FX Daily Strategy: Asia, May 15th

US PPI and survey data may be USD supportive

EUR/USD more rangy but risks on the downside

AUD could benefit from solid employment data

Nok still has scope for recovery versus SEK and CHF

US PPI and survey data may be USD supportive

EUR/USD more rangy but risks on the downside

AUD could benefit from solid employment data

Nok still has scope for recovery versus SEK and CHF

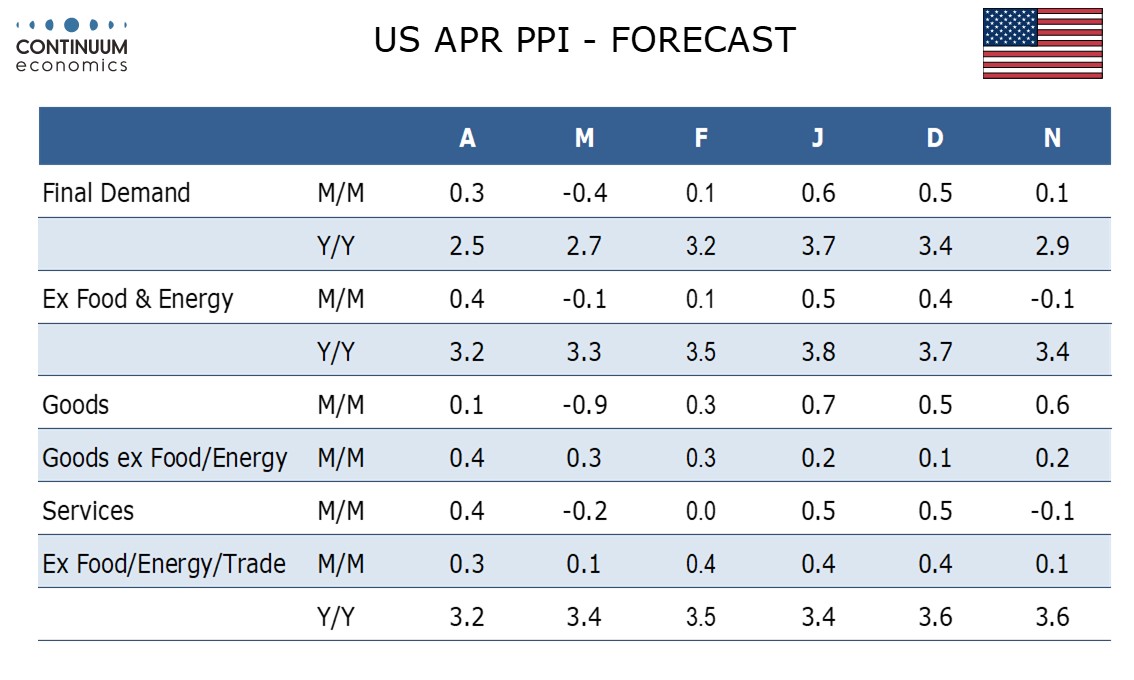

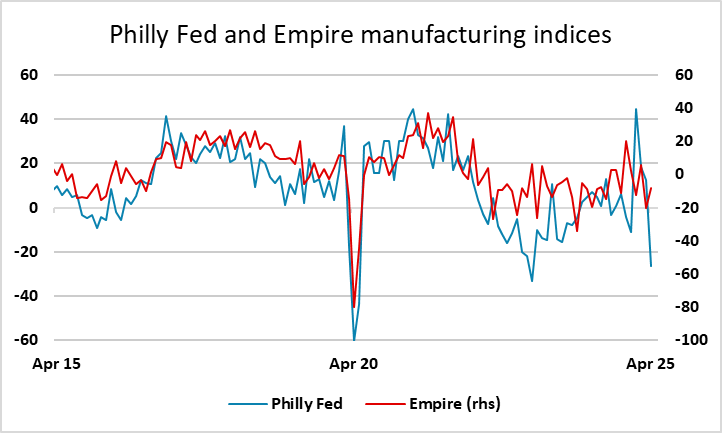

In the US, there is an array of data that might normally be considered second tier but will be seen as potentially significant given the uncertainty about the current state of the economy. We expect April PPI to bounce from a weak March with a 0.3% rise overall and a 0.4% increase ex food and energy. Ex food, energy and trade, we expect a rise of 0.3%. Tariffs are likely to continue supporting goods prices while services are likely to correct from a weak March. Our forecasts are a tad above the market consensus, and may provide some support for the USD. However, this will depend on how the other data come out, with jobless claims and the Philly Fed and Empire manufacturing surveys also due. The Philly Fed showed a sharp dip in April and a recovery in May could be USD supportive if jobless claims continue to show no evidence of weakness.

