FX Daily Strategy: Asia, Oct 24th

US CPI long awaited but likely of little market significance

Japanese CPI unlikely to reverse JPY decline

PMIs may favour USD and EUR

CHF strength continues to look excessive

US CPI long awaited but likely of little market significance

Japanese CPI unlikely to reverse JPY decline

PMIs may favour USD and EUR

CHF strength continues to look excessive

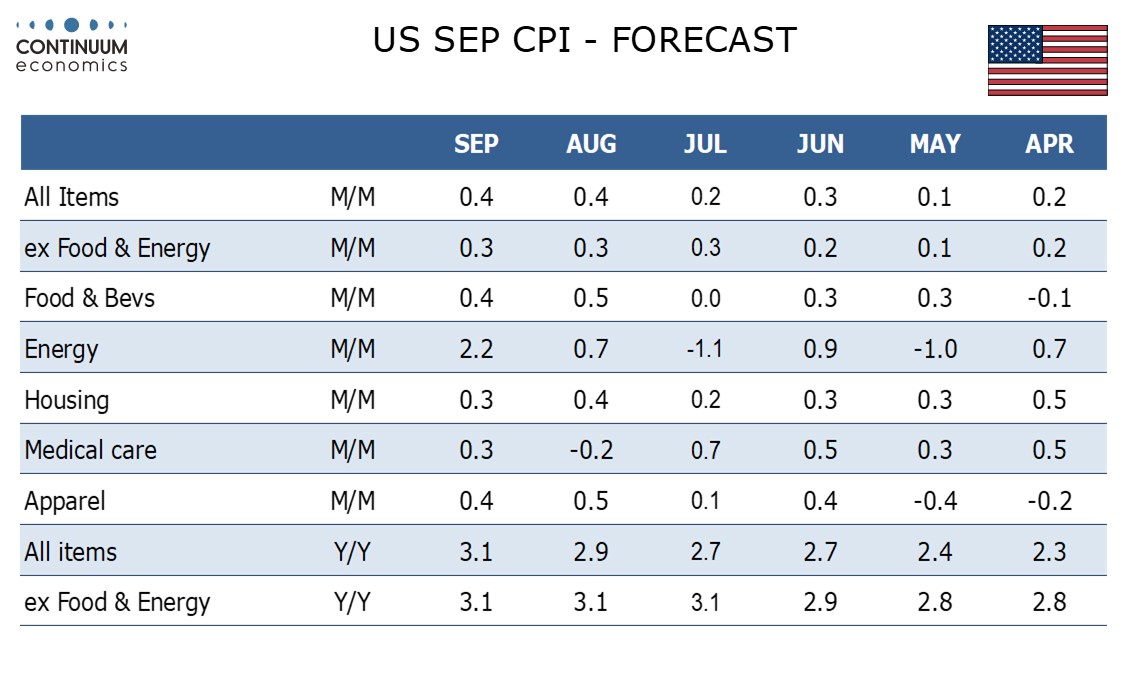

After a generally quiet week for data, Friday sees the first significant US data since the government shutdown in the form of September CPI. The release was considered essential as it is needed for annual cost of living adjustments to Social Security benefits. It is however possible the shutdown will compromise accuracy of the release. Even before the shutdown, recent CPI releases had seen increasing numbers of inputs estimated to reduced staffing. We expect a 0.4% increase overall in September CPI with a 0.3% rise ex food and energy, matching August’s outcomes after rounding. Our forecasts are in line with consensus, so will probably not have a significant market impact. The Fed is fully priced to cut the funds rate target by 25bp at the October 29 meeting, and it will take a lot to shift the market away from that expectation. Stronger numbers would likely be seen as USD positive and risk negative, hurting the riskier currencies.

