FX Daily Strategy: N America, April 10th

US CPI of limited interest in current conditions

Norway CPI similarly irrelevant, with the NOK under extreme pressure

Scope for some stabilisation in the risk sensitive currencies

USD seems likely to remain under some pressure given high starting point

US CPI of limited interest in current conditions

Norway CPI similarly irrelevant, with the NOK under extreme pressure

Scope for some stabilisation in the risk sensitive currencies

USD seems likely to remain under some pressure given high starting point

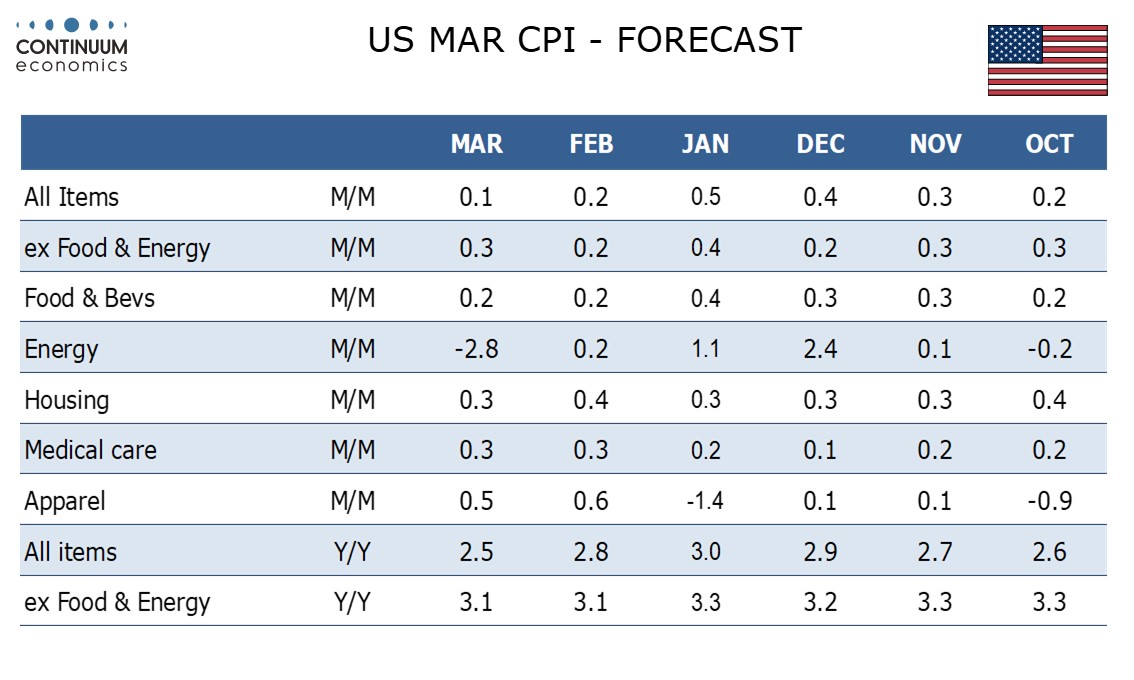

Thursday sees US CPI data for March, which might normally be seen as the main event of the week but in this case looks likely to be irrelevant given the current state of the markets and the likely big rises in CPI that can be expected in the next few months due to the rises in tariffs. We expect March to increase by a subdued 0.1% overall but by 0.3% ex food and energy, with the core rate likely to be on the firm side at 0.335% before rounding. This will follow core rates of 0.2% in February and 0.4% in January, both of which were rounded down. Our forecasts are in line with consensus so we don’t see a significant market reaction.

Similarly, the European data on Thursday is unlikely to move markets. This is mostly out of Scandinavia, with March CPI from Norway and February GDP from Sweden. Norwegian CPI is expected to fall substantially on a headline basis but the targeted core rate is seen remaining steady at 3.4%. But for EUR/NOK, the focus will be much more on risk appetite in the markets in general. EUR/NOK made a new all time high of 12.18 on Wednesday excluding the pandemic spike. The NOK continues to be treated as a risk sensitive currency, when the big budget and current account surpluses run by Norway argue for it to be more of a safe haven. It was treated much more in this fashion until the mid-2010s. It’s hard to buck the market, and even without the recent sharp decline in risk appetite the NOK has been underperforming in the last year, but we find it hard to see the case for further EUR/NOK gains.

FX markets saw more USD negative/risk negative trading on Wednesday as the “reciprocal” tariffs came into effect, although equities only declined modestly intitally before Trump U turn caused a risk on and USD rally.

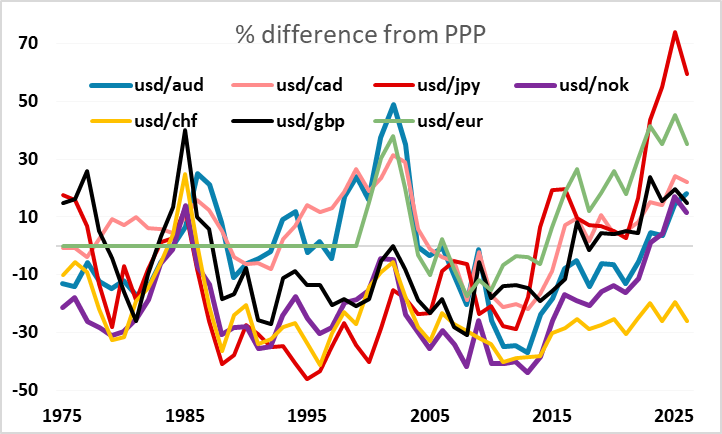

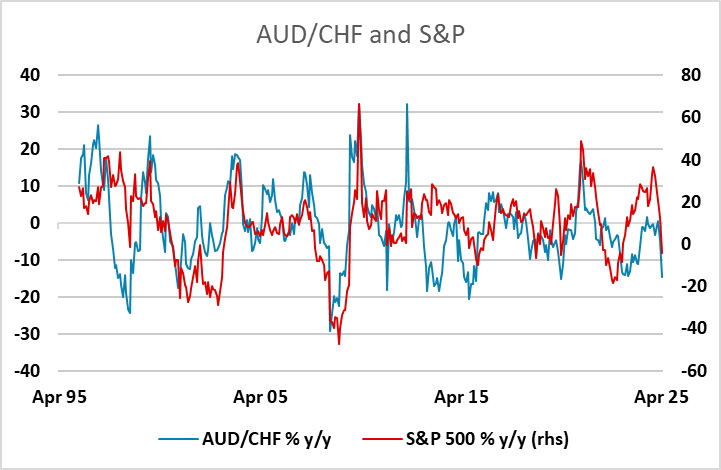

From here, we would expect some stabilisation in the risk sensitive pairs, as we would expect the market to now wait for evidence of the economic impact of tariffs before we see another significant move in equities. However, there could still be further to go if the current sell off in bonds continues. But there may yet be further general USD weakness, as the USD is starting from quite extended levels across the board, with the exception of USD/CHF. In the absence of significant tariff retaliation, the US looks the most vulnerable to the US tariff increase (among the G10).