FX Weekly Strategy: January 22nd-26th

No action expected from the BoJ or the ECB

JPY still weak, and should recover, but no trigger seen this week

USD should remain well supported on solid GDP data

EUR might benefit modestly from continued ECB hawkish tone

GBP vulnerable to weaker PMIs

Strategy for the week ahead

No action expected from the BoJ or the ECB

JPY still weak, and should recover, but no trigger seen this week

USD should remain well supported on solid GDP data

EUR might benefit modestly from continued ECB hawkish tone

GBP vulnerable to weaker PMIs

The ECB and BoJ meetings are the highlights of the week, although neither are seen as having even a small chance of delivering a change in policy. What is said rather than what is done is therefore likely to be the focus. The BoJ is first up on Monday, and the weak wage and CPI data since the December meeting makes it hard to imagine that we are going to see any more hawkish rhetoric. Even so, we believe the BoJ are heavily focused on the spring wage round, and Ueda has indicated that a tightening of policy is on the agenda in the coming months, so the market will be on watch for any commentary. This is even more the case since the JPY has been very weak so far this year, so much so that it triggered some jawboning from Japanese finance minister Suzuki on Friday.

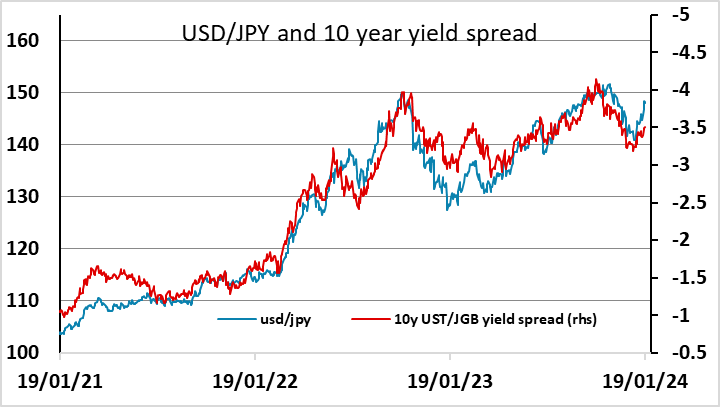

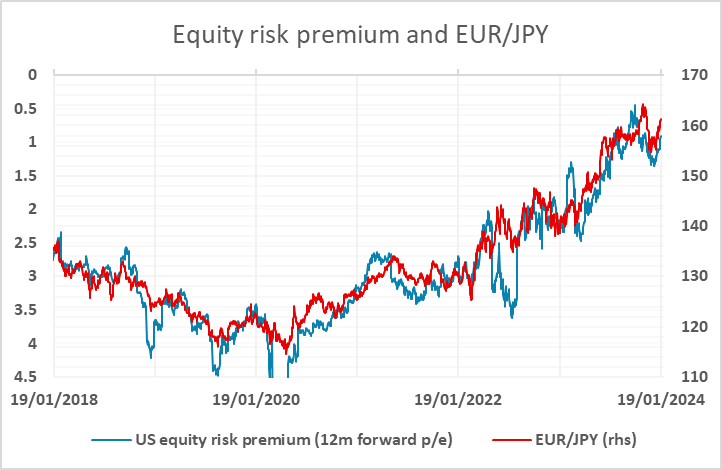

Although we doubt there will be any overtly hawkish comments, and this could trigger some knee jerk JPY weakness, we still see the current levels of the JPY as likely to be very close to a near and long term JPY low against a range of currencies. While rising US yields have pushed USD/JPY higher this year, spreads haven’t risen enough to justify the current JPY weakness. At the same time, JPY crosses continue to benefit from low levels of US equity risk premia, helped by steady US equity indices in the face of rising yields. EUR/JPY continues to correlate well with this metric – much better than with yield spreads, which are already consistent with a much lower EUR/JPY. But in a subdued growth environment with the US close to full employment, it’s hard to make a case for the current high US equity valuation. Risks should therefore be on the JPY upside, but for the moment we lack a trigger for a JPY recovery.

