FX Daily Strategy: N America, Sep 24th

Japanese PMI disappoints

JPY continues to look substantially undervalued

IFO makes German PMI look suspect

US home sales data could renew USD downside pressure

Japanese PMI disappoints

JPY continues to look substantially undervalued

IFO makes German PMI look suspect

US home sales data could renew USD downside pressure

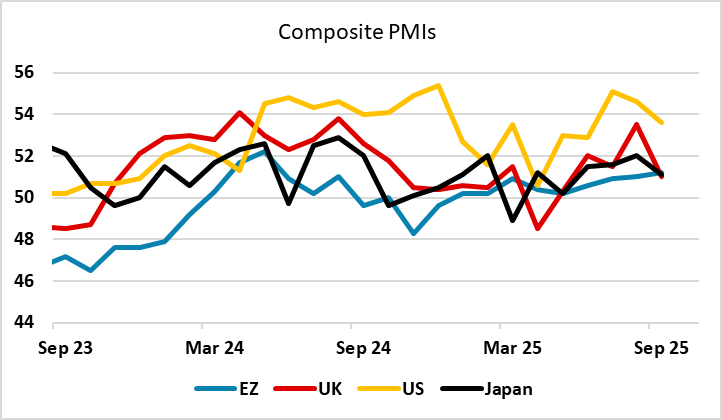

Wednesday is a relatively quiet calendar. We start with the Japanese PMI data, delayed because of the Japanese holiday on Tuesday. While most take little notice of these numbers, there has been evidence of a modest improvement in the Japanese economy both in this data and in the GDP numbers this year, but the September data has disappointed. Even so, hopes of an October rate hike from the BoJ remain.

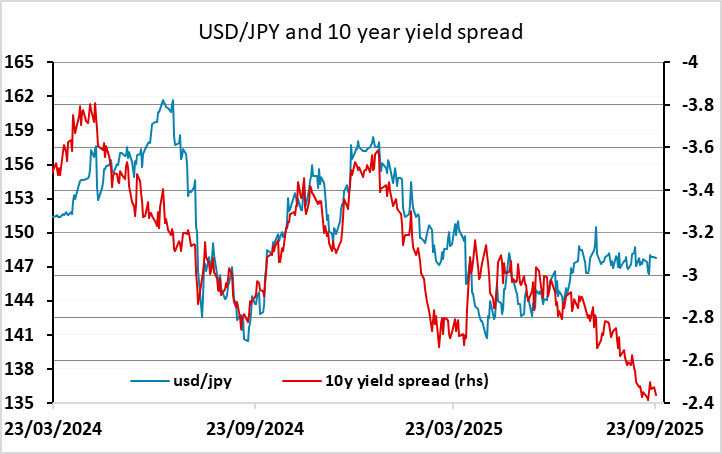

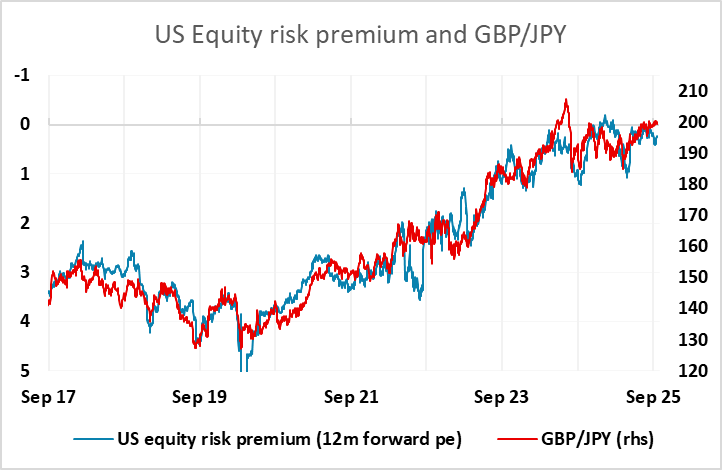

USD/JPY remains extremely high from a fundamental perspective and also well above the level normally associated with the current level of yield spreads. Most of this is because of low risk premia and persistent equity market strength, but even on this basis the JPY is starting to look too low. The range could be broken if we see increased expectations of a BoJ rate hike in October. This is currently seen as slightly less than a 50-50 chance, but expectations of tighter policy could increase after the LDP choose a new leader on October 4th. However, for the moment, quiet markets favour the higher yielders and furtehr JPY weakness, albeit very gradual.

