FX Daily Strategy: Asia, January 10th

US employment report to dominate

Strong numbers may be needed to sustain USD strength

CAD had some upside scope after recent losses

NOK/SEK remains undervalued

US employment report to dominate

Strong numbers may be needed to sustain USD strength

CAD had some upside scope after recent losses

NOK/SEK remains undervalued

Friday sees the main event of the week in the shape of the US employment report, with the Canadian employment report as a supporting act.

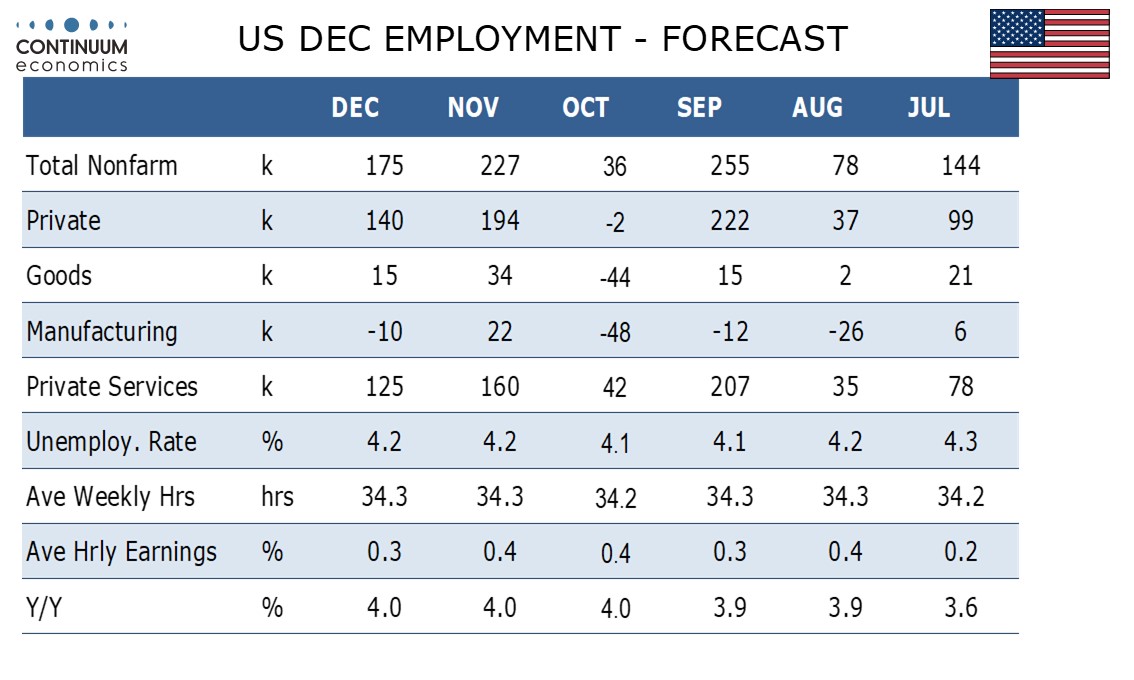

We expect 175k increase in December’s non-farm payroll, with 140k in the private sector, a number that should be closer to underlying trend than a strong November and a weak October. We expect unemployment to be unchanged at 4.2% and average hourly earnings to slow to a 0.3% increase after two straight gains of 0.4%. Our forecasts are marginally above consensus, but not sufficiently to have a noticeable market impact.

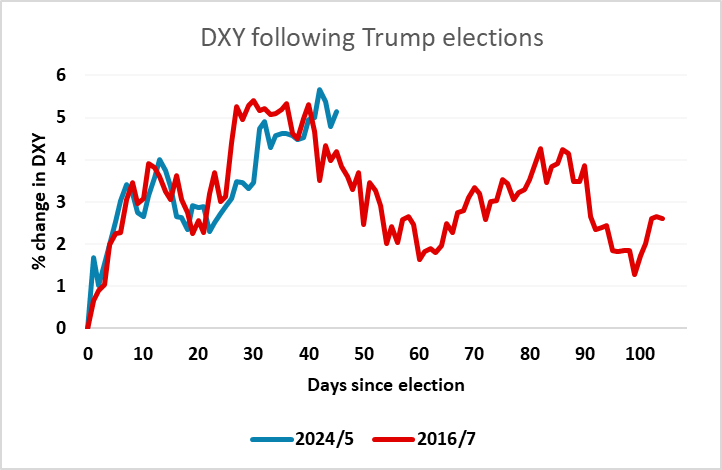

If anything, the risk now is to the USD downside, due to the persistent strength of the USD since the election. The central market view continues to be that the US economy will perform strongly, the equity market will continue to gain, and The Trump administration will deliver tax cuts over and above the extension of the 2017 cuts enacted in the last Trump administration, while tariffs will be raised on China and potentially elsewhere. But it is not 100% clear that Trump will be able to make all the tax cuts he wants, and while he is likely to have control of tariff policy, it is far from clear that such policy will prove USD positive. It should be remembered that in the first Trump administration, the USD’s initial gains quickly faded and the USD fell back sharply through 2017. The USD gains we have seen since the election broadly mirror the USD behaviour seen after the 2016 election, but from here we may need to see some concrete positive US news to justify current levels. There are risks that the huge US budget deficit limits tax cuts unless Bessant and Musk manage to find surprising spending cuts, which in themselves could lead to lower US yields and a lower USD.

