FX Daily Strategy: APAC, January 14th

US retail sales the next data focus

USD strength and JPY weakness persist

JPY weakness likely to continue unless the BoJ intervene

AUD and NOK may benefit from strong equities

US retail sales the next data focus

USD strength and JPY weakness persist

JPY weakness likely to continue unless the BoJ intervene

AUD and NOK may benefit from strong equities

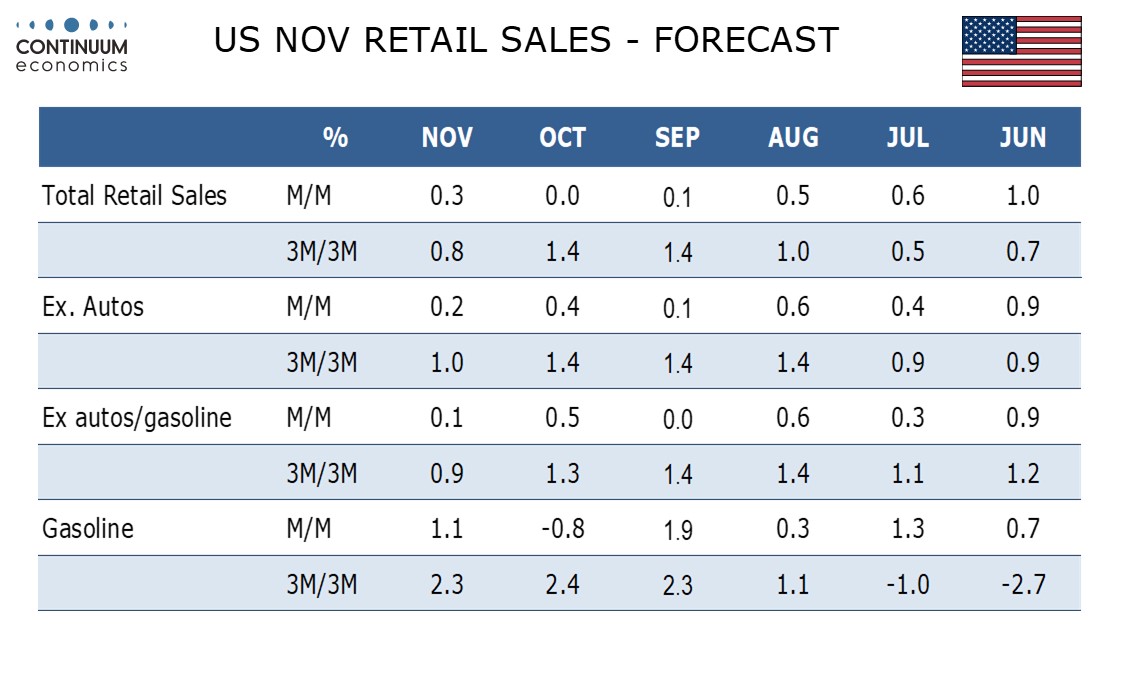

Wednesday sees US retail sales data for November, which will have an impact on market expectations of Q4 GDP and Fed policy. The softer CPI data in the last couple of months opens up the possibility of easier Fed policy somewhat earlier than the June 2026 data that is currently priced in, but only if we see some weakening in US real sector numbers. While the employment data have been softening, the domestic demand data has been generally strong, with the 0.8% gain in the retail control measure (which is the relevant measure for GDP) in October suggesting a solid Q4. We expect a modest 0.3% increase in November retail sales, with positive contributions from autos and gasoline. Ex autos we expect a rise of 0.2% with ex auto and gasoline sales rising by only 0.1%. The retail control measure was much stronger than the headline in October, so may see some payback.