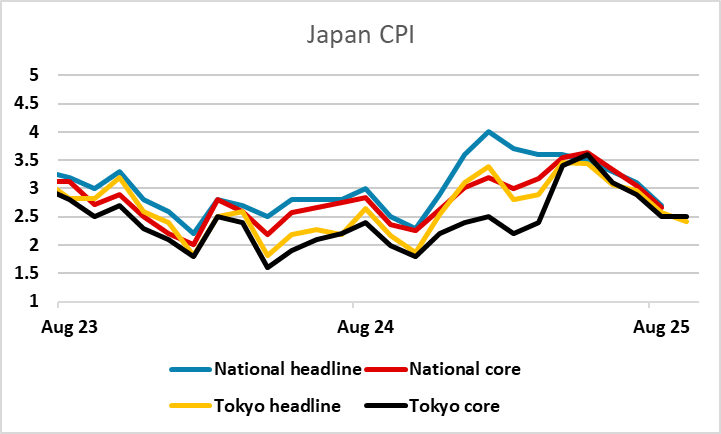

Japanese national CPI is the first data of significance on Friday. Tokyo CPI was steady in September, but the national core number is expected to rise to 2.9% from 2.7% in August. After the Tokyo number, the risk must be towards a weaker outcome, which might be seen as another JPY negative. The decline in the JPY on Thursday looks to have been based on a combination of positive risk appetite, a strong oil price after the announcement of sanctions on Russia, and a belief that the new government will be more tolerant of JPY weakness than the old one, as comments from the new Finance minister Katayama suggested a laissez faire approach. In reality we would expect the government to prefer a stronger JPY, as this would reduce the risk of early/aggressive BoJ tightening and help bring down imported inflation, thus supporting the government’s attempts as domestic reflation. But unless they state this explicitly the market is likely to continue to follow the weak JPY trend.

