USD, JPY flows: Equity carnage points to big JPY rally

Equity collapse suggests JPY set for major rise

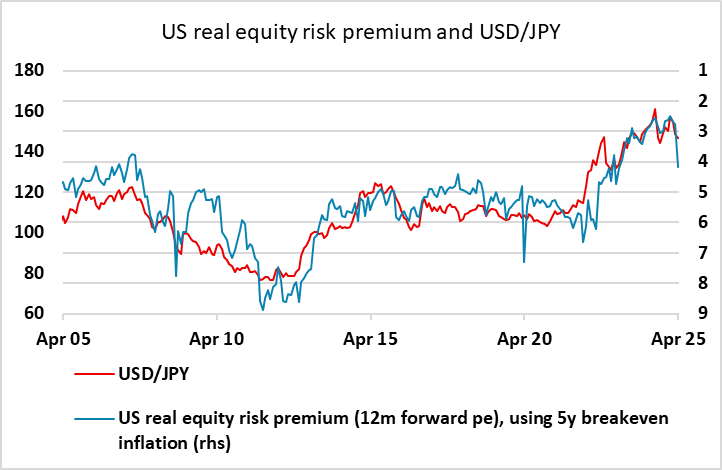

More heavy losses for equities seen overnight with no sign of any reversal in Trump’s tariff policy. Asian equities have been the biggest losers, but the S&P 500 futures have lost another 4% and are now down more than 20% from the high of February 19, establishing the bear market. The worry is that without some reversal in policy, this is only the beginning, because US equities are still expensive from a long term value perspective, although a decline of another 10-15% would take us back to the risk premium that prevailed for much of the last 20 years, GFC excluded. The worry is that we are heading for a sell off of the scale of the GFC, in which case we could see another 50% off US equities.

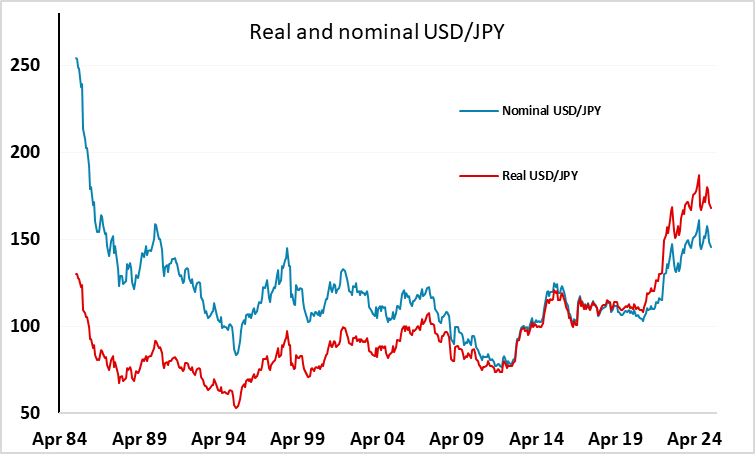

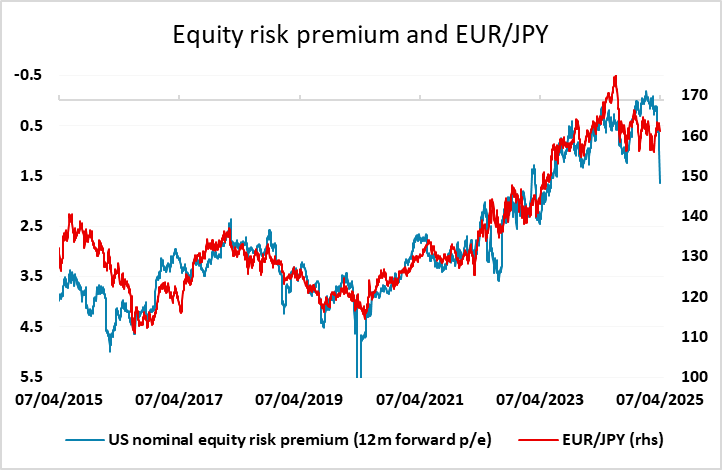

From an FX perspective this ought to be extremely positive for the JPY based on the equity risk premium correlations that have persisted through the last 20 years, which suggests a USD/JPY move sub-140, and a EUR/JPY move sub 150. From a fundamental value perspective, USD/JPY is in any case extremely expensive even at 140, with long term fair value nearer 100, due both to the gains seen in recent years and to the relatively low Japanese inflation rate which has mean that the real JPY decline has been even larger than the nominal decline. It may take time, as the tariff threat is undermining confidence everywhere, but the JPY looks set for a major rally.