German Data Review: Inflation Drop Continues But Amid Still Resilient Services

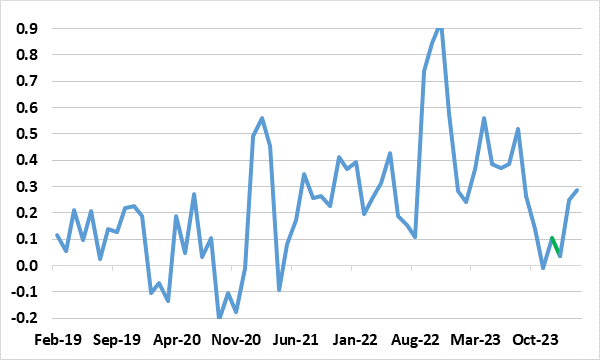

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflation, and in spite of pick-up in services, both possibly held up somewhat by the earlier Easter this year. Energy’s impact was marginal, however. As a result, the HICP core rate (not published in the preliminary reading) may nevertheless have fallen 0.2 ppt to 3.3%, a 21-month low. But adjusted m/m readings once again suggest that core rate disinflation may have stalled, albeit at a pace still down and largely consistent with 2% target.

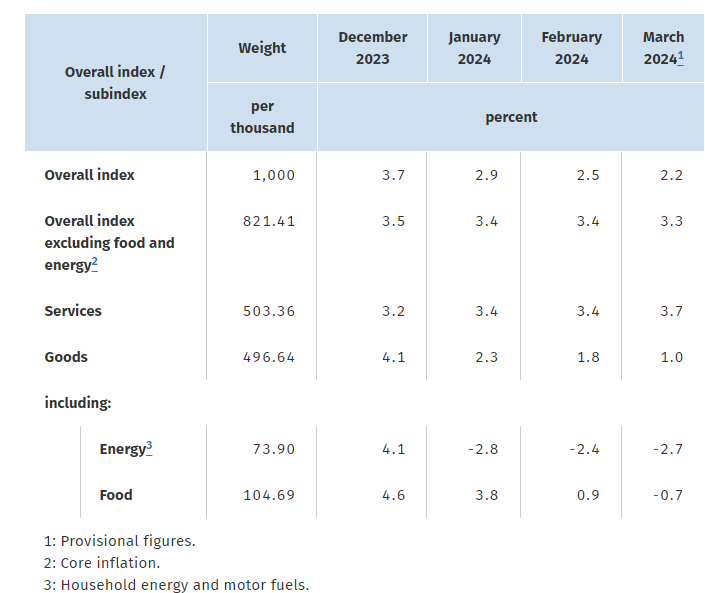

Figure 1: Food Takes Inflation Lower?

Source: German Federal Stats Office

In March, energy prices in March were 2.7% lower y/y despite the discontinuation of the brake on energy prices as of January 2024 and the introduction of a higher carbon price also from January 2024, which affects the price of fossil fuels such as motor fuels, heating oil and natural gas. But last month was also the first month since February 2015 (-0.2%) in which food prices fell in y/y terms. Food prices were also substantially lower again than the general rate of price increase.

Regardless, while several special effects may act to push headline inflation slightly higher again sometime in the next 3-4 months, a general downward trend will still be evident an d enough to and inflation is likely to fall below 2% in the second half of 2024, albeit again with month-to-month volatility.

Figure 2: Adjusted Core Rate No Longer Falling?

Source: German Federal Stats Office, CE, seasonally adjusted % chg m/m, smoothed