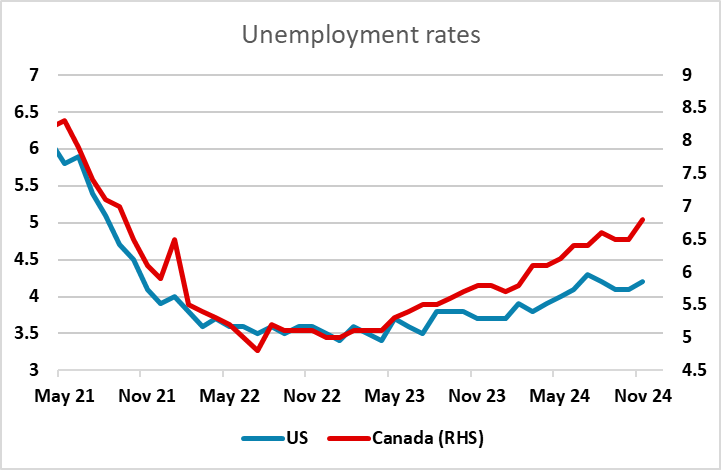

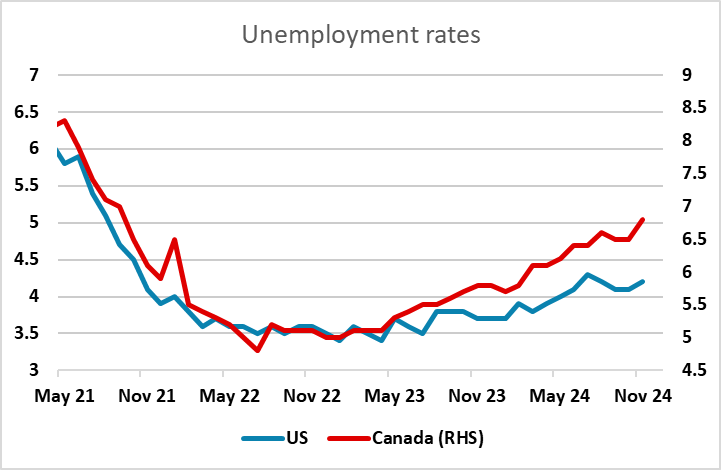

On the Canadian side, the focus may be mostly on the unemployment rate, which rose sharply to 6.8% in November, and contrasts strongly with the relatively stable US unemployment rate. However, USD/CAD is by now already very high by historic standards, and has even overshot the yield spread correlation. The market consensus looks for another rise in the unemployment rate to 6.9%, so even holding steady at 6.8% could be seen as CAD positive, and after such a sharp rise las month, another rise is less likely. We would consequently favour the USD/CAD downside here on as expected data.

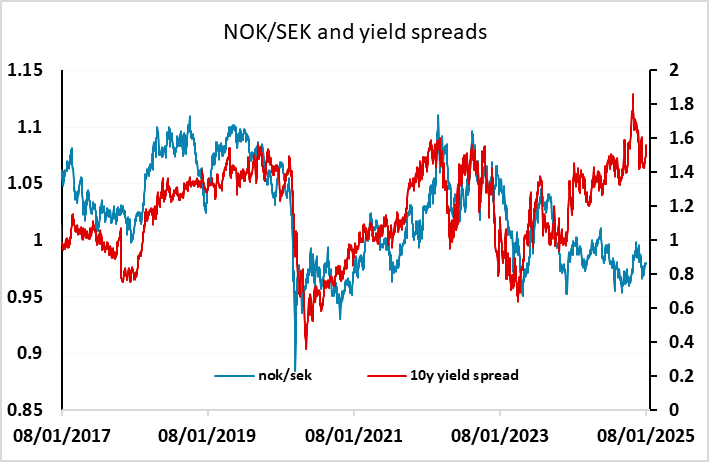

Before the US data we have Norwegian CPI in Europe. The NOK persistently underperformed yield spreads through 2024, and continues to look cheap at current levels relative to yield spreads, both against the EUR and the SEK. With softer Swedish CPI already reported this we favour the NOK/SEK upside, with Norwegian headline CPI expected to edge a little higher to 2.5% y/y. Core is seen coming down to 2.8% y/y from 3.0%, but this will still prevent Norges Bank easing before the March meeting.