Preview: Due February 20 - U.S. December Personal Income and Spending - Firmer prices matching income and spending

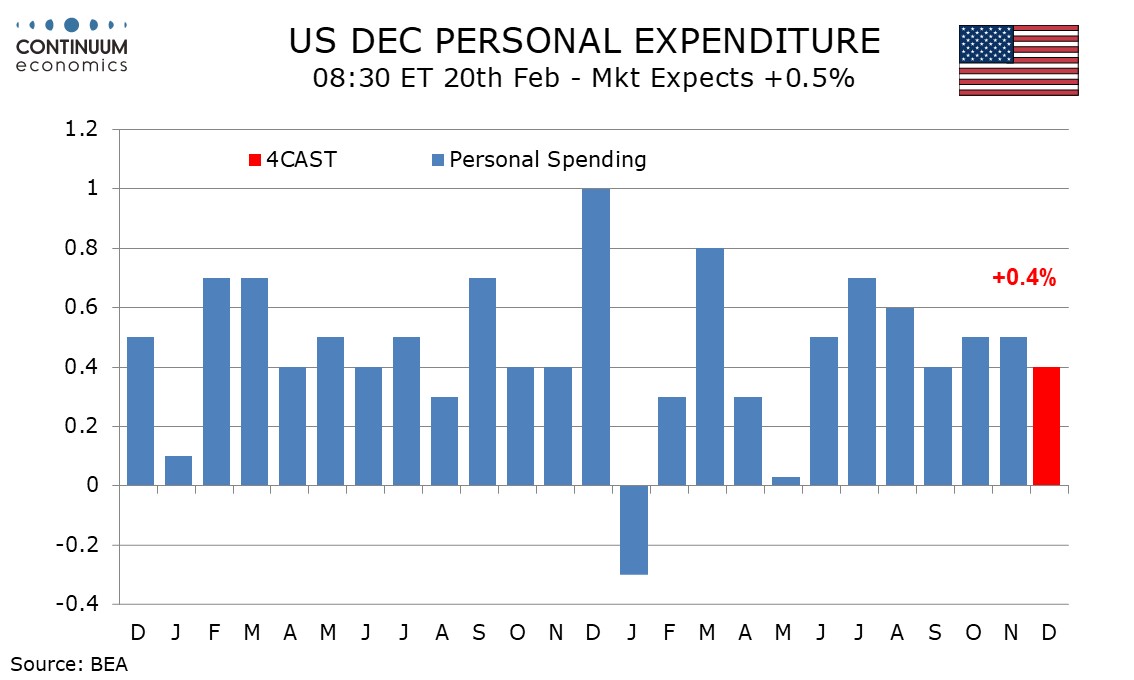

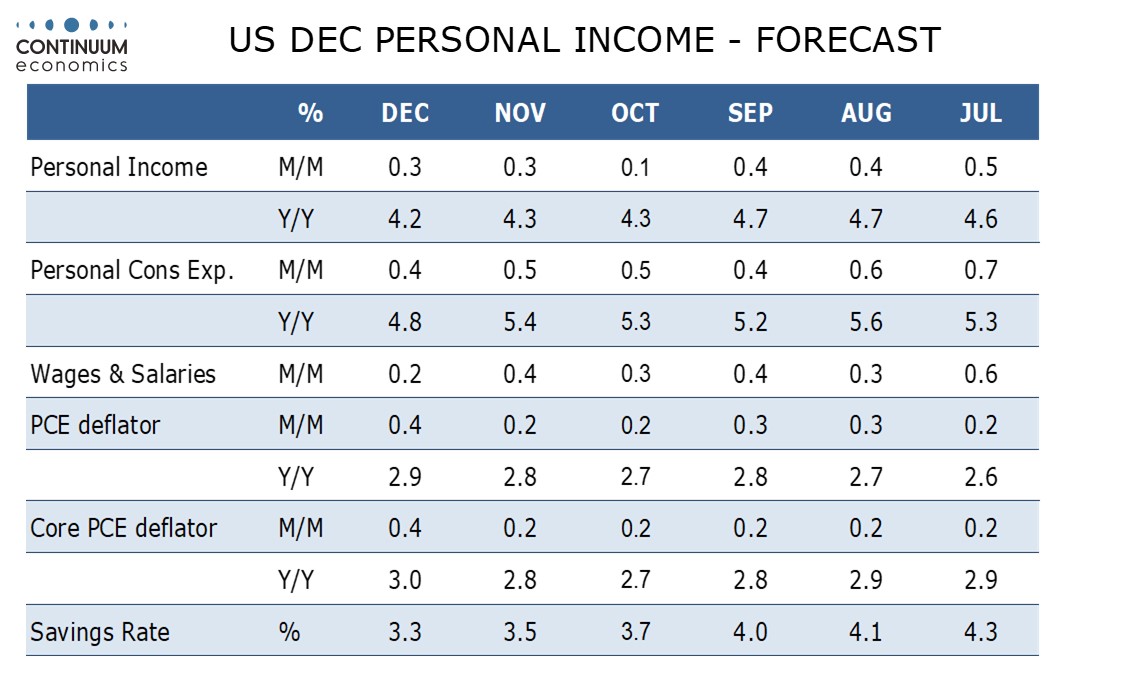

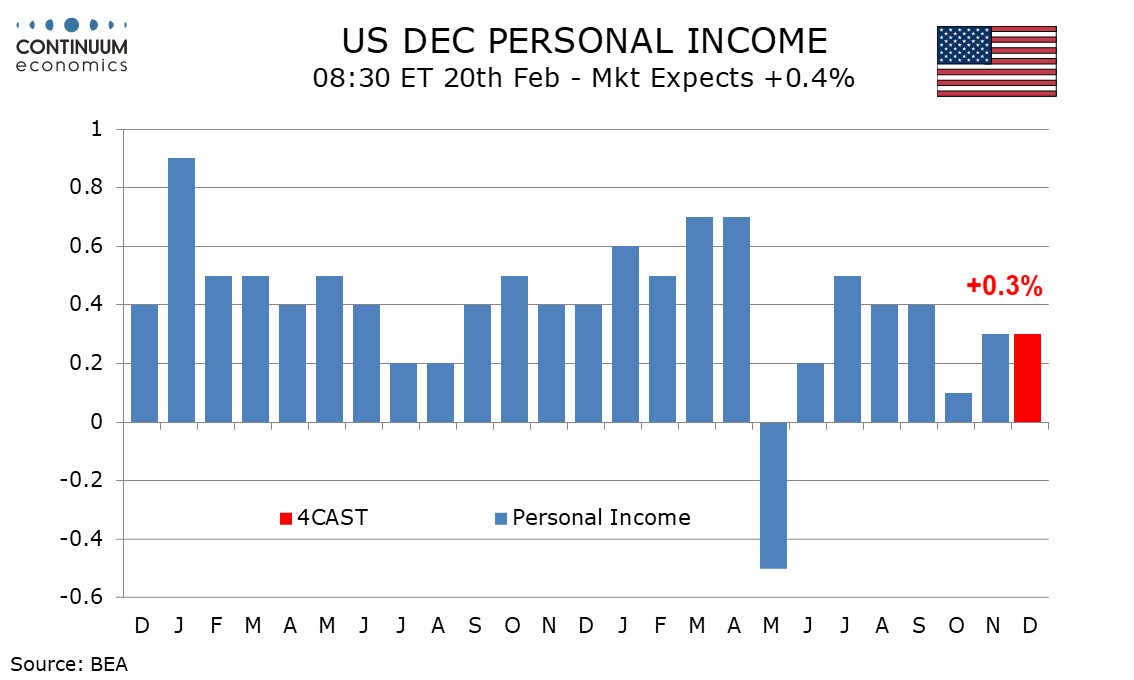

December’s personal income and spending report may be overshadowed by Q4 GDP data released at the same time, but is likely to see a strong core PCE price index increase of 0.4%, the highest since February. We expect personal income to rise by 0.3%, underperforming a 0.4% rise in spending, with both series soft in real terms.

