FX Daily Strategy: Asia, August 27th

USD becalmed as Fed expectations unlikely to move far

USD continues to follow similar path to Trump 1.0

GBP/JPY toppish as risk premia risks are on the upside

NOK/SEK bouncing from strong support with more upside scope

USD becalmed as Fed expectations unlikely to move far

USD continues to follow similar path to Trump 1.0

GBP/JPY toppish as risk premia risks are on the upside

NOK/SEK bouncing from strong support with more upside scope

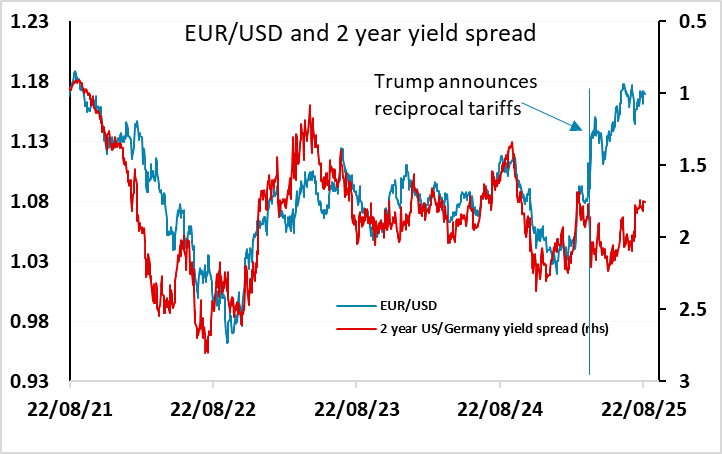

Another quiet day for data on Wednesday, with most currencies remaining range-bound. There isn’t a lot to look forward to for the remainder of the week either, so although there has been some mild interest in Trump’s attempt to oust Fed governor Cook, it’s hard to see any major moves. The Fed is 80% priced to ease in September, and with 130bps of easing priced in for the next year, it’s hard to see US front end yields going a lot lower, so the risks may be slightly to the USD upside if we continue to get strong activity data like the S&P PMIs last week and the durable goods orders data this week. But it’s also hard to see the market moving away from expecting a Fed ease in September, so upside for yields is very limited. In any case, the USD’s correlation with yields has been weak since the announcement of reciprocal tariffs in April, particularly against the EUR.

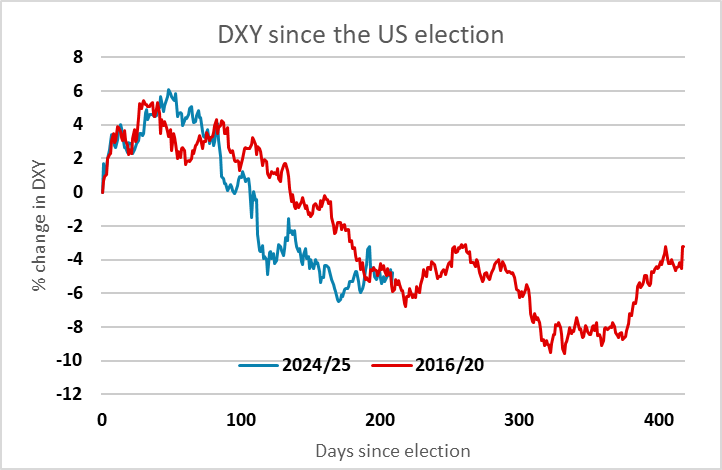

The USD’s performance broadly continues to map its behaviour in the first Trump administration, when after a net 6% decline in the first 200 days (after an initial 6% gain) we saw a period of broad stability for the next 100 days. While it’s hard to find a strong justification for the USD’s performance to mirror its behaviour in the first Trump presidency, the lack of correlation with yield spreads leaves us with little else to follow.

