FX Daily Strategy: Europe, June 27th

Some SEK downside risks on the Riksbank

JPY weakness extreme and BoJ will have to act soon

US trade data of interest after rise in April deficit

Some SEK downside risks on the Riksbank

JPY weakness extreme and BoJ will have to act soon

US trade data of interest after rise in April deficit

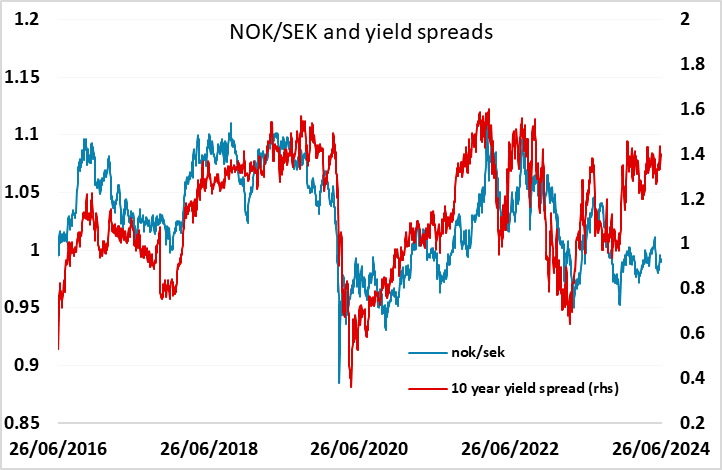

The Riksbank policy meeting the is the main calendar event on Thursday. While there is no real risk of any change in policy, with nothing priced in and all forecasters calling for no change, the real focus will be on what sort of guide the Riksbank provides for the August meeting. Currently, this is priced as a 65% chance of easing. We don’t see a lot of upside for the SEK here, as the Riksbank seem unlikely to change their stance significantly. They are likely to leave the possibility of easing in August open, provided the data behave, and the SEK has outperformed yield spreads in the last few weeks. NOK/SEK still should have scope to trade back above parity after the more hawkish tone from Norges Bank last week.

