FX Daily Strategy: APAC, March 13th

GBP downside risks on GDP

GBP already stretched relative to yield spreads and positioning

Watch on FOMC comments after CPI

JPY may benefit from Toyota wage announcement

GBP downside risks on GDP

GBP already stretched relative to yield spreads and positioning

Watch on FOMC comments after CPI

JPY may benefit from Toyota wage announcement

GDP - Sliding or Stagnating?

Source: ONS, CE

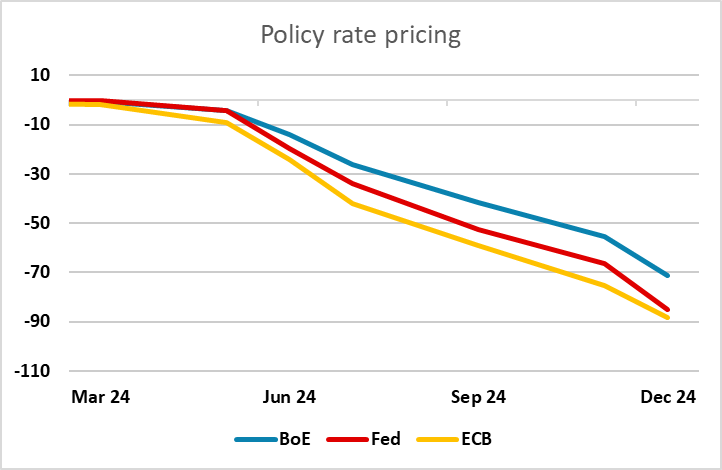

UK GDP for January is the first significant data on Wednesday. The weaker than expected UK labour market data on Tuesday triggered some modest GBP losses, but there could still be more to come if the market starts thinking that the BoE might match the Fed and/or the ECB in rate cuts this year. Some progress in this direction was seen on Tuesday, but there could be more to come if the UK GDP data fails to recover sufficiently from the 0.1% decline in December. The market is looking for a 0.2% rise, and we see risks to the downside.

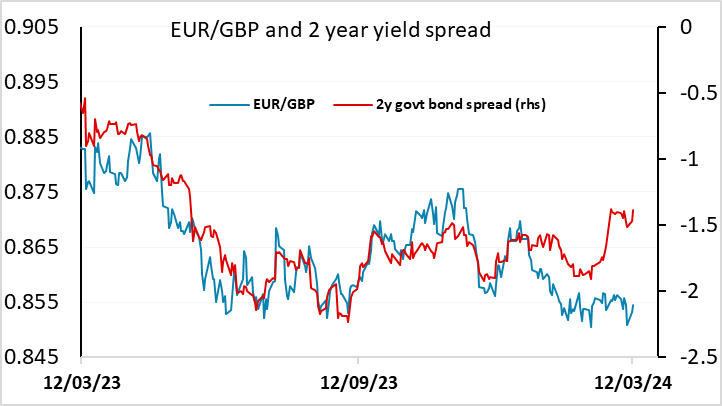

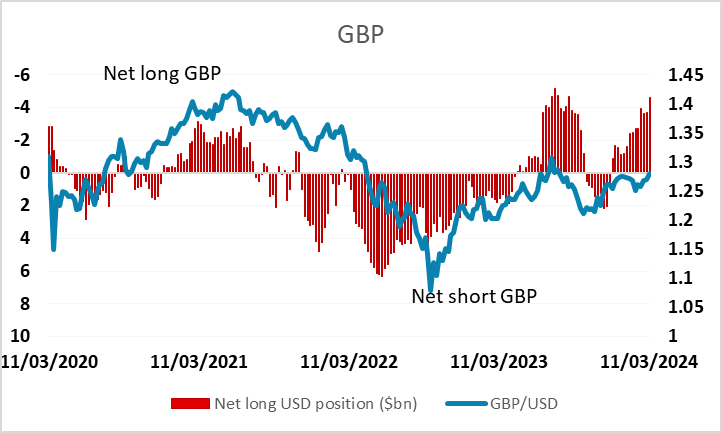

The December result that reflected the plunge in retail sales and abnormal weather that meant a Q4 drop in GDP and consumer spending. We see stagnation in the January figures, this actually extending through the whole of the current quarter so that a flat q/q Q1 GDP reading is also envisaged (I.e. a notch below BoE thinking) and with downside risks. Admittedly some upside risks are apparently posed by some survey data. However, the likes of PMI numbers have been very poor guides to GDP swings, and the clear recovery already reported for January retail sales is likely to be offset by industrial action hitting health once more, by a sharp fall in manufacturing (based around vehicles), and maybe the impact of warm weather at the end of the month hitting utilities. Even a rise of 0.1% should be enough to trigger more GBP losses, especially since positioning remains quite extended, and yield spreads point towards 0.86.

There isn’t a great deal else of real significance on the calendar, but the market will be on the lookout for any statements from the Fed after the stronger than expected February CPI released on Tuesday. US yields did eventually edge a little higher after the data, and the USD benefited, but any FOMC members expressing concern about inflation could lead to more US yield rises and more USD gains, particularly if we get such comments from established doves. EUR/USD risks consequently look to be on the downside.

GBP IMM positioning

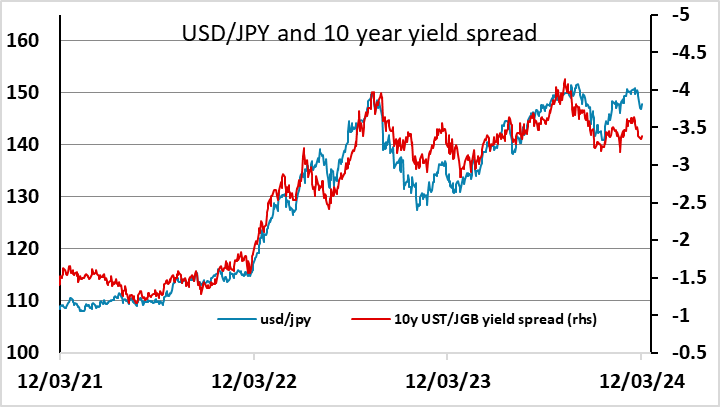

The USD/JPY picture is less clear, as there is mounting speculation of a tightening of BoJ policy as early as next week’s meeting, and yield spreads show a clearer case for JPY gains already. On top of this, we are likely to see Toyota release details of wage settlements for this year. Unions say most companies have agreed to a higher wage hike than the previous year with numbers floating around currently at 5.1% base pay and 6.2% overall pay increase. If the pay increases indeed reached 5%, it will be viewed as hawkish from the BoJ's standpoint because they are only looking for a 2% growth to sustain trend inflation in Japan. Realistically, anything above 4% will likely see the JPY strengthen.