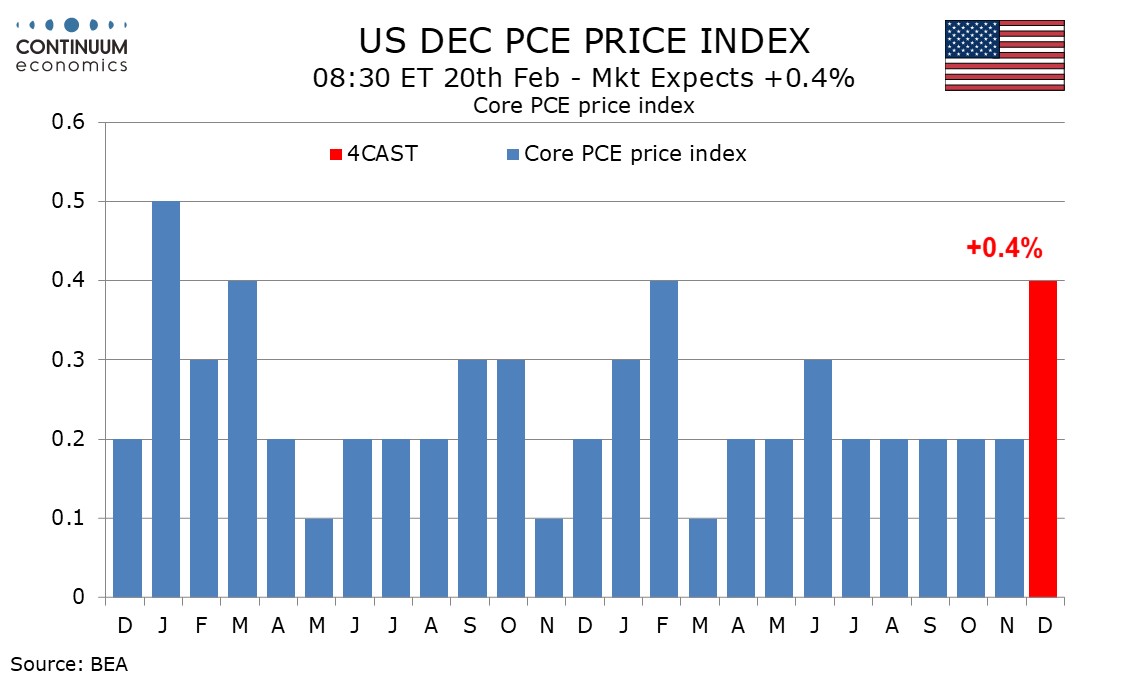

We expect 0.4% gains in both overall and core PCE prices, which would be stronger than their respective CPI counterparts, which increased by 0.3% and 0.2%, with core CPI on the firm side before rounding. PCE price data will be given a further boost from a strong December PPI. This would leave annualized Q4 gains of 2.8% in overall PCE prices and 2.6% in the core.

Assuming no back month revisions, yr/yr growth in core PCE prices would then pick up to 3.0% from 2.8%, reaching its highest level since February, while overall PCE prices would increase to 2.9% yr/yr from 2.8%. This would be the highest since March 2024. Both of these yr/yr rates have been signaled by Fed officials.

A subdued December non-farm payroll breakdown suggests a modest 0.2% increase in wages and salaries. We expect a slight pick-up in the other components of personal income after two weak months though at 0.3% personal income would still fall short of PCE prices. We expect real disposable income to fall by 0.3% annualized in Q4 after a flat Q3.

Retail sales were unchanged in December but if auto sales are consistent with industry data, they may outperform the retail auto data. We expect durables and services to both increase by 0.5%, with overall personal spending at 0.4% but flat in real terms. Q4 real personal spending would still be up by 2.7% annualized, significantly outperforming real disposable income.