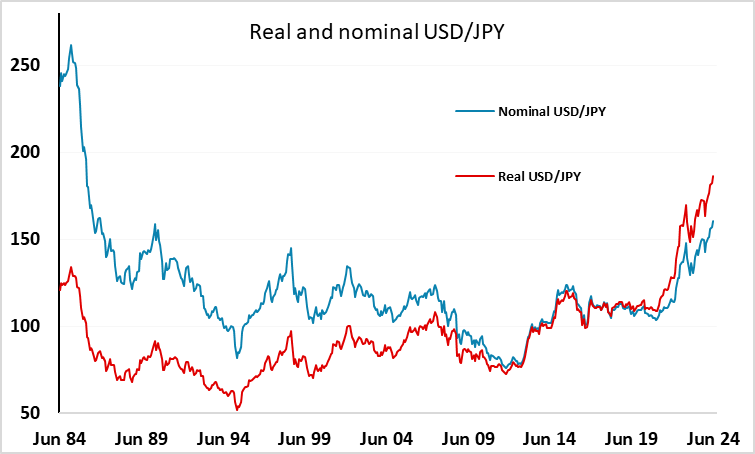

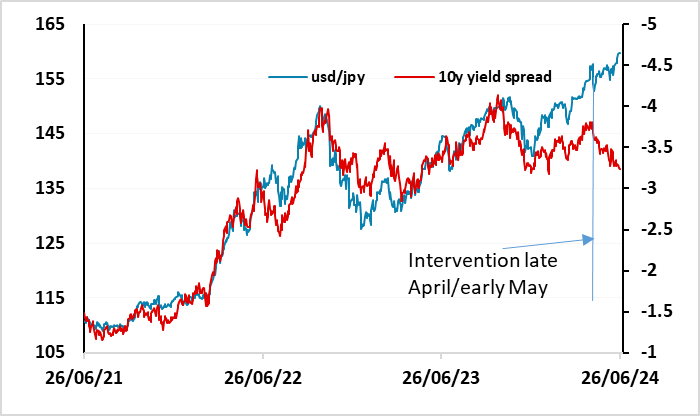

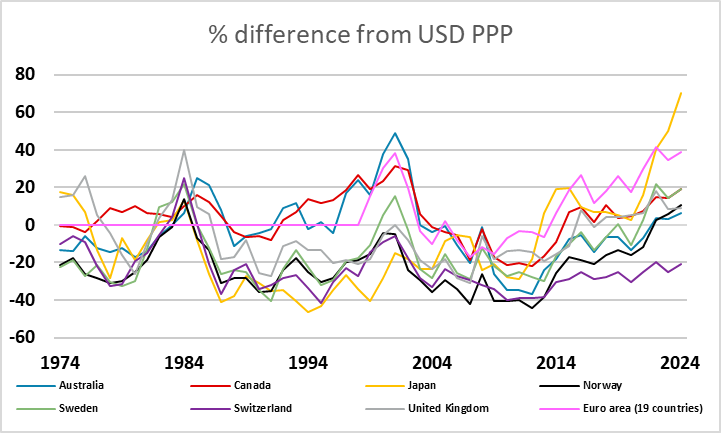

USD/JPY continued to move sharply higher on Wednesday, without any obvious news. Stops have no doubt been taken out at the previous highs, and we are now at the highest level since December 1986. Of course, in real terms this massively understates the weakness of the JPY, as relatively low Japanese inflation means that we are already at all time real terms USD/JPY highs (see chart). The BoJ cannot allow this to continue unchecked, so the question is when rather than if they will intervene, and what the impact is likely to be.

After the last intervention, USD/JPY fell sharply but has recovered to new highs even though the rise in yield spreads that drove the JPY weakness in recent years has been partially reversed in the last month. This may mean that JPY bears are unafraid of BoJ action. But when the market is this one way, with the JPY falling even when there are yield moves in the JPY’s favour, the BoJ is likely to want to make the next intervention stick. They might well be happy to just stabilise the market below 160, but we can’t envisage them allowing levels above 160 to persist. After all, this is more than 70% above the Purchasing Power Parity level of USD/JPY. The USD has never trade more than 50% above PPP against any other developed market currency in the floating era.

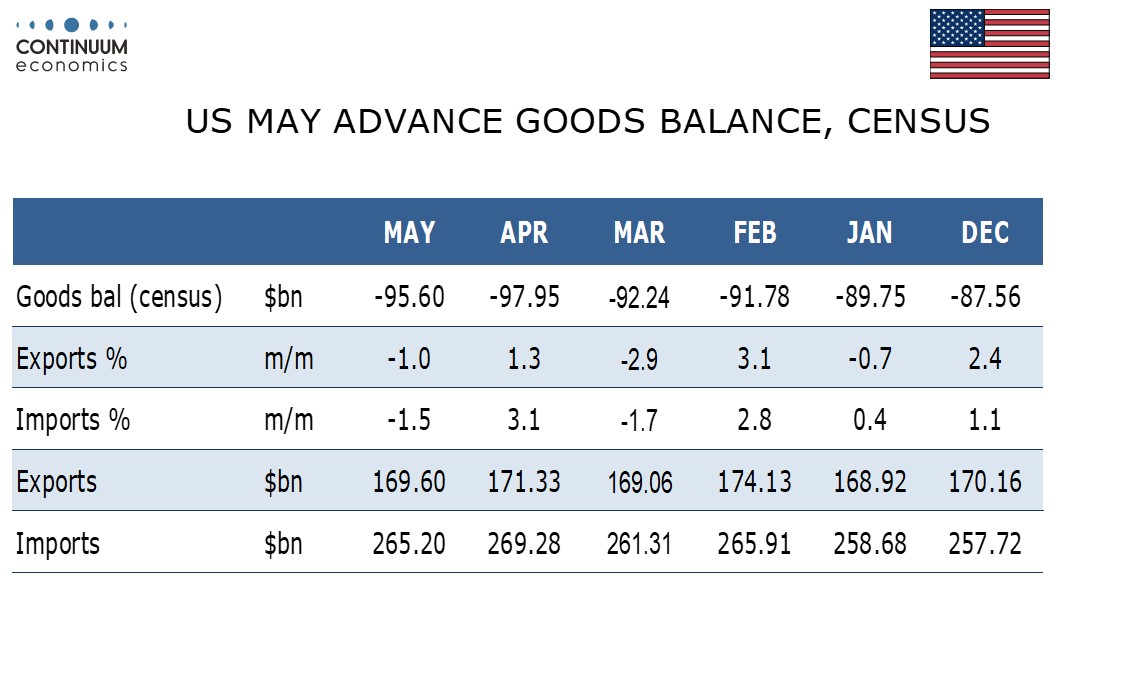

There is US data on Thursday, but not data that is likely to be particularly market significant, although there will be some interest in the jobless claims data after the higher number seen in the last few weeks. These have more potential to move the market than the May durable goods orders data or the revised Q1 GDP data. But there may be some interest in the trade data after the big deficit in April suggested a weaker Q2 GDP outcome than had previously been anticipated.