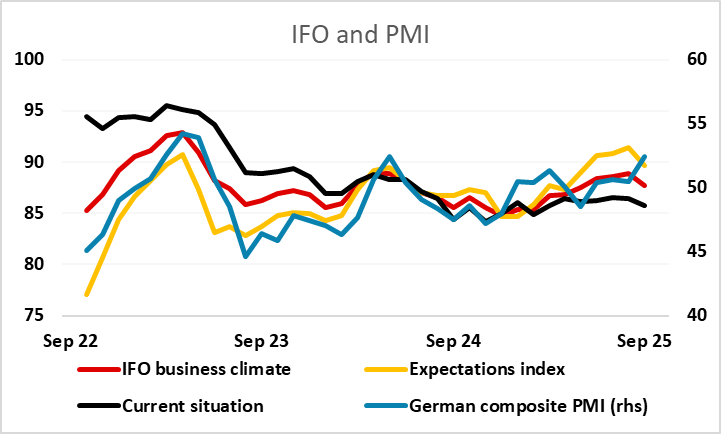

This morning saw the German IFO survey, following on from the German PMI data on Tuesday. The German PMI moved sharply higher in September due to strength in services. The IFO business climate index has tended to move closely with the composite PMI in the last year or so, but hasn't matched the rise in the MI, challenging the credibility of the PMI reading. Without the strength in Germany, the Eurozone PMI would have been significantly weaker, so the EUR has slipped back a little as a result.

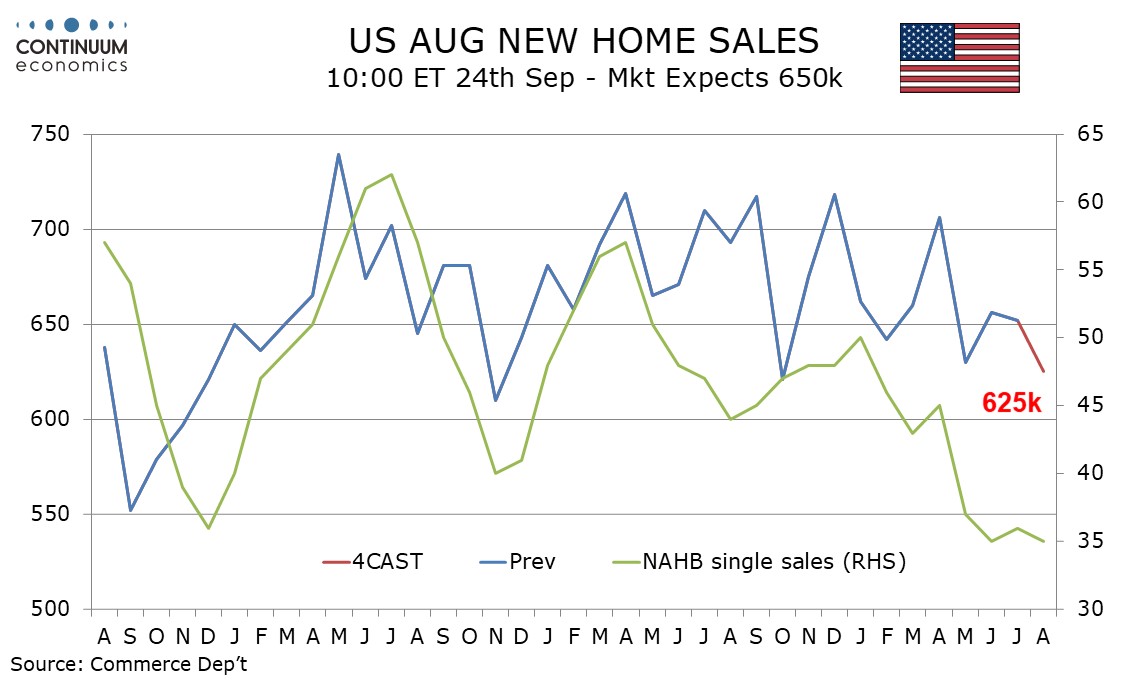

In the US, we expect an August new home sales level of 625k, which would be a 4.1% decline if July’s 0.6% decline to 652k is unrevised. The level would be the lowest since October 2023. Trend has been fairly stable but the NAHB survey suggests there may be some near term downside risk. New home sales have shown surprising resilience since the NAHB homebuilder’s index saw a sharp dip in May. This resilience may be difficult to sustain in August but once Fed easing is seen the housing market is likely to find some support. Even so, weak data could renew downward pressure on US yields and the USD.