FX Daily Strategy: Asia, April 15th

GBP may recover against the EUR even if labour market data shows weakness

CAD should hold firm against the USD helped by CPI

EUR/USD strength not supported by yield spreads but could still continue

GBP may recover against the EUR even if labour market data shows weakness

CAD should hold firm against the USD helped by CPI

EUR/USD strength not supported by yield spreads but could still continue

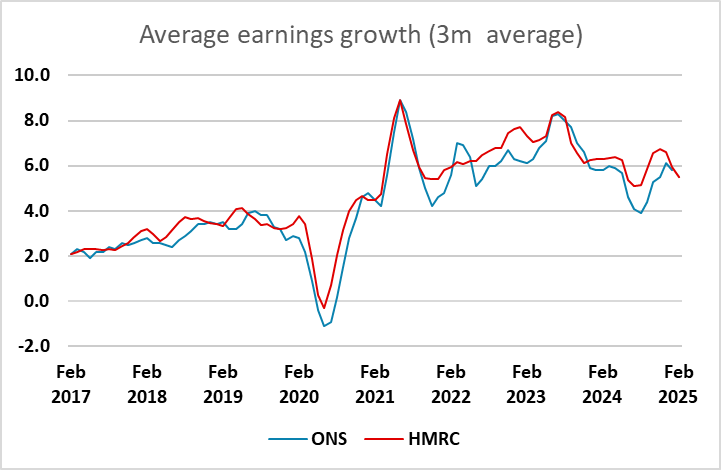

UK labour market data for February (ONS data) and March (HMRC data) is due on Tuesday, and as usual holds significant interest for the Bank of England. There is nowadays more focus on the more up to data HMRC data, which saw a significant decline in the y/y rate of earnings growth in February to 5.0%, suggesting we can see some weaker ONS numbers this month. The market consensus is for the headline growth rate to dip slightly to 5.7%, but the risk may be on the downside. There will also be interest in the employment data, which has been essentially flat in the HMRC data for the last year, and has shown some signs of starting to decline, with unemployment starting to rise, helped also by a rising labour force.

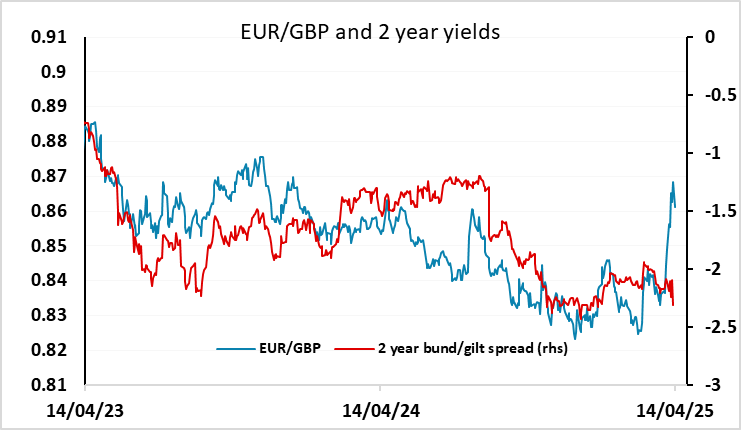

However, while we do see some scope for weakness in the UK labour market data, this may not have much impact on GBP, which has been driven very much by risk considerations in the last week or two. EUR/GBP has risen 3 figures on the back of the tariff driven sell off in equities, breaking away from the relationship with yield spreads. If we now see a period of consolidation the risk is that EUR/GBP slips lower, even if EUR/USD doesn’t, as concerns about the USD don’t in this case necessarily transfer to GBP.

