FX Daily Strategy: APAC, November 21st

Quiet day for data, some focus on equity earnings

CHF strength continues to extend

JPY still has upside scope

Quiet day for data, some focus on equity earnings

CHF strength continues to extend

JPY still has upside scope

Thursday is a quiet day for data, with the regular US jobless claims data probably the most significant focus, although there will be some interest in the Philly Fed survey and the US existing home sales data.

After a mild risk recovery through Asia and European trading on Wednesday, risk sentiment softened once again in the US session, taking the JPY and CHF higher. Unlike the move on Tuesday, which had been drive by Russia related geopolitical concerns, the decline in Wednesday happened without any decline in yields, which ensured the USD performed relatively well against the riskier currencies. The CHF continues to perform strongly, with EUR/CHF hitting its lowest level since August. Although the JPY gained in US time on Wednesday, it hasn’t managed to move convincingly lower, but yield spreads still suggest downside risks.

CHF strength is always hard to oppose when geopolitical risk is high, and CHF bulls have been in the ascendancy for some time. However, if we see the concerns around Russia and Ukraine fading, and get to the December 12 SNB meeting with EUR/CHF near current levels, there is a strong chance that the SNB will cut rates 50bps. Currently the market is pricing in 31bps of easing, or a 25% chance of a 50bp move, but with inflation below target it’s hard to see a case for the SNB not being more aggressive. Even so, the CHF has not tended to respond much to interest rate moves historically, so the SNB may need to back up any rate cuts with intervention if they want to prevent further CHF gains.

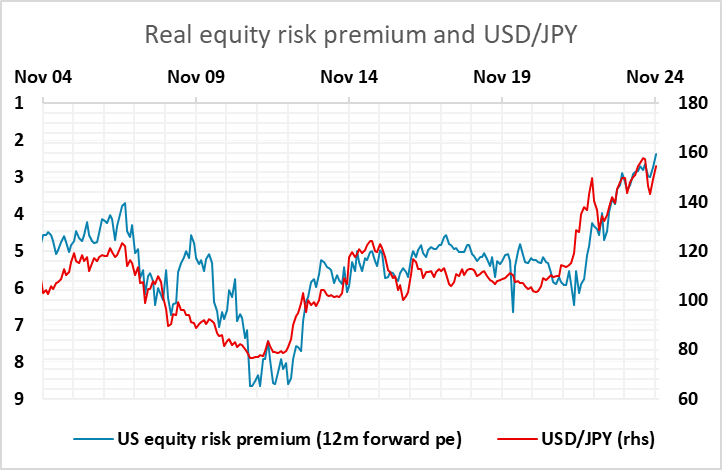

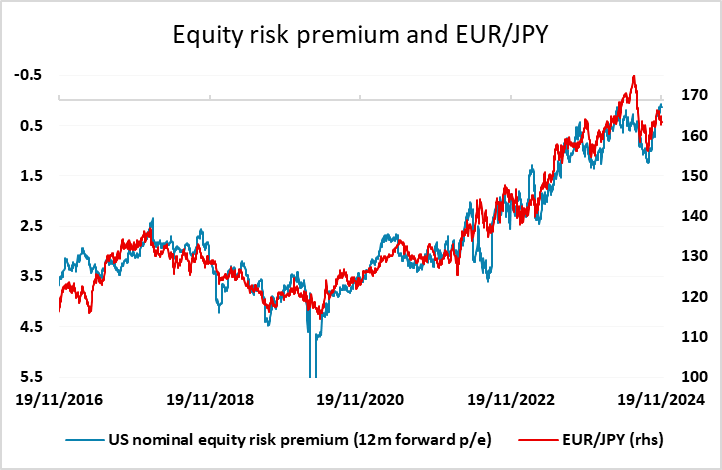

The US data is unlikely to trigger major moves, with the initial jobless claims data having been volatile of late so unlikely to be seen as definitive if they deviate from the recent underlying slightly improving trend. There may be more focus on equity market earnings, with the Nvidia results being keenly awaited on Wednesday. As it stands, earnings need to clear a high bar to maintain current equity valuations, with the equity risk premium close to the lowest since 2002. Whatever the market optimism on growth due to potential Trump tax cuts, it is hard to sustain current implied growth expectations when we are starting from a level of near full employment. So even if equities manage to hang on to current levels or gain a little on some good earnings numbers, we don’t see much upside scope and this suggests the JPY should be strongly biased lower.