FX Weekly Strategy: Europe, May 19th - 23rd

Focus on PMIs, USD needs stronger data to extend recovery

AUD has upside potential on RBA

EUR/GP downside risks look very limited below 0.84.

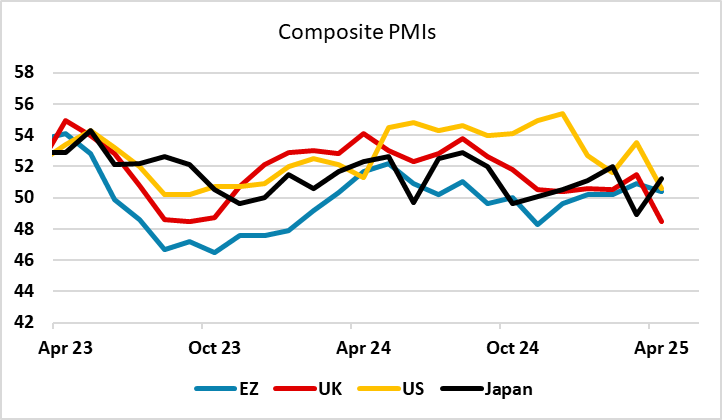

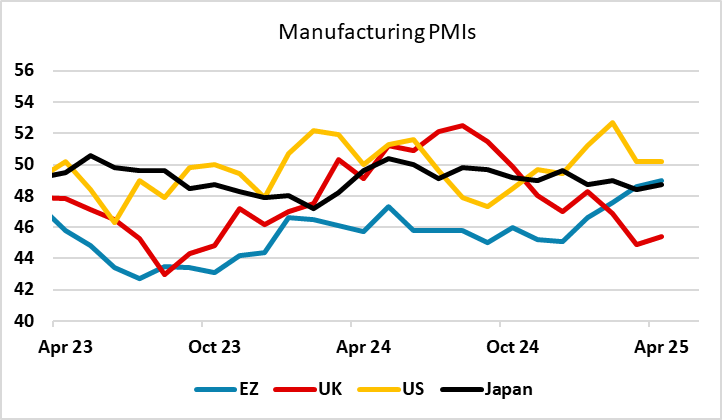

In what is a mostly fairly quiet week for data, the main interest will be in the S&P PMIs for May. The US business surveys have thus far shown a slight recovery after the dip in April, notably the Philadephia Fed survey, but we see a slightly dip n the manufacturing index and a modest rise in services. If the data isn’t dramatic we may continue to see some consolidation in recent ranges in financial markets. However, the University of Michigan survey at the end of last week suggested consumer confidence remains weak, mainly due to worries about rising prices, and this could be reflected in some weakness in business surveys, especially on the services side.

So we would see the risks as being towards weaker numbers, which we would expect to be USD negative. Conversely, positive news should be seen as good news for the USD, especially against the EUR. The EUR remains elevated relative to its normal relationship with yield spreads, and this has been helped by significant relative strength in European equities this year, with reports of some shifting of portfolios towards Europe. However, it is likely to be hard for European markets to continue outperformance if there is general equity market strength. Typically, this still seems likely to favour the more growth oriented US equities, but weaker or neutral equity markets would favour the more defensive European market, and provide some support for the EUR. Even so, steady asset markets might see some more retracement of the recent EUR gains, with potential for EUR/USD to slip towards 1.10, especially if European PMIs remain in the doldrums.