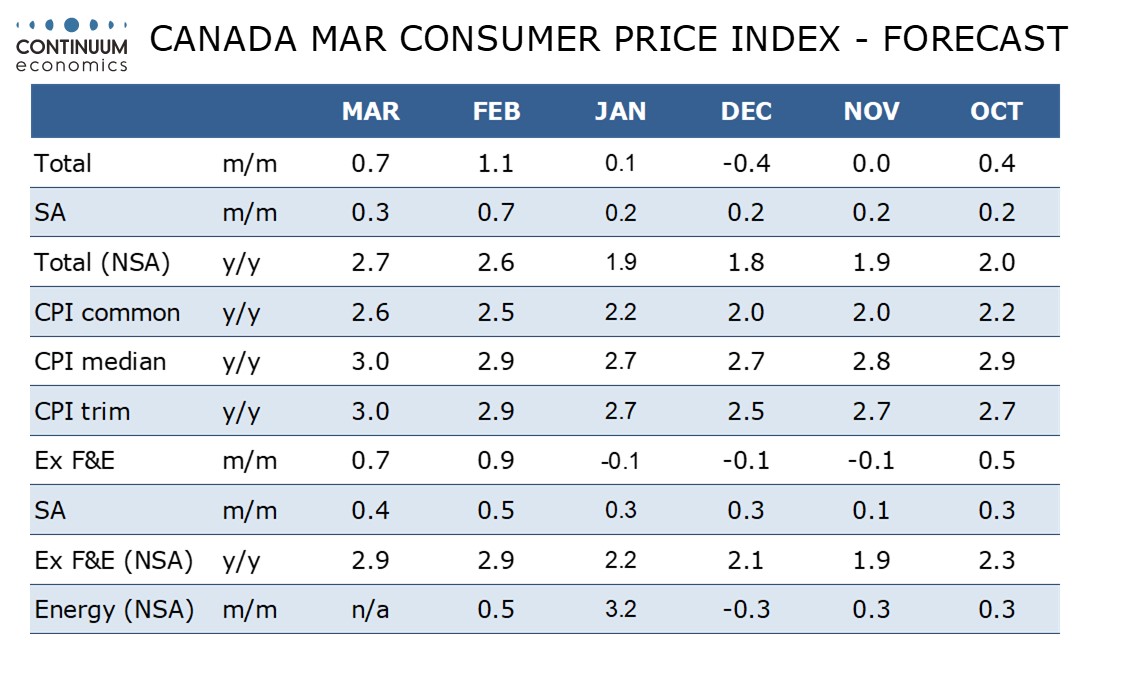

We also have Canadian CPI later on, which takes on greater significance given the BoC meeting on Wednesday. We expect March Canadian CPI to increase to increase to a 9-month high of 2.7% yr/yr from 2.6% in February. We also expect the Bank of Canada’s core rates to move higher, moving further above the 2.0% target. These forecasts are above consensus, so may be slightly CAD positive with the market currently divided on whether to expect a BoC rate cut on Wednesday. A 25bp cut is priced as around a 40% chance, and we are in line with the majority in expecting no change, but the CPI data could influence our and the market’s view. We do not expect that a pause at this meeting will mark the end of the easing cycle, but our view of firmer CPI should be mildly CAD supportive.

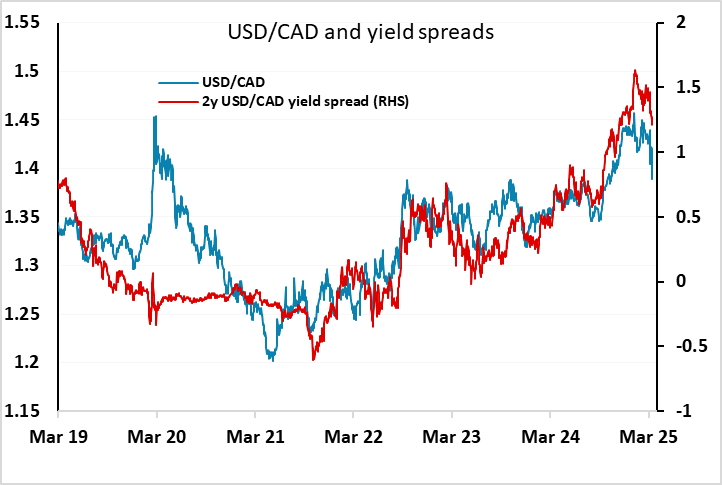

The CAD has broadly continued to follow moves in front end yield spreads with the USD, at least directionally, even if the CAD has somewhat outperformed in scale as the USD has generally struggled. The market may be overestimating the scope for Fed easing judging by recent Fed comments, and there may be scope for US front end yields to edge higher this week if Powell sounds hawkish relative to the market. But for now we would expect USD/CAD to remain biased slightly lower.

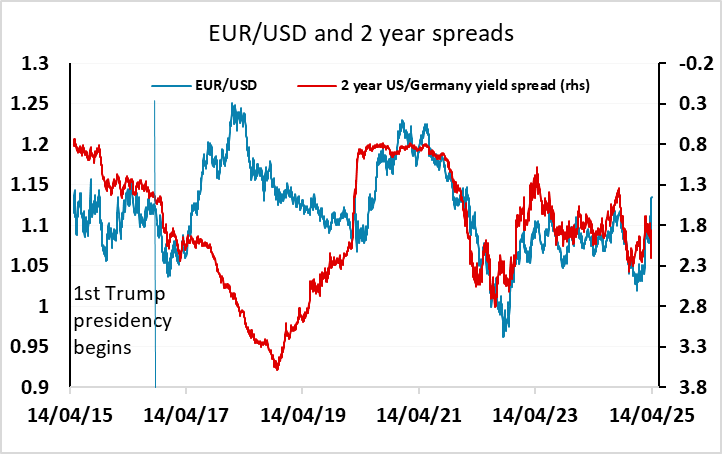

The USD’s weakness against the EUR isn’t showing the same sort of correlation with yield spreads as the USD/CAD move, with EUR/USD very much moving in the opposite direction to yield spreads in the last couple of weeks. This was a phenomenon that was very much in evidence in Trump’s first term, so although there is scope for some correction to recent EUR/USD strength if we see a stabilisation in equity and bond markets, we wouldn’t look to oppose EUR strength on the basis of the yield spread moves at this stage.