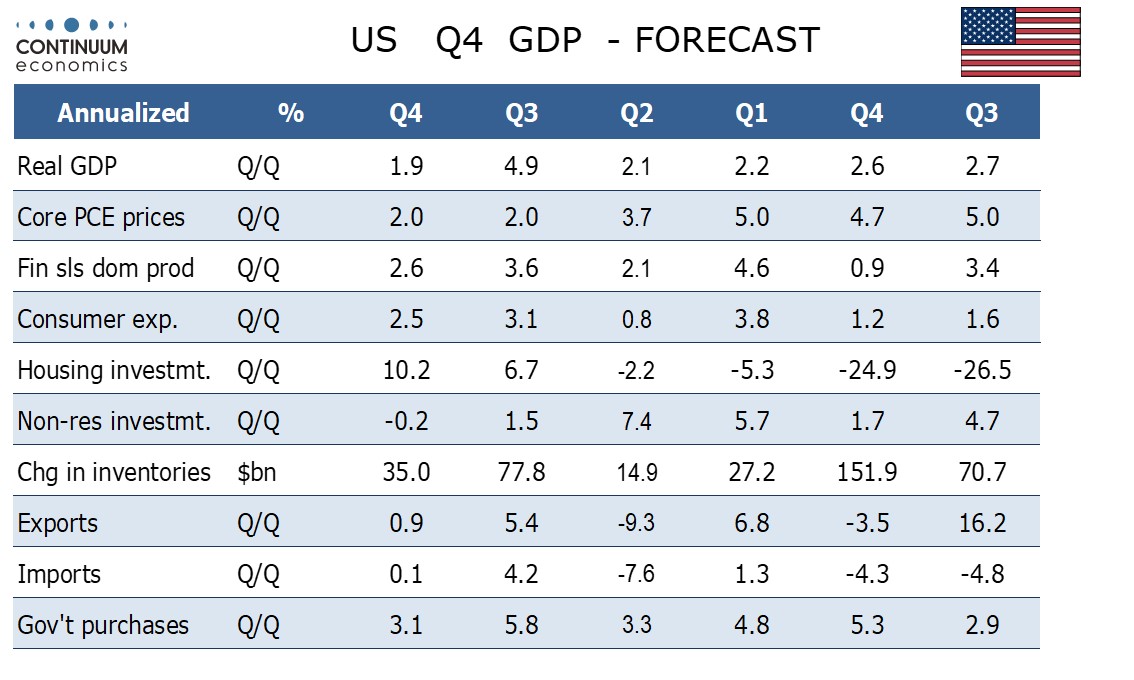

The US Q4 GDP data this week could be such a trigger, but only if it disappoints. We don’t expect it to, with our forecast marginally above the market’s 1.8% annualized, which is not strong, but is very adequate after the big 4.9% annualized gain seen in Q3. So while we would expect to see the JPY bottoming out near current levels, we wouldn’t expect any major rally in the short term.

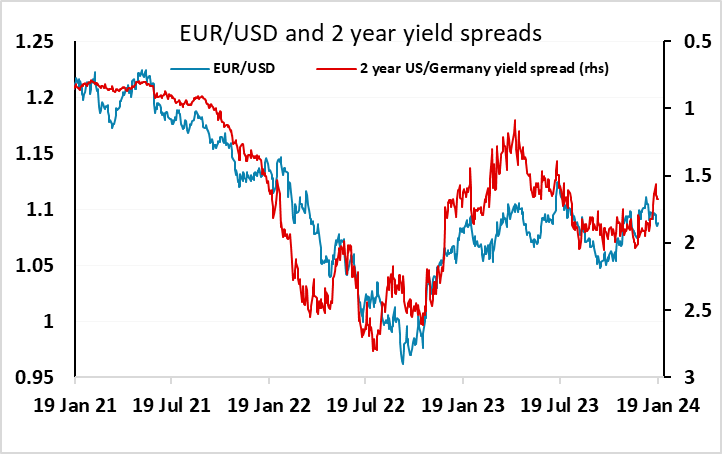

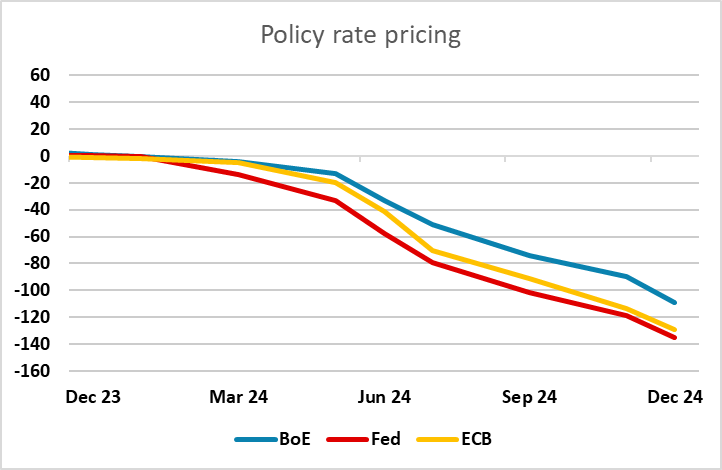

The ECB meeting also looks unlikely to provide any significant change in market expectations of policy. Currently, the market is pricing 130bps of easing from the ECB this year, or five and a bit rate cuts. This is more than the hawks would like to see, but with inflation running at or below target in recent months on a seasonally adjusted basis, it’s hard to argue too strongly against it with the growth numbers still close to zero. Nevertheless, the hawks on the council don’t want to encourage expectations of easing until they are more sure that inflation is back to target, so we wouldn’t expect dovish language from Lagarde. The risks might therefore be slightly towards higher EUR rates, given that he first rate cut is 80% priced by April. EUR/USD already looks a little extended on the downside relative to yield spreads, so there may be some upside risks out of the ECB.

