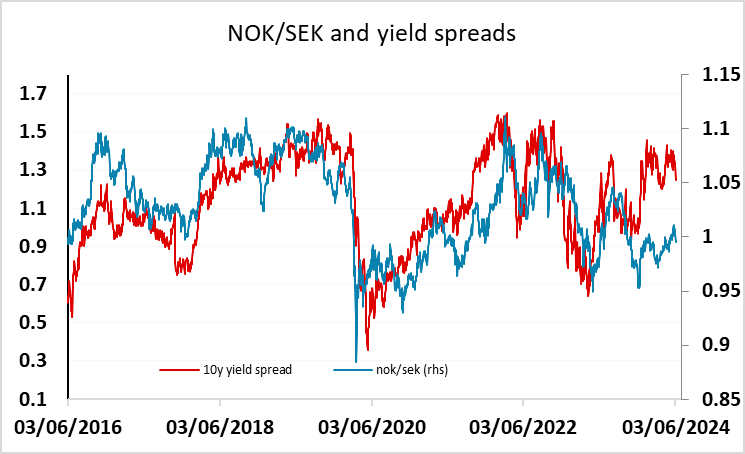

Otherwise there isn’t a great deal on the calendar, with German unemployment not typically market moving. There is French budget data, which may garner a little attention after the France downgrade at the weekend, but is still unlikely to be market moving. One notable move on Monday was the rise in the SEK, which gained more than 0.5% after the stronger than expected Swedish PMI. SEK gains have taken it a little above the level suggested by yield spreads, but there is some attraction in the SEK as a European recovery play, as it does tend to benefit from relative European growth improvement. However, from a yield spread perspective, the NOK is much more attractive, with the dip below parity on Monday likely to be seen as a long term buying opportunity.