FX Daily Strategy: Asia, May 9th

JPY weakness looks aberrant but could still extend

Japanese wage data will be a focus

CAD starting to look vulnerable to weak employment data

NOK has potential to recover further unless CPI weakens more than expected

JPY weakness looks aberrant but could still extend

Japanese wage data will be a focus

CAD starting to look vulnerable to weak employment data

NOK has potential to recover further unless CPI weakens more than expected

Friday has no significant US data but there is wage data out of Japan which is important for BoJ policy as well as the Canadian employment report and Norwegian CPI.

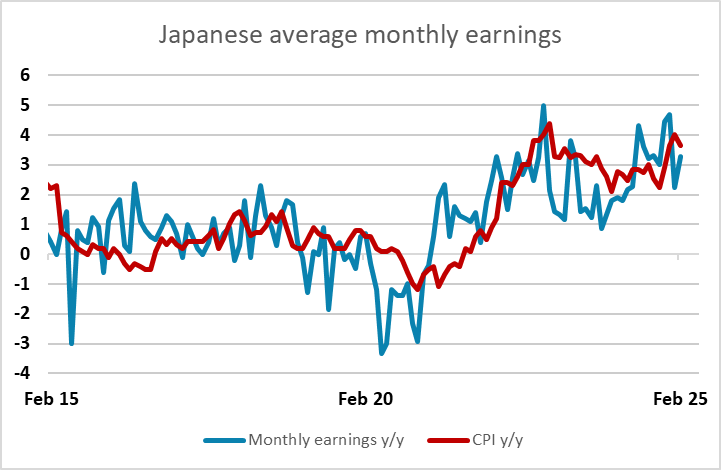

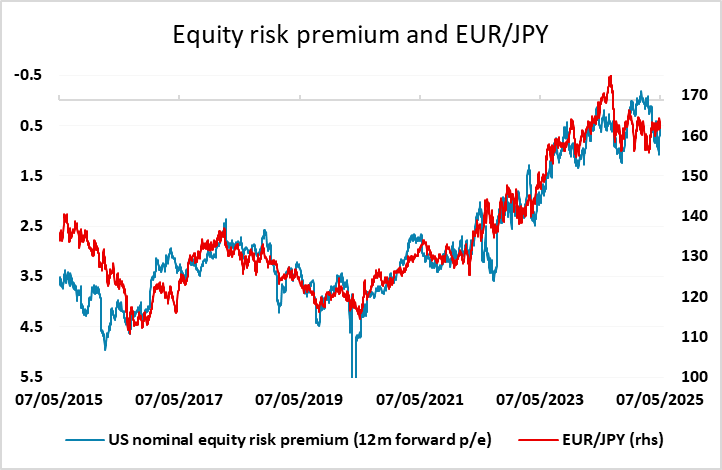

The Japanese wage data may be significant in view of the weakness of the JPY in the last few sessions. This relates mainly to the recovery in equities and the decline in equity risk premia that we have seen in recent days, but the JPY has been struggling to make progress since the last BoJ meeting which reduced growth forecasts and suggested a slower pace of tightening. Weaker wage data would support that view, but there is some inconsistency between strong equity markets and expectations of a slower pace of growth. The S&P 500 has moved back above the opening level seen on the day of the tariff announcement on April 2, which looks a very optimistic take, and we would see risks for equities as being on the downside from here, which would suggest upside risks for the JPY. But if equities hold current levels it will also be harder to make a case for a delay to BoJ tightening, unless there is evidence of weakening wage and price inflation in Japan. The consensus is expecting some decline in household wage growth in March, but if this is not forthcoming we may see a rise in Japanese yields and the JPY.

However, if the current more positive equity market tone persists, we would not rule out further short term JPY weakness. While this is unlikely to persist, there is heavy long JPY positioning evident in the CFTC futures data, and there will be pressure on these positions to close if we see a break above 146 in USD/JPY and/or 165 in EUR/JPY. The expectation of further trade deals, even if they don’t restore things to the pre-tariff position, could maintain the short term risk positive corrective tone. Longer run, we still see scope for substantial JPY gains, but this is likely to require a turn lower in equities.