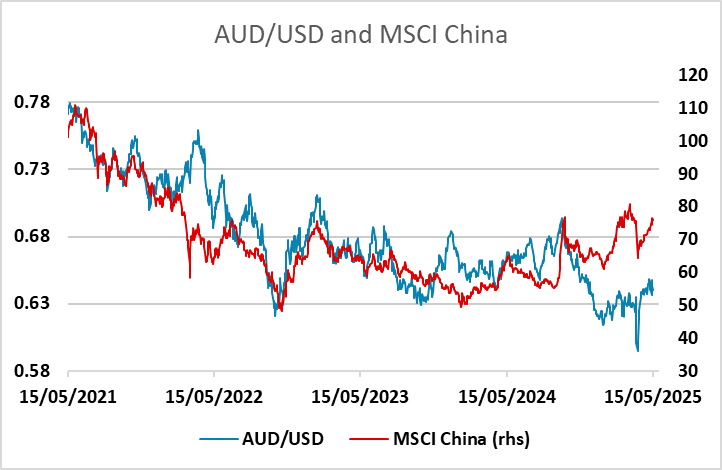

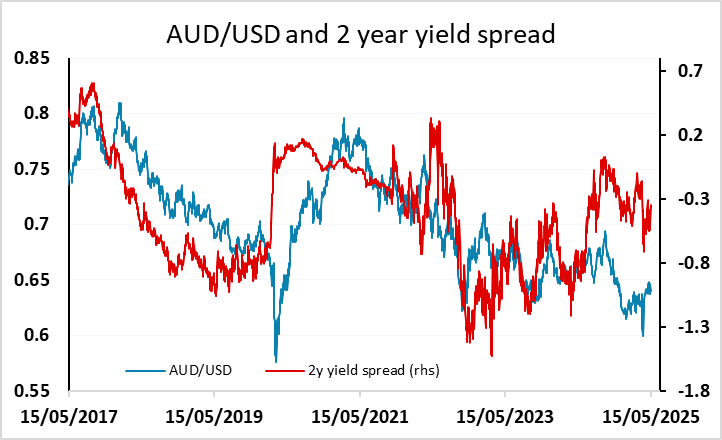

The RBA meeting is the main central bank activity, and the market is pricing nearly a 90% chance of a rate cut. However, with CPI still above target, and the wage and price index and the employment data both showing strength last week, we see the risks of no change as greater than the market is pricing in. Even if the RBA do cut, they may sound more hawkish than expected regarding the prospects for future easing. The market is pricing in three cuts this year, and they may have to reduce this in the wake of the meeting, in which case we see scope for and AUD recovery. In any case, AUD/USD looks to us to be well supported near 0.64, and both yield spreads and the performance of Asian equities suggests there is upside scope from here.

