Preview: Due April 1 - U.S. March ISM Manufacturing - To slip back below neutral

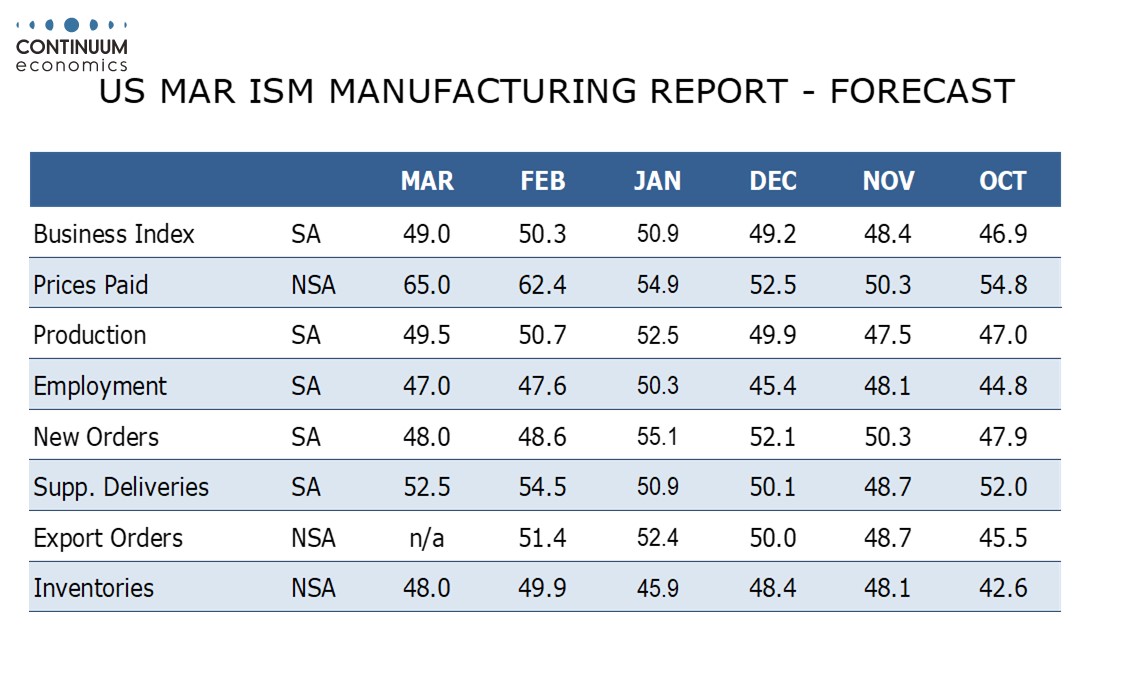

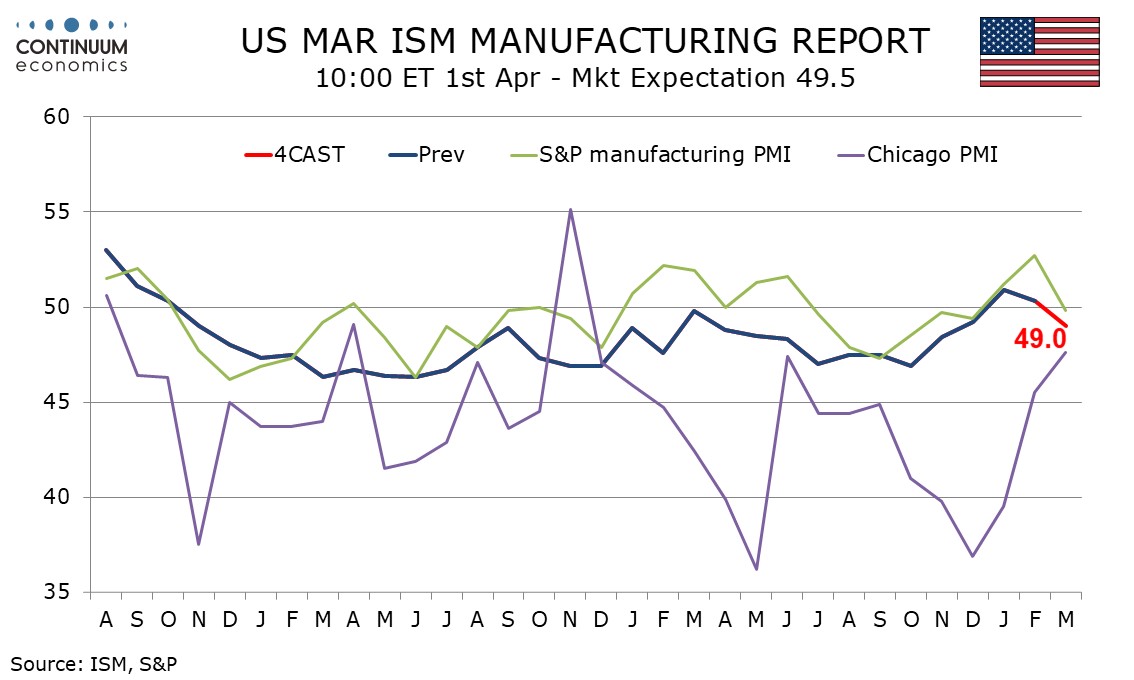

We expect a March 1SM manufacturing index of 49.0, slipping back below neutral for the first time in three months, after positive readings of 50.3 in February and 50.9 in January.

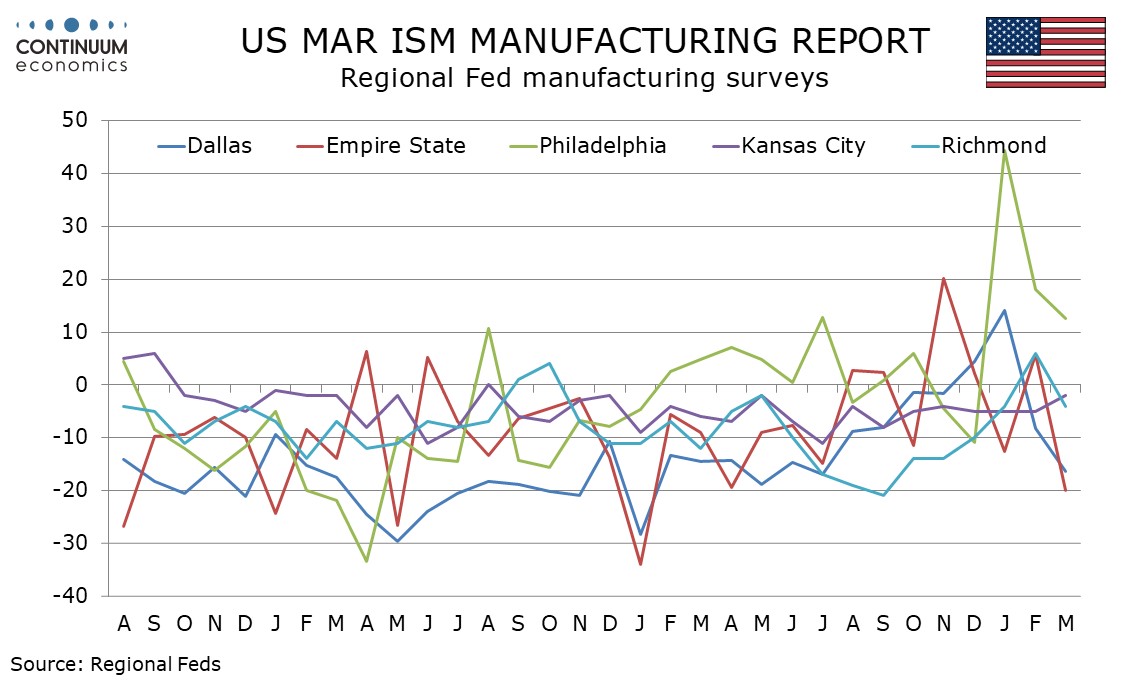

March’s S and P manufacturing index slipped back below neutral after two positive months and regional surveys are generally weaker, with the Philly Fed’s less positive, the Richmond Fed’s turning negative and the Empire State and Dallas Fed surveys very weak. The Kanasa City Fed and Chicago PMIs were slightly improved, but still negative.

That February’s ISM new orders index moved below neutral; was a negative sign. We expect increased weakness from new orders in March, and softer data from the other contributors to the composite, production, employment, deliveries and inventories.

Prices paid do not contribute to the composite and here we expect an increase, to 65.0 from 62.4, taking the index to its highest level since June 2022. Tariff concerns are likely to both lift prices and restrain activity.