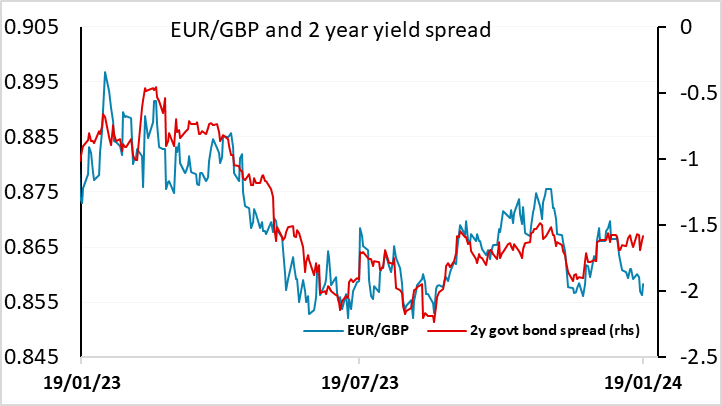

However, flash PMI number sin Europe will also be a focus this week, particularly for the UK where the last two numbers have been above 50 on the composite index, encouraging hopes of recovery. We are a little sceptical of the UK’s prospects, partly because we don’t have a lot of faith in the PMIs as an indicator of growth, partly because we don’t believe that the UK has yet felt the impact of the majority of the monetary tightening of the last year. Many mortgages are still to be reset at higher rates in the coming months, putting further downward pressure on consumer spending, which as Friday’s retail sales data highlighted is already weak. We would expect to see some easing in the UK PMIs this month and this should help GBP to slip lower, particularly since it already looks to be outperforming yield spreads this year, and the market is currently pricing the BoE to ease less than either the Fed or the ECB.

Data and events for the week ahead

USA

The US week starts quietly with little on Monday other than December’s leading indicator and little on Tuesday other than January’s Richmond Fed survey. Tuesday does see the New Hampshire primary where Nikki Haley will need to defeat Donald Trump to keep the Republican race competitive. On Wednesday we expect January’s S and P PMIs to show manufacturing edging up to 48.0 from 47.9 and services slipping to 51.0 from 51.4.

