FX Daily Strategy: APAC, November 19th

UK CPI data to keep some downward pressure on GBP

GBP looks set for a steady decline against the EUR

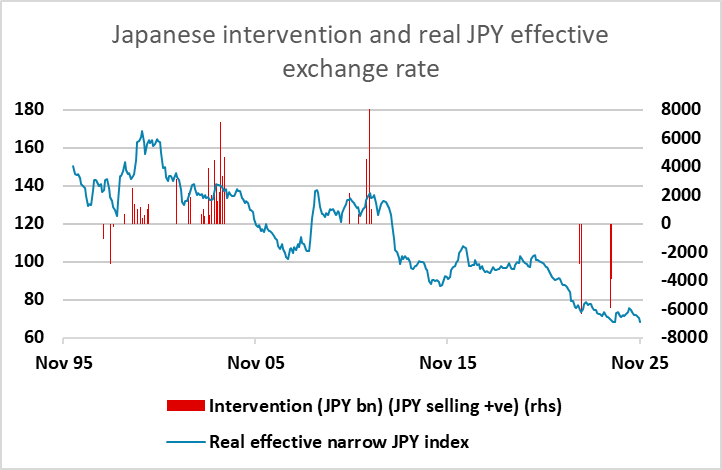

JPY decline is slow but inexorable – official Japanese action likely necessary to halt decline

EUR/CHF extending bounce but upside looks quite limited

UK CPI data to keep some downward pressure on GBP

GBP looks set for a steady decline against the EUR

JPY decline is slow but inexorable – official Japanese action likely necessary to halt decline

EUR/CHF extending bounce but upside looks quite limited

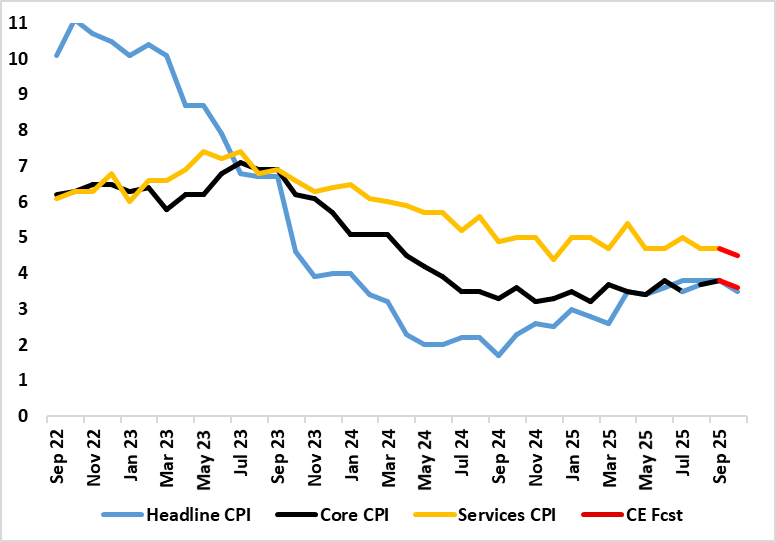

UK Headline and Core CPI to Fall Further

Source: ONS, Continuum Economics

Wednesday sees UK October CPI data. We expect the October figure will drop a notch more than BoE thinking, to 3.5%, helped by favourable energy base effects, with the core rate seen dropping 0.1 ppt to a ten-month low of 3.3%. Our forecast for the core is a tad lower than the market consensus, and numbers in line with our forecast could be expected to firm up market expectations of a December BoE rate cut. As it stands, this is priced as an 80% chance, but even without a softer than expected CPI number, we would anticipate the November budget being tight enough to ensure the BoE cut the base rate 25bps to 3.75%.

