JPY flows: JPY under pressure as US and European yields rise

JPY falls across the board as US and European yields rise despite hawkish comments from BoJ deputy governor Himino

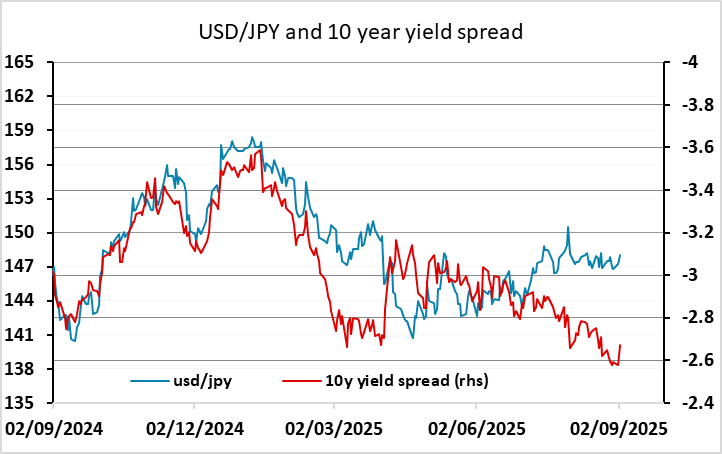

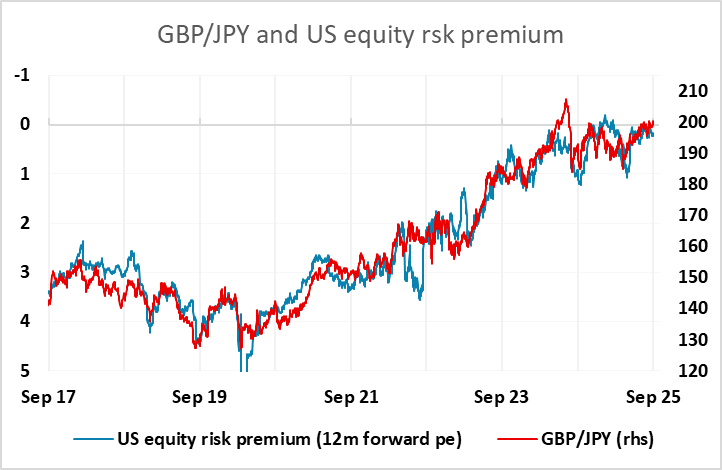

JPY weakness has been the theme overnight and this week. US 10 year yields spiked higher early in Asia following the US labour day holiday, and this looks to be at least partly responsible. There were overnight comments from deputy BoJ governor Himino that certainly looked to be on the hawkish side, suggesting that rate hikes were on the table with inflation still high and real rates still too low, but this failed to prevent USD/JPY gains back above 148. The move was very much JPY weakness rather than USD strength, with EUR/USD back above 1.17 and EUR/JPY above 173 for the first time since July. Higher yields in Europe and lower yields in Japan in spite of the Himino comments also support the gains for European currencies, but both USD/JPY and EUR/JPY look stretched at these levels, and we would expect medium and long term sellers to emerge.

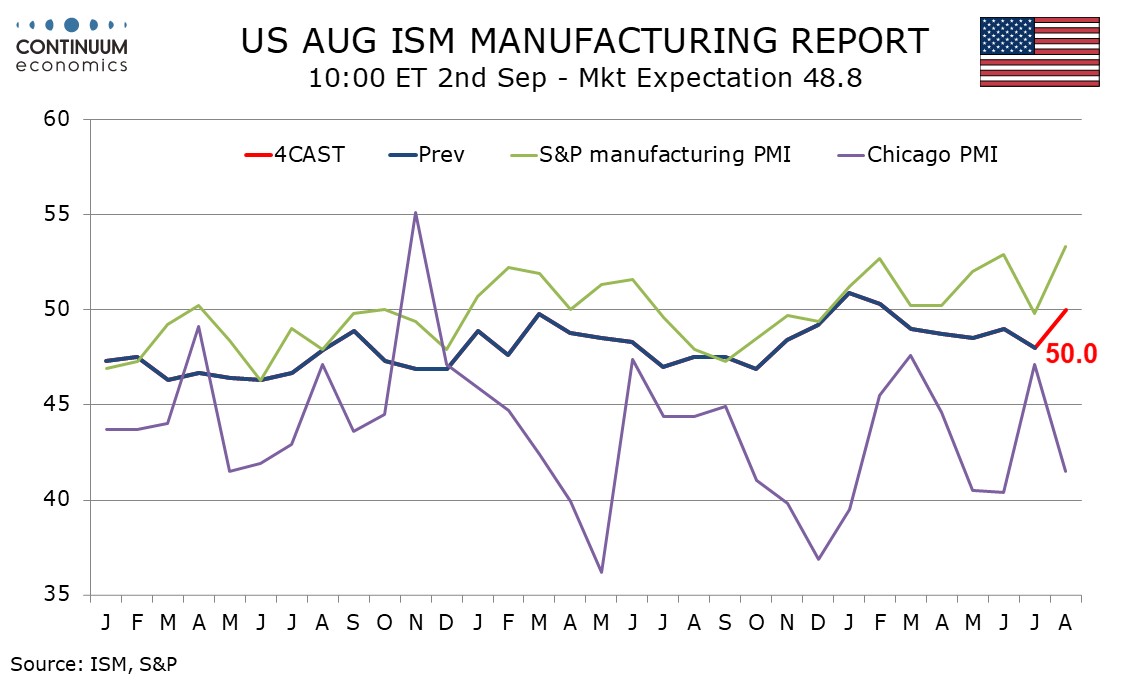

There isn't a great deal on today’s calendar with the Eurozone CPI data unlikely to provide major surprises with the national data already released, but the US ISM manufacturing survey will be watched to see if it matches the strength suggested by the S&P PMI.