FX Daily Strategy: APAC, July 29th

European GDP data unlikely to have much impact but SEK risks downside

US/EU trade deal shouldn’t be seen as risk positive

JPY consequently has potential for recovery

GBP can also make some gains against the EUR

European GDP data unlikely to have much impact but SEK risks downside

US/EU trade deal shouldn’t be seen as risk positive

JPY consequently has potential for recovery

GBP can also make some gains against the EUR

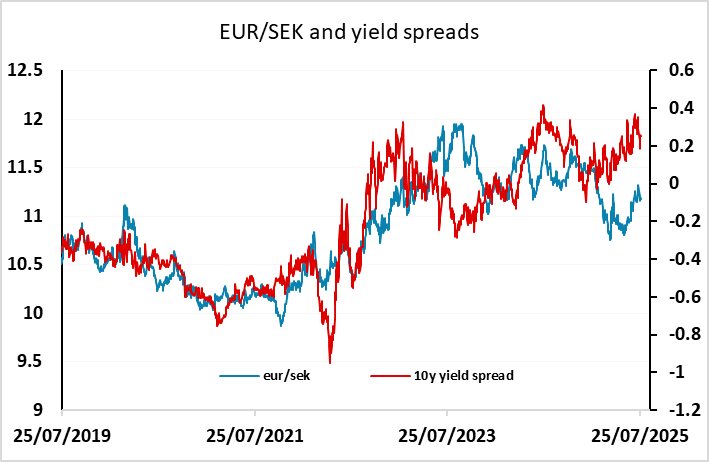

The calendar is fairly quiet in Tuesday, but there is Swedish and Spanish Q2 GDP which could have market impact, some UK money data, and the US goods trade balance for June could also be a significant factor for US the advance US GDP data released later this week. GDP data in Sweden is quite volatile, so we wouldn’t expect a big impact, but at this stage we see some downside risks for the SEK which has outperformed yield spreads and has been one of the main beneficiaries of the weaker USD trend this year. Inasmuch as the USD is managing a rebound, the SEK may suffer as much as anything.

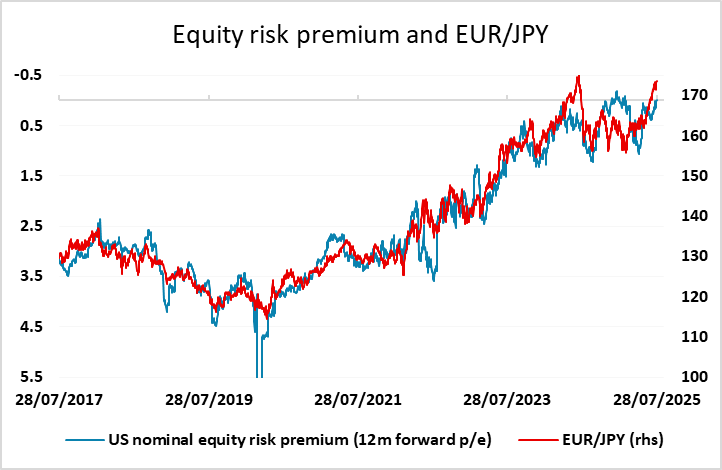

Spanish GDP is likely to be quite strong, but not representative of the general Eurozone trend, with Eurozone GDP expected to be flat in Q2. The data should therefore not have much impact, and the EUR tone should continue to be mostly a function of the market’s view of the EU/US trade deal. The general reaction has been that the deal is positive for risk sentiment because of the reduction in uncertainty, with some seeing the terms of the deal as unfavourable for the EU. This looks like a bad take to us. The main impact of the imposition of a 15% tariff on the EU and Japan, and similar elsewhere, is that US prices will rise. The tariff is effectively a tax on consumers. The government is raising money from it, but if this is not spent, the net effect is contractionary. The fact that equity markets are higher now than they were before the tariffs were first announced underlines that they are frothy. Risk premia are much too low to take account of the risks of US slowdown.

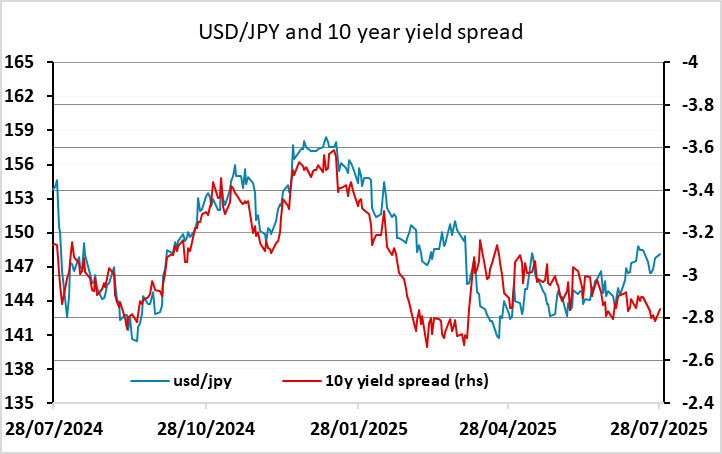

US GDP on Wednesday is expected to be in the order of 2.5% annualised, following a small Q1 decline. This is below trend for Q1, and is also not consistent with the positive equity tone. The trade data today could impact expectations of GDP, and our forecast of rise to $101.6bn in June from $96.4bn in May is above market consensus and may mean some downgrades to Q2 GDP forecasts. This should in turn mean some negative impact on risk sentiment, and likely on the USD, with the JPY still looking like the currency with the most potential for recovery. Yield spreads still point to a lower USD/JPY, and the 9 week run of EUR/JPY gains is also likely to come to an end if we see any equity market weakness.

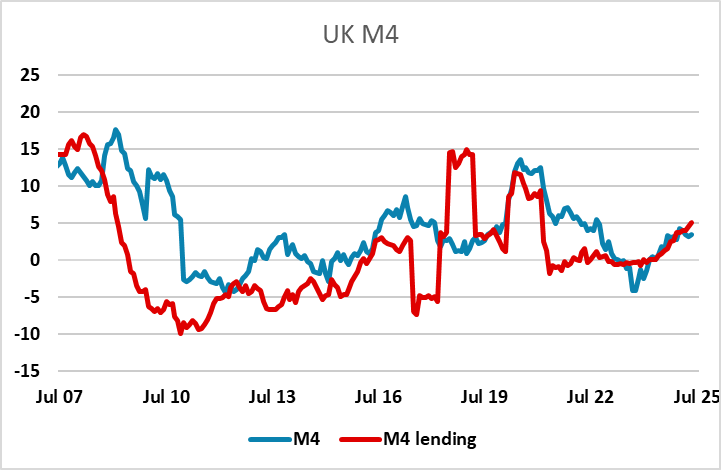

The UK money data doesn’t typically have much of an impact, but it was notable that GBP made good gains against the EUR on Monday, with GBP/USD holding fairly steady. Some of this reflects a belief that the UK has received more favourable trade terms with the US. While this is true, we doubt it is of any real economic significance in the foreseeable future. But the money data has provided some reasons for mild optimism on the UK, with a steady uptrend in both M4 and M4 lending growth in the last couple of years. If we get solid set of money data, it should mean that further forays above 0.87 in EUR/GBP are unlikely near term, with potential for a move back down to test 0.86.