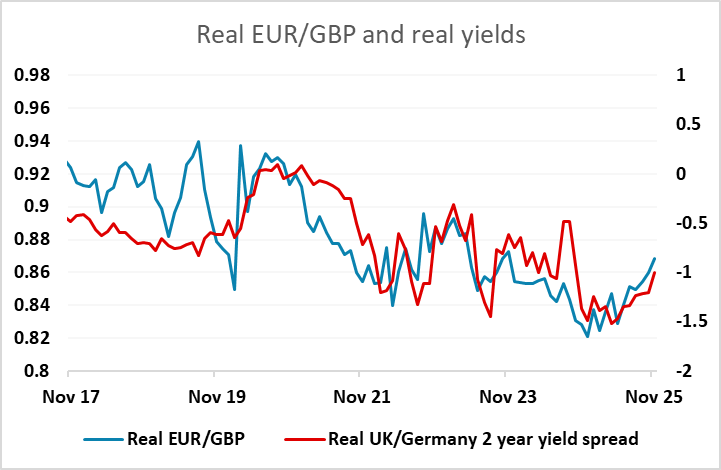

All this suggests some upside risks for EUR/GBP, although it is still likely to be difficult to break convincingly above 0.8850. Real EUR/GBP continues to move broadly with real yields, but has already moved a little ahead of the move in spreads, as GBP sentiment was damaged by the news that Chancellor Reeves was abandoning plans to raise income tax at the Budget. But although this was disappointing, it is still expected that there will be other tax rises to raise the required revenue, and this should avoid any renewed concerns about the stability of the public finances. GBP should therefore move broadly in line with the yield spread relationship, which suggests slow upwards progress in EUR/GBP. Every 1% contraction in the 2 year yield spread is typically worth 6 figures in EUR/GBP, and we see scope for gradual convergence in real yields from here over the next couple of years. Although the front end spread with likely stay above zero, we would expect sufficient convergence to take EUR/GBP above 0.90, but we should hold below 0.89 this year.

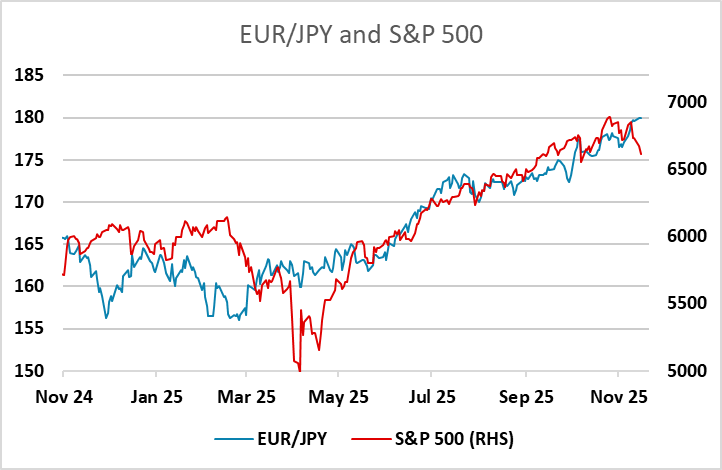

There isn’t a lot else on the calendar, with final Eurozone CPI unlikely to provide any surprises, and the September US employment report on Thursday remains the main focus for this week. However, equity markets will remain a factor, so the Nvidia results due after the close on Wednesday will be a focus. Having said this, the slippage in equity markets in recent data has had very little impact on FX markets, with the JPY continuing to edge lower despite the decline in equities, going against the usual negative correlation between JPY crosses and equities and/or equity risk premia. The language from new Finance Minister Katayama has become increasingly aggressive about excessive JPY weakness, but the Japanese authorities are going to have to put their money where their mouth is to stop the gradual JPY decline. The market will otherwise continue to play grandmother’s footsteps with the BoJ, continually edging the JPY lower awaiting intervention.

FX markets were generally very quiet on Tuesday, but there was some softness evident in the CHF, which continued its reversal away from the 0.92 support area. This is a little unusual given the weak equity market tone seen through most of the day, but there is still a long way to go to challenge the medium term downtrend seen since August. For now, we would expect EUR/CHF to hold below 0.93, although CHF valuation remains very high and there may yet be scope for bigger correction towards 0.95 if the downtrend breaks.