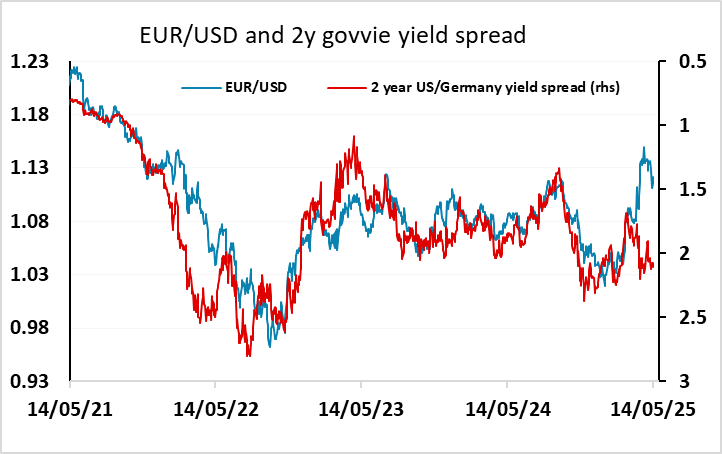

The softer USD on Wednesday made some sense in that the recovery on the back of the US/China deal was somewhat overdone, given that there is still likely to be a significant negative economic impact from the tariffs that remain. But at this stage it seems unlikely that the effect will be sufficient to trigger a recession, so we would expect EUR/USD to settle into a 1.11-1.13 range. If anything, the risks should be on the downside as EUR/USD remains well above the level consistent with the previous yield spread relationships, whereas the AUD still looks cheap on that basis and the JPY no better than fair.

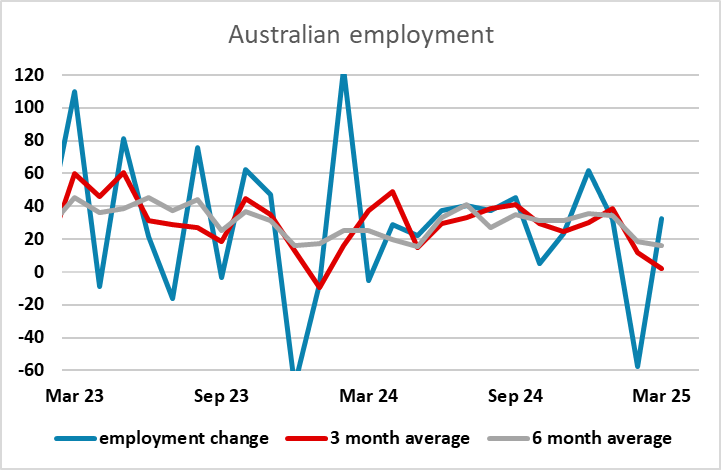

Australian April employment numbers are due early on Thursday, and there will be more interest than usual as the trend appears to have been weakening in the last couple of months. While the wage and price index released Wednesday was on the strong side, the market is still near enough fully pricing a rate cut at next week’s RBSA meeting, and it would now take a lot to prevent a cut. However, the outlook beyond next week could influence future rate expectations. The market is currently pricing three cuts by the end of the year, and a number in line with consensus at 20.9k would support this easy policy bias, as it would indicate a flattening trend in employment growth after the 57k decline in February and the partial 32k recovery in March. But the risk may be that the February number was an anomaly and we see a stronger number in April. This would put the AUD risks on the upside, and given the recent strong performance of equity markets and the risk positive bias in the AUD there may in any case be some potential for further AUD gains. 0.64 in any case looks to be a solid base for AUD/USD and shouldn’t be threatened unless we see a negative employment number.

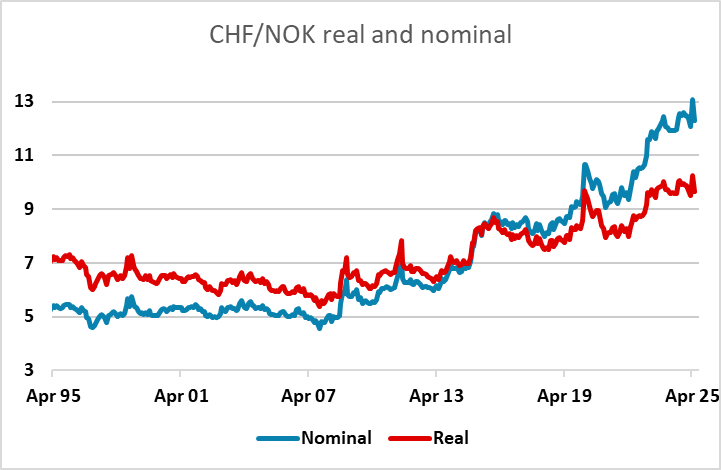

In Europe we have revised GDP data from the UK and the Eurozone, which is expected to be unchanged from the preliminary estimates of 0.6% and 0.4% respectively. There is a first take on Q1 Norwegian GDP, where the mainland number is expected to rise a healthy 0.6% in Q1 after a 0.4% decline in Q4. These numbers can be choppy, and tend not to have much impact on the NOK which tends to be driven more by general risk sentiment of late. Nevertheless, the data should be a reminder that the Norwegian economy is solid and with the recovery in equities and risk appetite in the last couple of weeks, there is scope for a bigger recovery in the NOK. NOK/SEK continues to look cheap sub 0.95, but CHF/NOK is perhaps even more out of line, with EUR/CHF still not far off its recent lows in spite of the generally stronger risk performance.