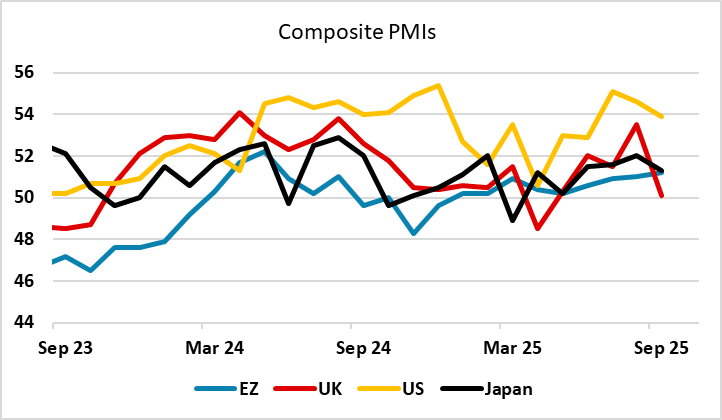

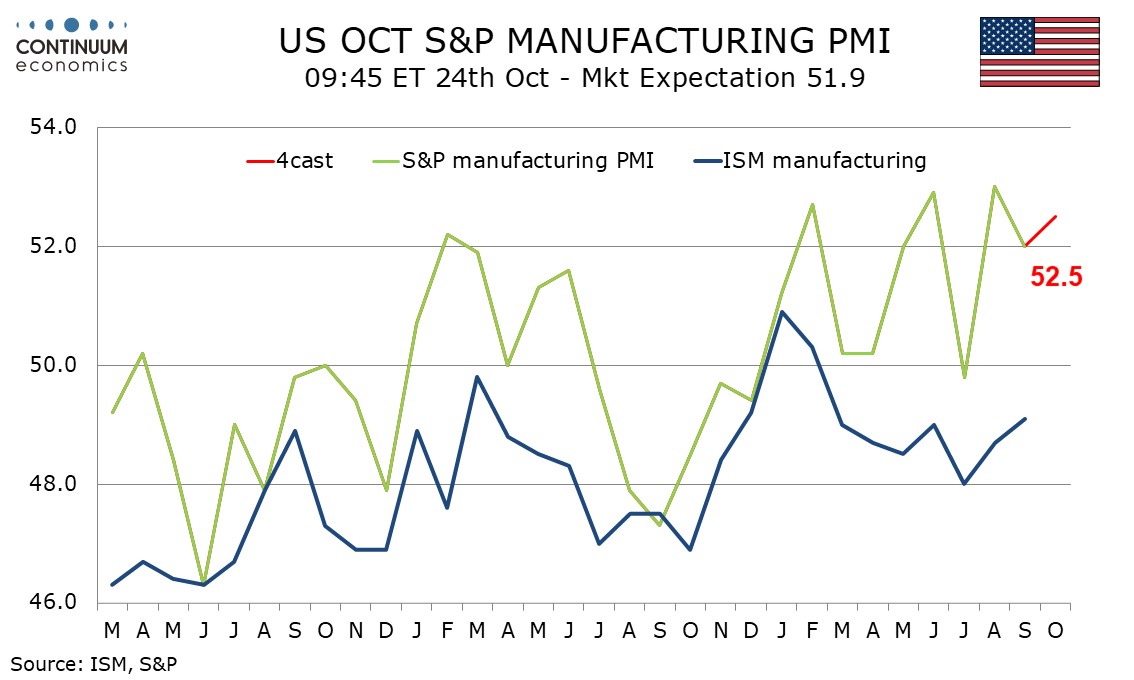

In Europe, the provisional PMI data for October will be a focus. The market consensus is for a modest decline in the Eurozone composite index and a modest improvement in the UK index. The Eurozone index has shown a very gradual improvement in recent months, but is still only consistent with very modest growth. However, the manufacturing index has improved more markedly, and the sharp rise in the French INSEE manufacturing outlook released on Thursday suggests there are some upside risks. On the UK side, there may be some risk of weakness, as according to the CBI industrial trends survey released on Thursday, total new orders fell through the quarter (-20%, from -17% in July), reflecting the fastest pace of decline since July 2020 for both domestic orders (-26%) and export orders (-26%). However, the UK PMI correlates poorly with the official data, so is of more limited significance. The US PMIs will also be of greater than usual interest, given the lack of official data. On balance we see the net picture as marginally positive with the Philly Fed detail showing new orders accelerating. This hints at a modest rise in the S and P manufacturing index after a dip in September, though it remained well ahead of its ISM counterpart. Our forecast for the services index is in line with the consensus expectation for a small decline. The USD risks should be on the upside, as the consensus looks for a small decline in the US manufacturing index.

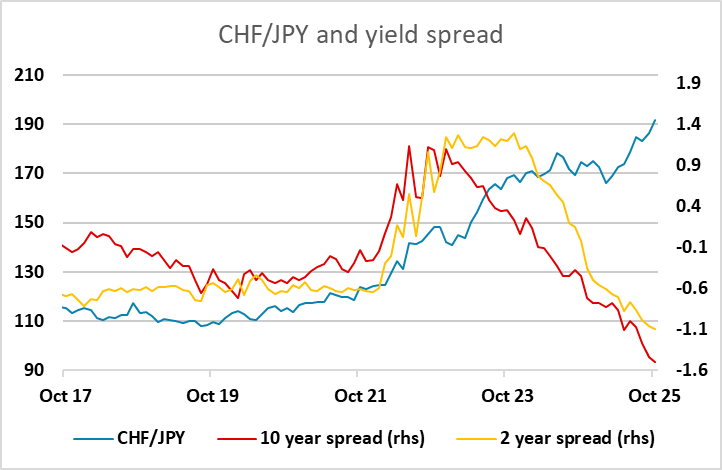

Other than the JPY, currencies have generally been quiet, with EUR/USD range-bound in a 1.1540-1.1780 range this month, and AUD/USD holding a 0.6440-0.6530 range since October 13. GBP had a brief dip after the weaker CPI data this week, but EUR/GBP looks unlikely to challenge the highs of the year at 0.8763 ahead of the November 6 BoE meeting, and probably ahead of the November 26 budget. CHF and JPY are showing the most extreme movements, with EUR/CHF testing the November 2024 low at 0.9204, which would have been an all time low excluding the January 2015 spike, while the JPY is close to its lows on real effective terms, and has hit a new all time low against the CHF on Thursday. The rationale for this remains unclear, as the initial case for JPY weakness in 2020 was based mainly on yield spreads, and this is no longer a JPY negative factor – quite the opposite.