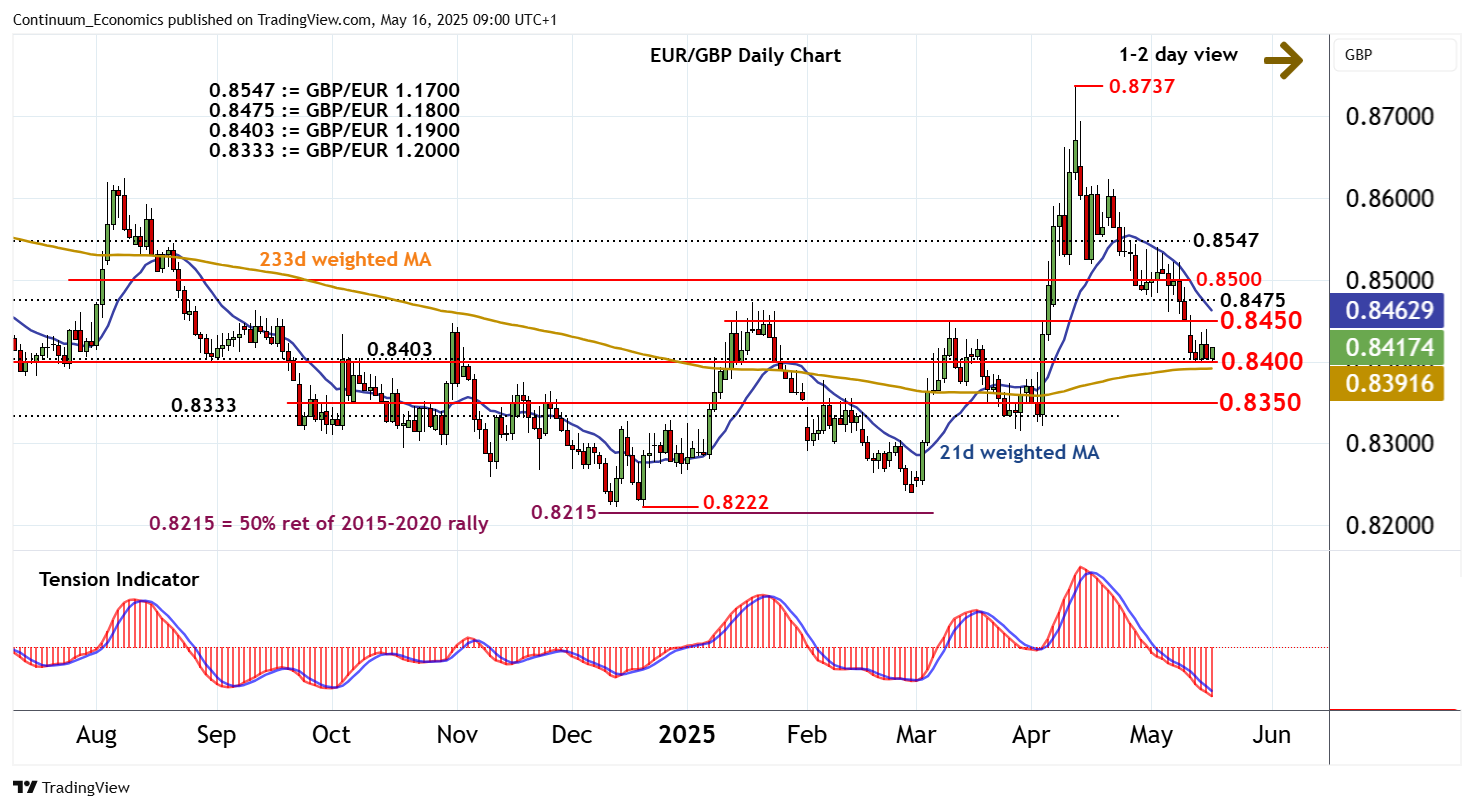

In Europe we have UK CPI data for April, which is expected to show a big jump in the y/y rate due to a variety of special factors. There are also MPC members speaking, which may provide some more insight into the split vote at the last meeting. In practice, it is likely to be difficult for EUR/GBP to fall back below 0.84, even if inflation data is on the strong side, as higher inflation might undermine confidence in UK growth prospects, and the move back to 0.84 puts GBP at already quite elevated levels. We therefore see the risks as being on the EUR/GBP upside, although a more neutral tone in the 0.8450 area may be seen.

Data and events for the week ahead

USA

It is a quiet week for US data. Monday sees April’s leading index, while Fed’s Bostic, Jefferson, Williams and Logan will speak. Fed’s Bostic, Musalem and Hammack speak on Tuesday while Williams speaks on Thursday. Thursday also sees weekly initial claims. May’s S and P PMIs follow, and we expect manufacturing to slip to 49.5 from 50.2 but services to rise to 51.5 from 50.8. Also on Thursday we expect April existing home sales to rise by 4.5% to 4.20m but on Friday we expect April new home sales to fall by 4.0% to 695k, both correcting moves in the opposite direction in March.

Canada

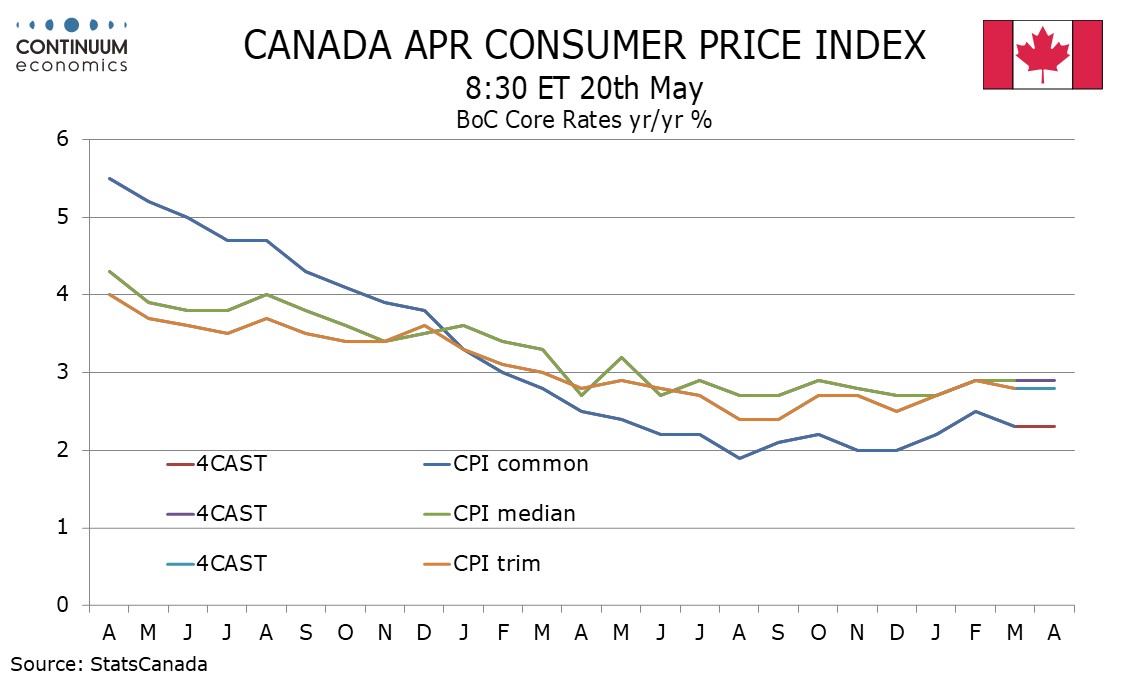

Canada’s data highlight will be April’s CPI on Tuesday. We expect yr/yr growth to slow to 1.6% from 2.3% but solely due to end of a consumer carbon tax. We expect the Bank of Canada’s core rates to be unchanged. Thursday sees April’s IPPI and RMPI. Friday sees March retail sales, for which a preliminary estimate for a 0.7% increase was made with February’s release.