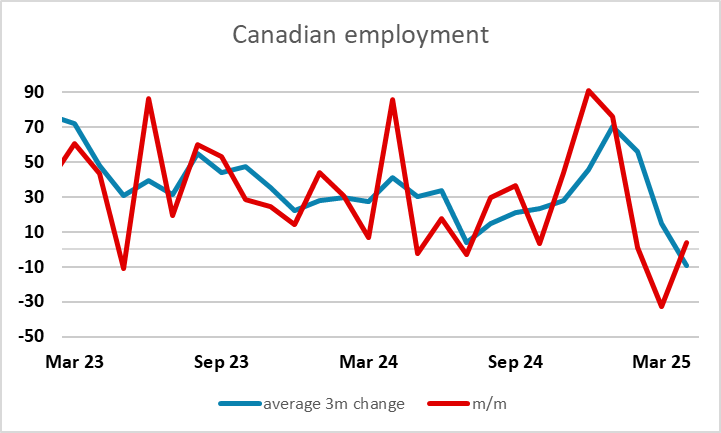

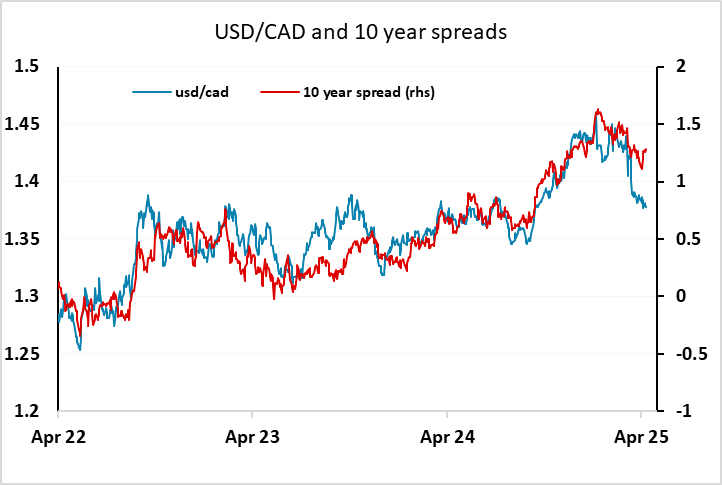

The Canadian employment report is expected to show only a small gain in employment of 4.1k in April, after a 32.1k decline in March, implying a significant deterioration in the underlying trend, with the unemployment rate seen rising to 6.8%. The CAD has performed well in spite of the increasing expectation of economic damage from the US tariff policy, but there are signs of a turn in USD/CAD in the last few days. A weak Canadian employment report could well trigger a bigger CAD correction towards 1.40.

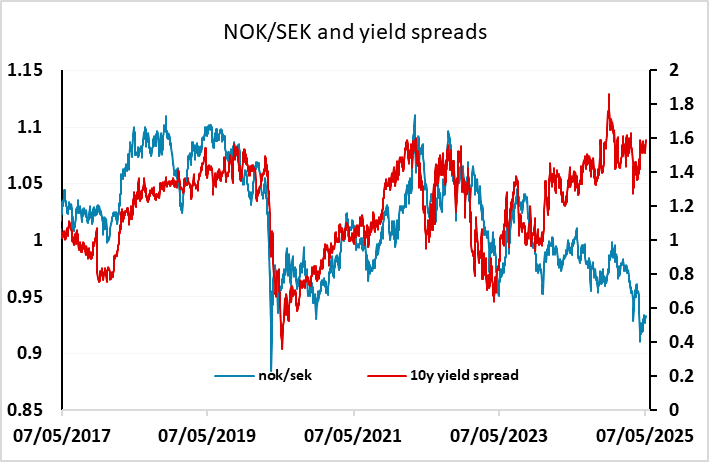

Norges Bank left rates unchanged at Thursday’s meeting, Along with other central banks, they cite uncertainty about future economic developments, but they still anticipate easier policy this year. The market is looking at August as the most likely time for a cut, but there is a possibility of a June cut if inflation falls further than expected near term. The April data is expected to show a modest fall to 2.5% headline, 3.2% core, and something beyond this will be needed to increase rate cut expectations. But in the more risk friendly markets we are seeing at the moment, there is potential for the NOK to recover some of the ground lost in recent weeks, particularly against the SEK, especially if the inflation numbers are on the strong side of consensus.