USD, JPY, NOK, SEK flows: USD stabilising but downside risks remain. NOK/SEK weakness is extreme

USD reocvered modestly overnight but downside favoured as long as concerns about slowing growth persist. NOK/SEK testing 2024 lows and continues to look very undervalued.

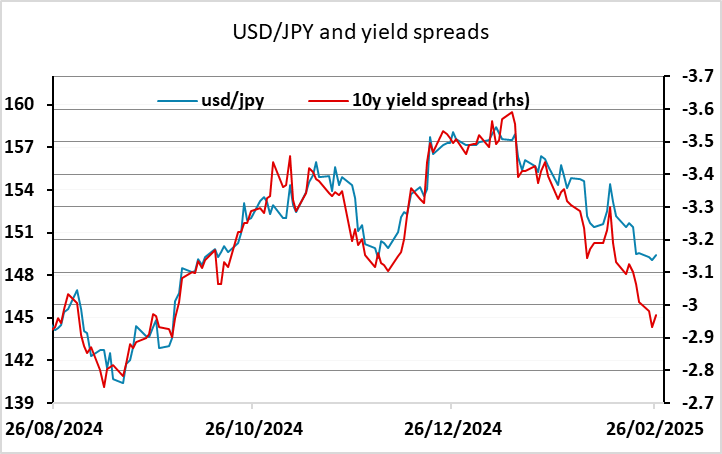

The USD has recovered modestly overnight, but the underlying trend remains mildly negative due to the decline we have seen in US yields reflecting growing worries about emerging weakness in the US economy. Until or unless these are dispelled, the USD risks look to be to the downside, particularly against the JPY, where yield spreads still point to a break below the key support at the December low of 148.65.

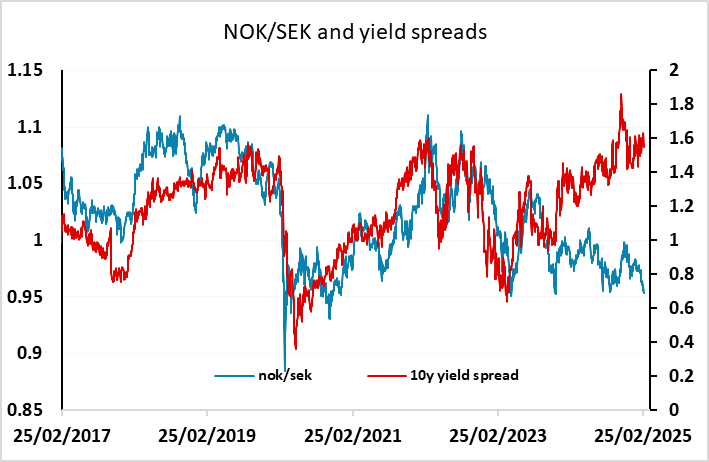

It’s another quiet day for data. The European session has started with Swedish PPI and German consumer confidence, respectively on the strong and weak side of expectations, but neither are significant enough to drive any FX moves. However, it is notable that NOK/SEK is testing the 2024 lows below 0.95. It remains hard to find a good rationale for the weakness of the NOK (and it is mostly NOK weakness although the SEK is also showing strength against the EUR), with yield spreads still pointing to a major NOK recovery. Possibly expectations of a peace deal in Ukraine favour the SEK over the NOK, with gas prices seen declining if relations with Russia are normalised, while reduced security concerns would be seen as more SEK positive. But it is a stretch to ascribe NOK/SEK weakness to this when the underperformance relative to yield spreads has been seen for over a year. We still see scope for a long term NOK recovery, and dips below 0.95 are likely to attract longer term buyers.