FX Daily Strategy: Europe, January 21st

Market to focus on Trump executive orders, with particular sensitivity to tariffs

AUD may have the most potential to extend Monday’s rally

CAD upside may be brief if CPI softens

GBP looks likely to remain under pressure

Market to focus on Trump executive orders, with particular sensitivity to tariffs

AUD may have the most potential to extend Monday’s rally

CAD upside may be brief if CPI softens

GBP looks likely to remain under pressure

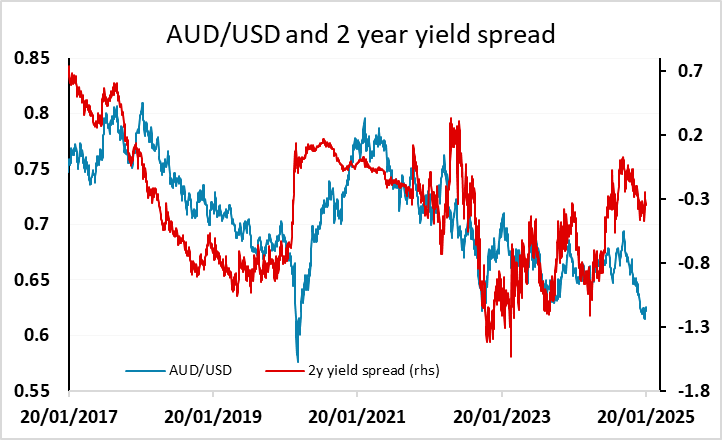

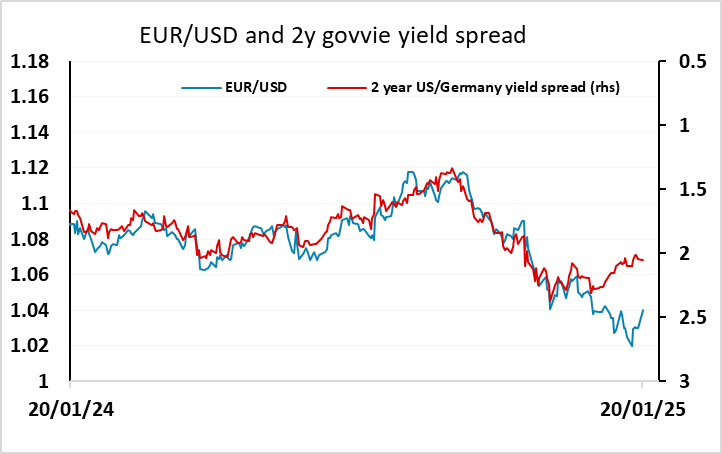

There isn’t any US data of any note on Tuesday, but the market will be very much focused on any executive orders coming out of the White House. The report in the WSJ on Monday saying that Trump would not be introducing tariffs immediately triggered a 1% USD decline across all the riskier currencies, and there looks to be scope for further USD declines if this is confirmed. The USD has outperformed yield spread moves against the EUR in the last month, and against the AUD for much of the last year. The AUD may be the best placed to benefit if the threatened tariff increases don’t materialise, especially if we also see equity markets continue to benefit, but yield spreads also suggest scope for gains in most of the riskier currencies.