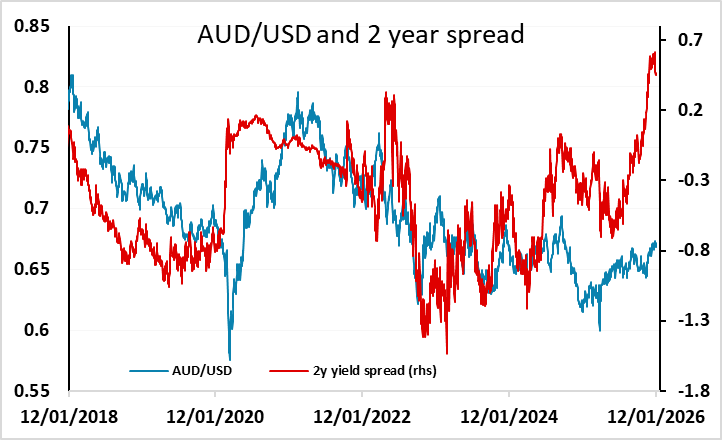

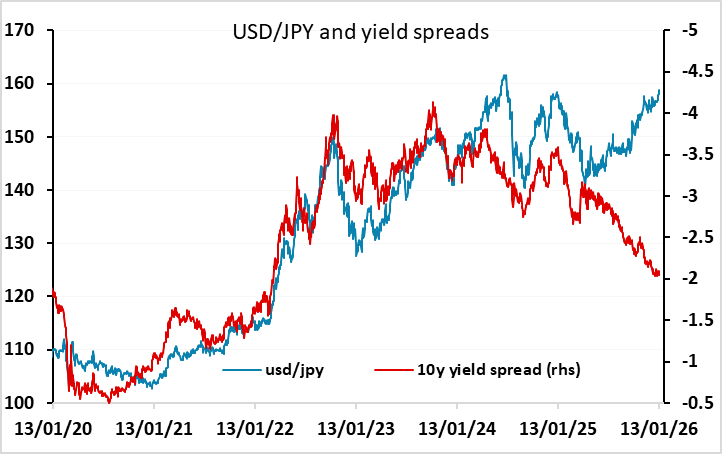

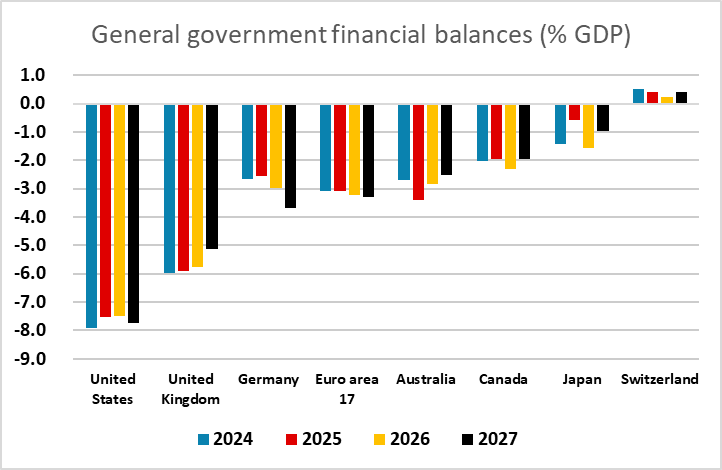

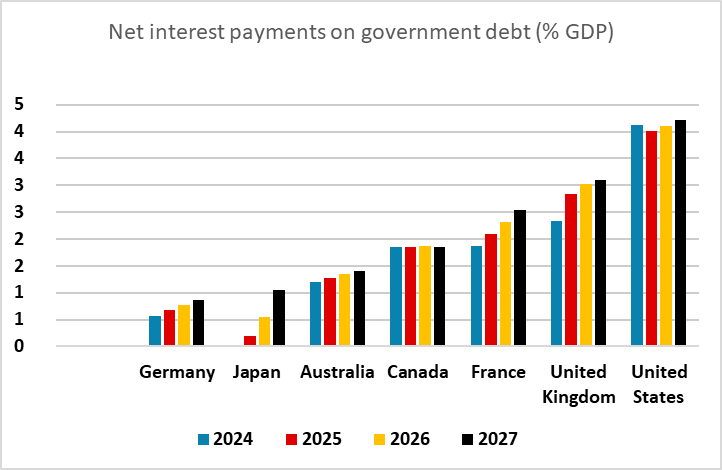

The USD initially slipped a little lower after the weaker than expected CPI data on Tuesday, but soon recovered and the underlying firm tone seen so far this year has persisted, particularly against the JPY. The rationale for this is, in our view, quite flimsy. While the US economy is solid it isn’t generating expectations of higher yields, and yield spreads continue to point to a weaker USD against the JPY (and AUD). While the possibility of a snap election in Japan has been cited as a reason for the latest JPY weakness, we would continue to point out that higher yields are generally a positive for a currency, not a negative. Only if higher yields reflect some view of unsustainability in fiscal policy is the reaction typically negative for the currency. Given that the interest burden on Japanese debt and the Japanese fiscal deficit are both among the lowest of the developed nations (and much lower in both cases than the US, UK and Eurozone), JPY selling on the basis of expansionary fiscal policy looks unjustified.

Nevertheless, the trend in the JPY is clearly lower, and when it is the case that the decline is illogical – as it is now – FX intervention is justified and in this case looks necessary to halt the decline. Despite the various justifications for JPY weakness that are being cited, the decline looks to be primarily momentum driven. Until or unless we see intervention to oppose the JPY decline, it is likely to continue in the absence of some other major external shock. The Japanese authorities are already too late, as the market no longer pays any attention to verbal protests. With the real trade-weighted JPY already at all time lows, there is no reason for any further delay. Delays will just mean more JPY declines. Ultimately, the JPY is likely to recover back to something near fundamental fair value, which is close to 100 for USD/JPY. The lower it goes in the meantime, the sharper the eventual JPY rally is likely to be, and the more problematic for policy.

As well as the US retail sales data there is PPI data, but this is unlikely to have much impact following the CPI data yesterday. There is little of note from Europe or Asia. Continuing new highs in equity indices suggest that there is scope for more gains for the riskier currencies, with the AUD and NOK looking the best supported by yield spreads.