UK

BoE Chief Economist Pill speaks on Tuesday and also Thursday, which also sees talks from MPC members Dhingra and Breeden, they possibly discussing the relevance of recent MPC split votes. But the main interest will be the flash PMI on Thursday this coming alongside public borrowing numbers, the first of the new FY. The latter may still show an overshoot compared to year-before outcomes. As for the PMI, at 51.5 in March, the Composite Output Index was the highest for five months but dropped to 48.5 in April. Subdued order books continued to weigh on business activity, with total new work falling at the sharpest rate since November 2022. This was driven by a steep and accelerated reduction in export sales, and this may continue to be the case in the May flash, the question being whether a somewhat less worrisome UK trade picture poses upside risks to our unchanged overall PMI forecast.

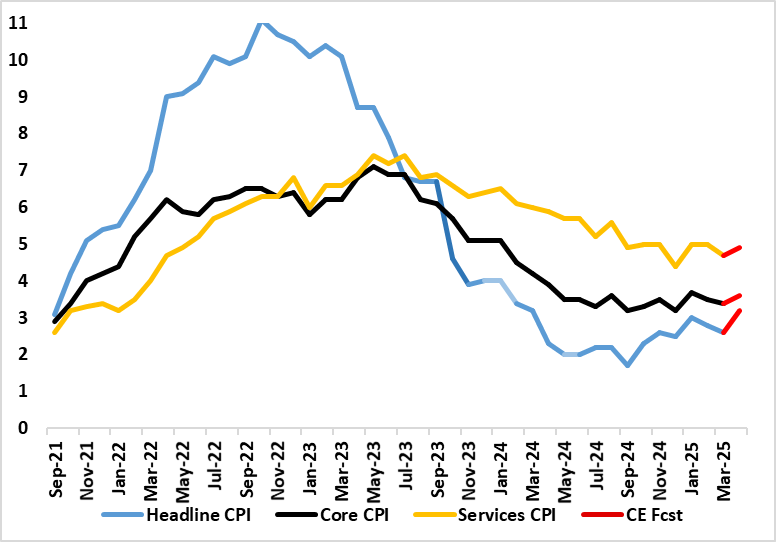

April CPI Inflation to Jump Broadly – albeit Temporarily?

Source: ONS, Continuum Economics

Most high-profile, however, will be the April CPI (Wed) where a series of energy, utility, post office and some other regulated and service price rises are due, albeit now offset somewhat by a fall in petrol prices. Indeed, this array of rises, all domestically generated, should see headline CPI inflation rise from 2.6% in March to 3.2%, with the BoE opting for a larger rise to 3.4%. Ending the week, Friday sees both GfK consumer confidence and retail sales data that we see both correcting back, but with upside risks posed by continued mild weather as some surveys have hinted at.

Eurozone

More ECB updates arrive via the Financial Stability Review (Wed) which is likely to underscore that despite broad resilience in both the financial and non-financial sectors, uncertainties arising from trade tensions, deregulation and reduced international cooperation are fuelling concerns about global economic and regulatory fragmentation are risks. Wednesday sees one of a series of ECB speeches this week but his one from Lane focuses on negative interest rates. Thursday sees the minutes/account of the last Council meeting. Thus may detail the shift from no longer talking about how restrictive policy may be and discuss the manner in which financial conditions had been tightening; the fall in official rates is giving misleading signals about policy restriction. If anything, the ECB may also have been perturbed and discussed by bank lending developments, which also suggest financial conditions may be tightening more broadly

Datawise, after Monday’s final HICP numbers (with a risk of an upward revision) there is an important update on negotiated wages (Fri) as well as consumer confidence and construction (Both Tue) all still leaving the week’s focus on flash PMI data (Thu). The Composite PMI Output Index slipped 0.5 ppt to 50.4, a 2-month low and featured a marked drop in business confidence with year-ahead expectations slipping to an 18-mth low. In terms of pricing trends, April survey data indicated a further cooling in the rates of both input cost and output charge in flat. We see little change in the overall PMI in the May numbers with more signs of disinflation alongside.

Rest of Western Europe

There are few key events in Sweden, most notably what have been volatile labor market data (Fri).

Japan

The National CPI on Thursday will be critical Japan next week. The inflation picture has remain hot for Japan in the past months but the hands of BoJ are tied for now due to the ongoing trade deal complication between Japan and U.S.. Another high read for now will not make BoJ happy, our central forecast currently do not see a move from the BoJ until the fog of trade war clears. There is also trade balance on Tuesday. For the economic growth to recover, we will need to see a strong trade balance along with consumption. Yet, in a short run, the Q4 2024 stockpile is likely to slow exports in H1 2025.

Australia

The RBA interest rate decision will be announced on Tuesday and we don’t see the RBA to move just yet. While market is anticipating three cuts this year, there is a good chance that the RBA will not move until trimmed mean CPI reaches 2.5% y/y where we are still some way off. Else, it is just tier two data across the week.

NZ

Trade balance on Tuesday and Retail sales on Thursday would be the more important release for NZ next week.