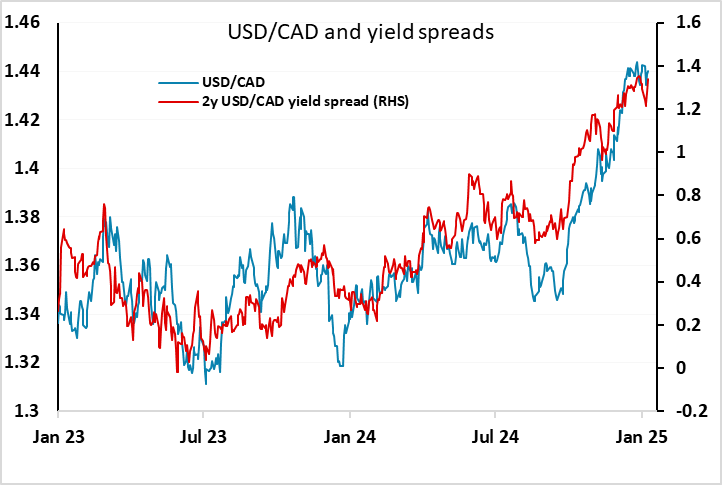

While the CAD and MXN may benefit the most from any announcement effect, as China, Canada and Mexico were the primary targets of Trump’s initial tariff threats, USD/CAD has actually stuck fairly close to the levels implied by yield spreads, so unless we see some yield spread narrowing, upside for the CAD still looks comparatively limited. The CAD also probably won’t be helped by the Canadian CPI data. We expect Canadian CPI to slip to 1.7% yr/yr from 1.9%, the fall largely due to a temporary supsension of the Goods and Services Tax that will run from Mid-December through Mid-February. Bank of Canada Governor Tiff Macklem has stated that the tax suspension is expected to move inflation down to a low of around 1.5% in January.

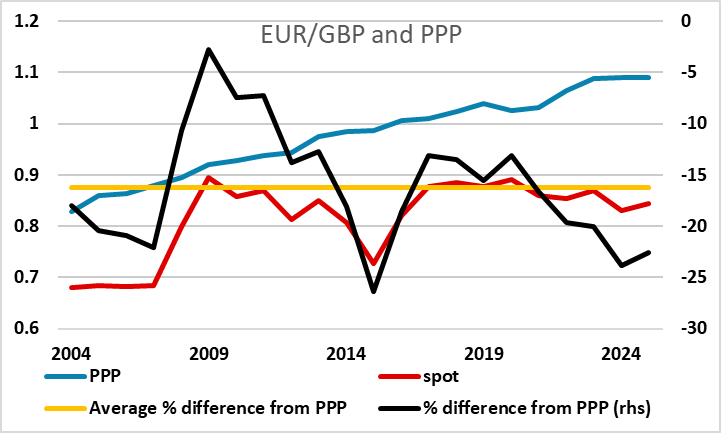

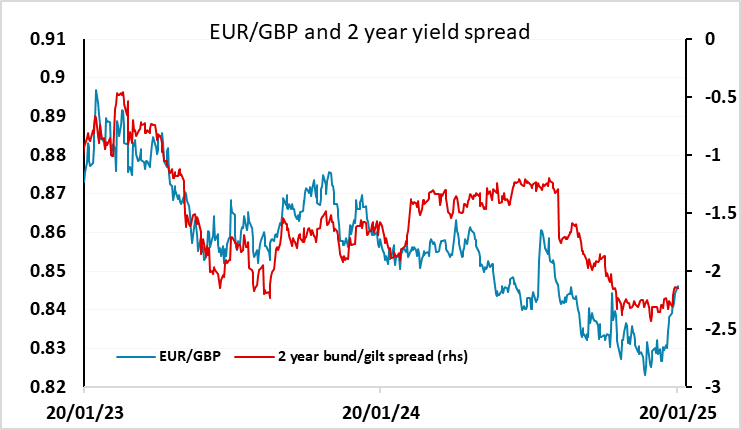

Elsewhere, UK labour market data looks to have the most potential for FX impact on Tuesday. This month, base effects are expected to lead to a rise in average earnings growth in the official ONS data covering the 3 months to November, but as usual there may be more interest in the HMRC data on payrolled employees covering December. But whatever the data, it’s hard to see much upside for GBP at this stage. GBP weakened against the EUR once again on Monday, and while UK yields were net little changed on the day, the initial decline in GBP once again came against a background of higher UK yields, suggesting either weak UK confidence or more concretely actual foreign selling of UK gilts. While stronger UK growth data could turn the trend, there isn’t any evidence of that at this stage. Meanwhile, higher inflation numbers that lead to higher yields will only further undermine confidence in the UK fiscal situation, while weak data will increase expectations of BoE easing and undermine the yield support for the pound.

So we still see mainly downside risks for GBP, all the more so because we are starting at high levels. Despite GBP/USD being close to 1 year lows, EUR/GBP is at historically weak levels in real terms, with the lows below 0.83 the lowest seen since before the Brexit referendum vote. We would expect GBP to weaken as the market gradually prices in more BoE easing in the coming months, as inflation is heading back to target and the BoE is likely to focus more on the need to encourage growth given the weakness evident in recent data.