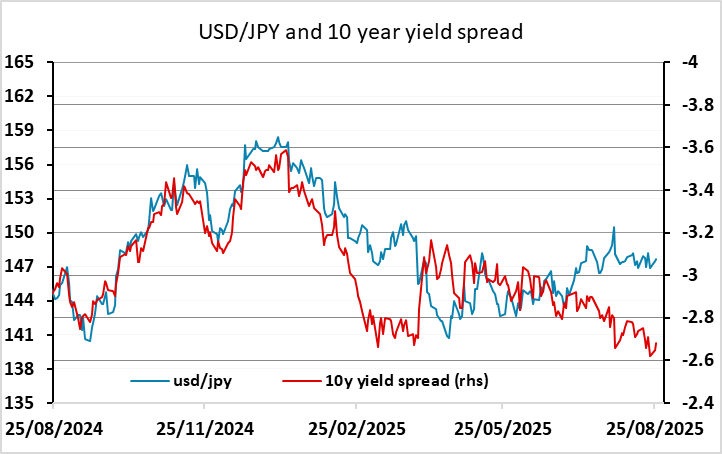

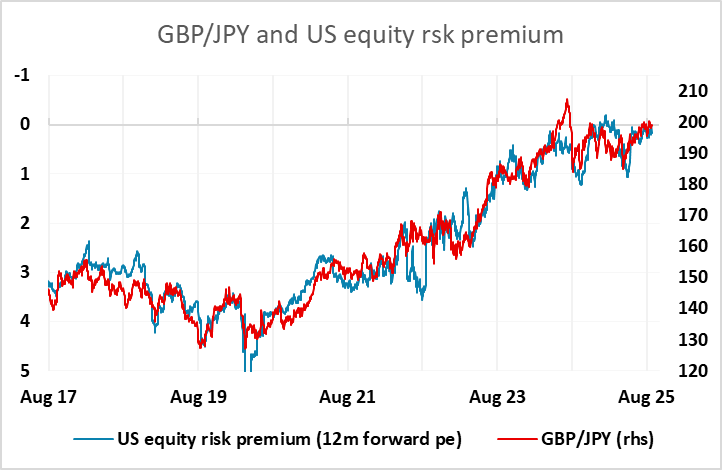

Crosses have behaved a little more regularly, with the JPY crosses in particular continuing to move in line with equity risk premia. GBP/JPY continues to show he closest correlation, and while we find it hard to see any justification for a further decline in risk premia from already low levels, it still looks likely to require clear weak US data to trigger any significant rise in risk premia, and this doesn’t look imminent.

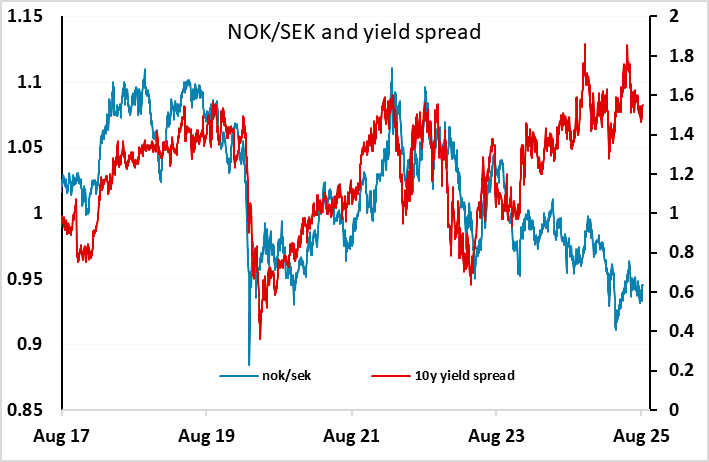

One cross that has moved significantly in the last few days is NOK/SEK, which has bounced off the key 0.93 support area, and still looks to have potential to advance towards parity. NOK weakness has been persistent for the last year, without any obvious rationale, and it is hard to have any confidence in there being a strong rally. However, there is even less reason to see any downside for NOK/SEK below 0.93, given the NOK’s yield attraction and recent underperformance, so we see upside risks as being dominant.