USD, NOK, NZD, JPY flows: NOK softer, NZD firmer, focus on JPY and US CPI

NOK softer as CPI comes in weaker than expected. NZD firmer after RBNZ. USD/JPY still hovering close to 34 year highs ahead of US CPI data

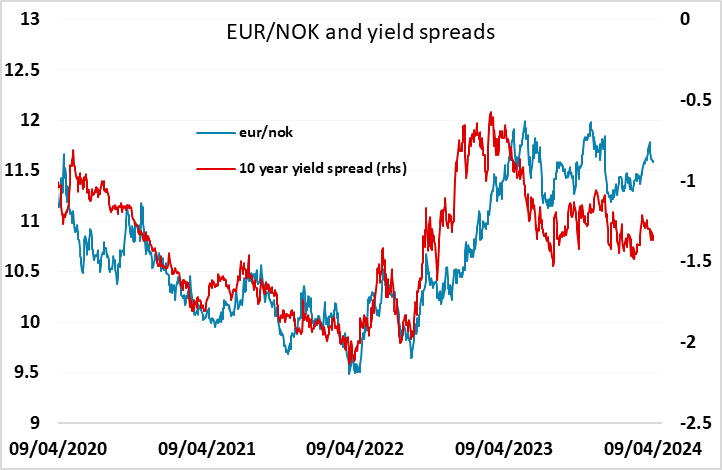

Norwegian March CPI came in below market consensus at 4.5% for the targeted CPI-ATE measure, and was also below the Norges Bank projection. EUR/NOK is a little higher in response, but has been trading on the high side relative to yield spreads, so even if this leads to some decline in NOK yields, it shouldn’t mean a weaker NOK other than in the short term. There may be scope to trade up to 11.65, but longer term we would target a move back to 11.

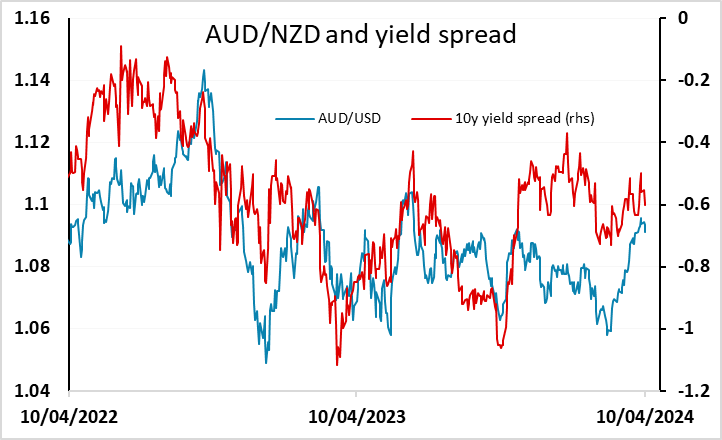

Overnight the NZD managed a modest recovery after the RBNZ meeting was seen as being on the hawkish side of expectations. There wasn’t a great deal of movement in NZD yields, but there was some correction due to the uptrend in AUD/NZD seen in the last month, and this could now extend further below 1.09.

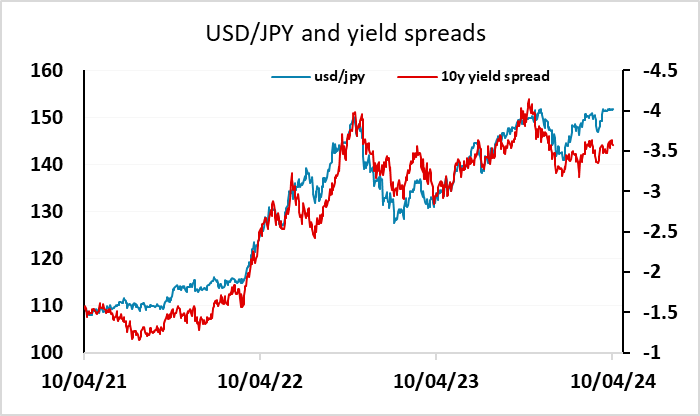

The main focus today will be on the US CPI data, and particularly in USD/JPY, which continues to play grandmother’s footsteps with the BoJ. BoJ governor Ueda said overnight that policy won’t be changed to address the weakness of the currency directly, but as usual currency weakness which leads to higher inflation would make policy tightening more likely. Yield spreads still suggest downside risks to USD/JPY, but the willingness of the Japanese authorities to use FX intervention to protect the USD/JPY upside will be tested if we see a stronger than expected US CPI number.