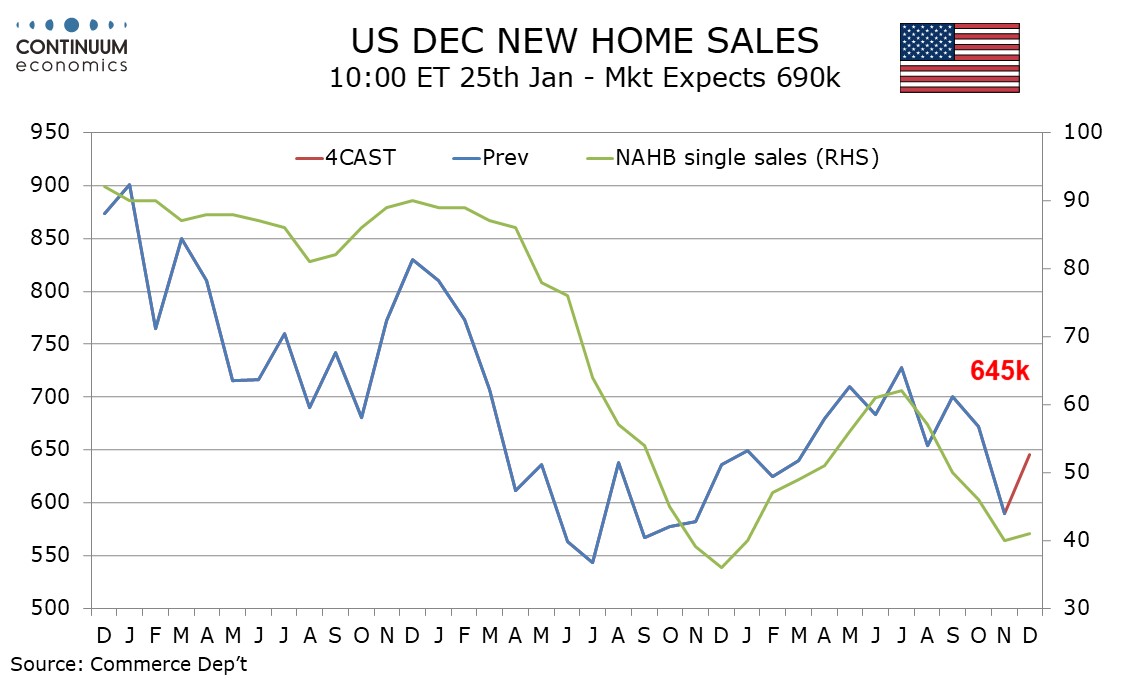

The most important release of the week is Q4 GDP on Thursday. We expect a 1.9% annualized increase, slower but far from weak, with a second straight 2.0% increase in core PCE prices, consistent with the Fed’s target. Weekly initial claims will also be watched coming after a sharp decline. Also due are December durable goods orders, where we expect a rise of 1.5%, with a 0.2% increase ex transport, and December’s advance goods trade deficit, where we expect the deficit to increase to $91.8bn from $89.3bn, mainly on lower export prices. Later on Thursday we expect December new home sales to correct higher to 645k after a weaker 590k outcome in November.

Friday’s December personal income and spending report will be a largely old news at the time of release with Q4 totals due with the GDP report. We expect gains of 0.3% in income, 0.5% in spending and 0.2% in core PCE prices. December pending home sales data follows.

Canada

With no significant data due the highlight of Canada’s calendar is Wednesday’s Bank of Canada meeting. With data showing subdued activity but stubbornly high inflation rates look highly likely to remain unchanged at 5.0%. The statement is likely to see a similar tone to that on December 6 which no longer saw the economy as in excess demand but remained willing to raise the policy rate further if needed.

UK

The data highlight this week is on Wednesday in the form of flash PMI numbers. December data saw the composite PMI at 52.1 in December, up from 50.7 in November and above the apparent neutral for the second month running. That reading was the highest since last June and pointed to a moderate increase in private sector output. UK private sector firms were the most upbeat about the year ahead business outlook since last May, but we see the index slipping back by around 0.5 point. NB CBI survey data (on Wed and Thu) will offer an alternative slant. Otherwise, public borrowing numbers (Tue) will perhaps suggest more signs of an overshoot of the OBR budget deficit target; borrowing in the first eight months of 2023-24 totalled £116.4 billion, £24.4 billion above the same period last year.

Eurozone

Data are subservient to the ECB this week with a Council decision due on Thursday. Once again the looming ECB meeting is one where markets are not preoccupied with what the Council will do but rather what is said. Stable policy is just about nailed on, but the question is whether there will be any more formal attempt to redirect market thinking that still prices in around 150 bp of rate cuts in the coming year. Given divisions within the Council, which have surfaced in terms of the hawks showing reticence about easing so much, there is likely to be something of communication fudge about the policy outlook. This makes next Tuesday’s ECB-compiled Bank Lending Survey all the more important, especially if it merely echoes the worrying s signs of the last such survey released last October. That pointed to an on-going and substantial cumulative tightening in credit standards with a record drop reported in regard to company lending.

As for data, Wednesday sees flash PMI numbers. The downturn in the EZ economy stretched into December as the composite PMI stayed at 47.6, extending the contraction seen since June. Demand for goods and services continued to weaken while employment levels fell again, just the second time this has been the case in almost three years. German Ifo data (Wed) may tell a sorrier tale but where consumer confidence numbers (Tue) may be less downbeat

Rest of Western Europe

There are few key figures in Sweden or Switzerland this week. But in Norway, the Norges Bank will leave rates on hold on Thursday, after slightly softer than expected but still resilient CPI data and as-expected GDP numbers since the surprise hike last month. There is no updated Monetary Policy Report, but markets will be alert to any comments about the exchange rate which rallied strongly after the hike last month but where this appreciation is now starting to unwind.

Japan

While next week’s headline item will be BoJ meeting on Monday, it will very likely be a non-event as the data released between the December and January meeting does not support or deter the exit of ultra-loose monetary policy. In the last meeting, it is suggested the BoJ will kick the can down to March’s spring wage negotiation before making any change to policy and it seems to be reinforced by the lacklustre November labor cash earning which missed significantly. It would be a big surprise for the market if the BoJ do something as close as a change to forward guidance. Trade Balance on Tuesday will have less impact than Thursday Tokyo CPI. The latest CPI data continue to show further moderation in the headline and ex fresh food item while ex fresh food and energy barely trimming. We forecast such pace of moderation to continue which is a tad lower than BoJ’s estimate. However, with wage in the spotlight, unless there is a huge miss/beat, the fx market should not endure any lasting move.

Australia

Little meaningful data for Australia next week. We will have business conditions on Monday and PMIs on Tuesday,

NZ

Key metric CPI will be released on Tuesday. The market is not ready for surprise in Kiwi inflation but the RBNZ may have opened the path for a hike after the revision of OCR path in the last meetings.

Highlights for the coming week