USD, AUD, JPY, CHF flows: USD and risky currencies being hit

USD and risky currencies under pressure versus JPY and CHF, but some stabilisation in risky currencies expected near current levels. USD may still have further to weaken

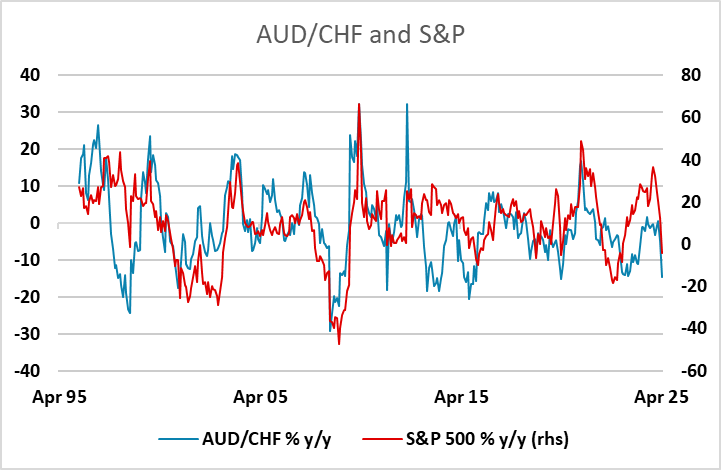

FX markets seeing more USD negative/risk negative trading in early US hours, although there hasn’t been much further movement in equities. USD/CHF has hit its lowest since December 2023, which itself was the lowest since the spike lower in January 2015. USD/JPY is at its lowest since September 2024, which compared to the CHF move is quite modest from a big picture perspective. USD/JPY remains substantially fundamentally overvalued at current levels. The best FX proxies for risk sentiment are showing substantial moves. AUD/CHF is notably at all time lows. This typically moves with equities as the chart below shows. It is already down 15% y/y, and very rarely falls more than 20% on a y/y basis. Given the rise in US yields, equities are holding up relatively well, but we would expect either yields or equities to have to fall from current levels., most likely yields, as the recent rise has been at least in part technically driven.

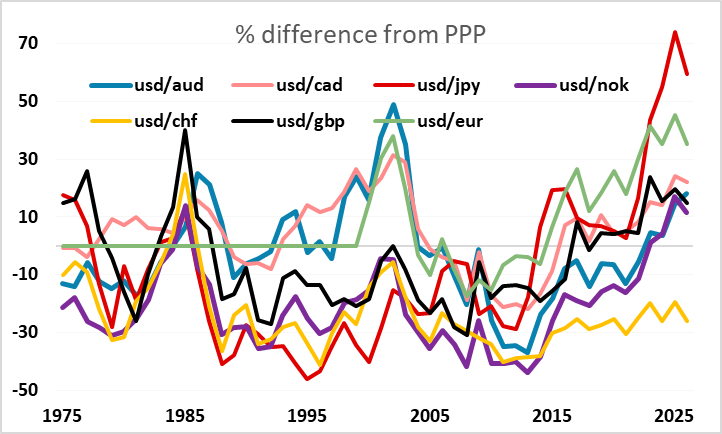

From here, we would expect some stabilisation in the risk sensitive pairs, as we would expect the market to now wait for evidence of the economic impact of tariffs before we see another significant move in equities. However, there could still be further to go if the current sell off in bonds continues. However, there may yet be further general USD weakness, as the USD is starting from quite extended levels across the board, with the exception of USD/CHF. In the absence of significant tariff retaliation, the US looks the most vulnerable to the US tariff increase (among the G10).