FX Daily Strategy: N America, November 28th

Thanksgiving likely to mean quiet markets

European focus on German and Spanish CPI

EUR/USD likely to hold 1.05-1.06 range absent specific Eurozone tariff threats

EUR/CHF being pulled lower by widening France/Germany spreads

JPY remains biased higher but upside limited as long as equities remain firm

Thanksgiving likely to mean quiet markets

European focus on German and Spanish CPI

EUR/USD likely to hold 1.05-1.06 range absent specific Eurozone tariff threats

EUR/CHF being pulled lower by widening France/Germany spreads

JPY remains biased higher but upside limited as long as equities remain firm

Thursday is the Thanksgiving holiday in the US, and is consequently likely to be relatively quiet overall. However, there is Spanish and German provisional November CPI data in the morning, which will set the tone for the Eurozone CPI data on Friday. German state CPI data suggests that the national data later will be slightly below market consensus, with the y/y rate for the largest state, NRW, falling from 2.0% o 1.9%. While other states saw the y/y rates pick up, they were generally no more than 0.2% above the October data. This suggests that the national data will see a rise in y/y CPI to only around 2.1 or 2.2% rather than the 2.3% expected, with the HICP rate possibly rising to 2.5% from 2.4% rather than the 2.6% expected. This keeps some hopes of a 50bp ECB rate cut on December 12 alive, although at the moment this is still only seen as a 16% chance. EUR/USD is slightly lower in response, but markets are quiet with the US holiday.

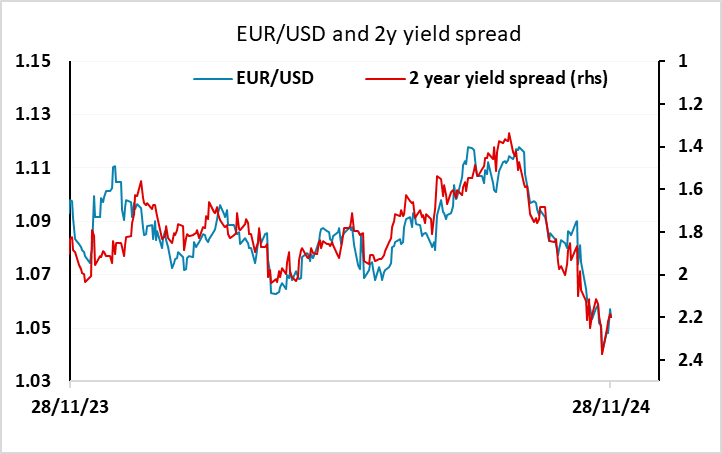

Wednesday’s recovery has brought EUR/USD back in line with the recent movements in 2 year yield spreads. Positioning in EUR/USD is quite light according to the CFTC data. While we saw a dip below 1.05 on the latest Trump tariff comments, this has proved short-lived so we would expect to see the 1.05-1.06 range to hold unless Trump makes some specific threats to the Eurozone. This is certainly quite possible- indeed, even probable - so the main risks may still be on the EUR/USD downside.

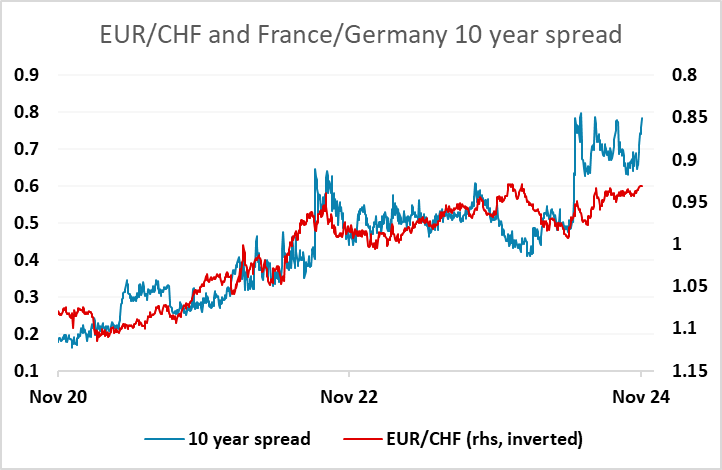

One other aspect of interest in Europe is the continued widening in the France-Germany yield spreads. The 10 year spread is at its highest since 2012, and likely reflects concerns about the deteriorating French budget maths. While a genuine crisis still seems some way away, concerns could mount if the recent spate of weak French data – notably the November PMI – extends in the coming months. EUR/CHF tends to be the FX rate that is most influenced by a widening of intra-Eurozone spreads, and we have seen a steady move lower in EUR/CHF in recent weeks. The SNB will want to try to limit CHF strength, but the trend is unlikely to turn unless we see some improvement in French confidence. While business surveys are just as weak if not weaker in Germany, there is more concern about the French budget and European weakness will always see intra-European spreads widen.

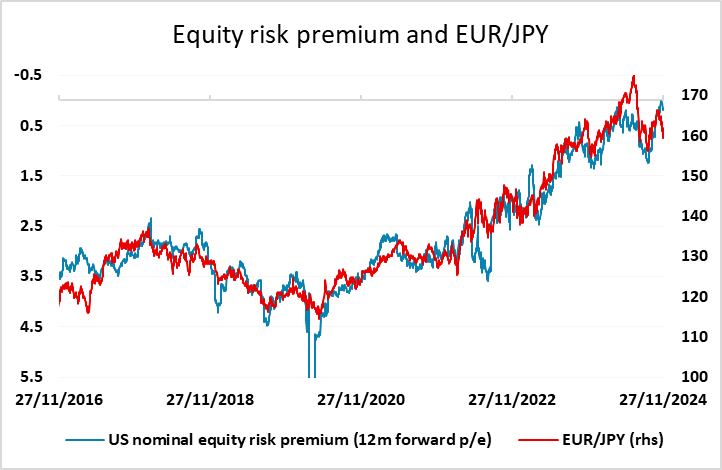

More generally, the JPY continues to look like the currency with then most potential for gains from here, but the scope for JPY strength in the short term still relies to some extent on the performance of the equity markets. As long as there is confidence in the Trump plan and equity risk premia remain very low, JPY strength is still likely to be quite modest and slow, even if the BoJ do hike rates in December. But the JPY remains extremely undervalued from a fundamental perspective, and any loss of confidence in the equity market which leads to US equities moving to more normal p/e ratios would mean a sharp JPY revaluation.