FX Weekly Strategy: Sep 29th - Oct 3rd

USD continues to follow Trump 1.0

Payroll data a focus, if it is released

European currencies may be most vulnerable to further USD gains

CHF could come under some pressure

AUD focus on the RBA

Strategy for the week ahead

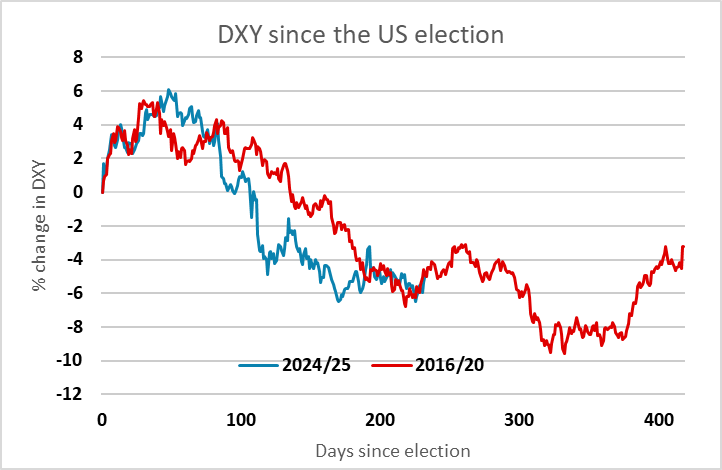

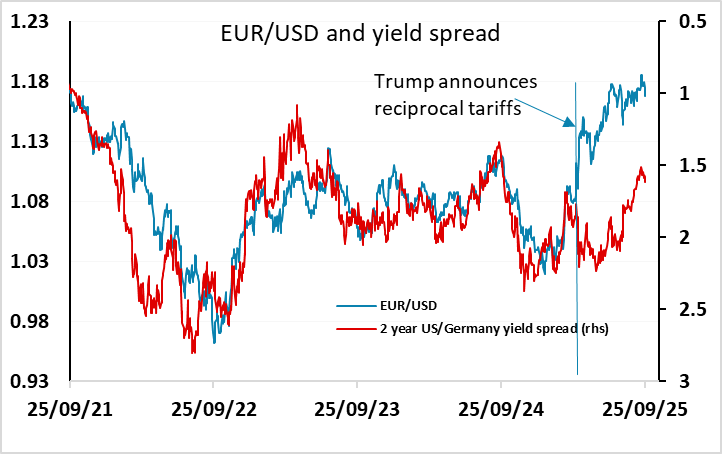

The USD performance under this Trump administration continues to follow the path seen in Trump 1.0, with the USD down just under 5% since the election. In the first Trump administration, the next month saw the USD recover another 1% with USD weakness only resuming in the New Year. A similar performance looks possible this year, as the risks for US rates look to be on the upside. And the EUR has outperformed yield spreads in the middle of the year. Weaker PMI data from Europe last week suggests growth will continue to underperform the US in the second half of the year.

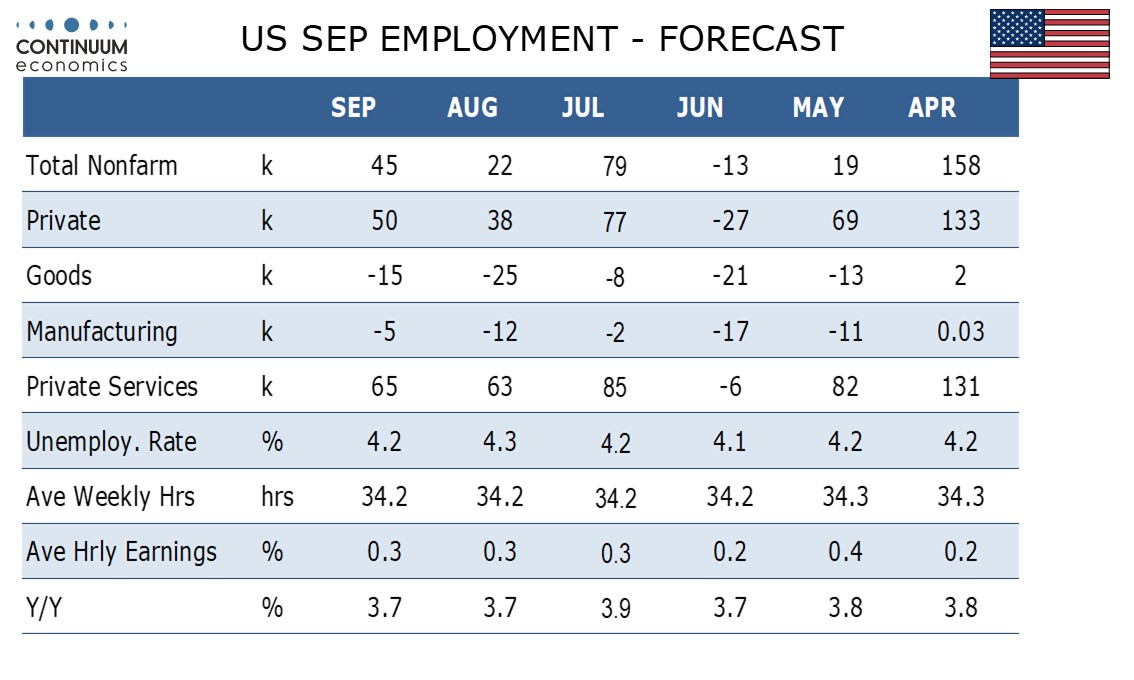

The September US payroll data is the main data of the week, but it is possible a government shutdown could prevent its release. If so, the ADP data on Wednesday will take on greater significance. Our forecast is marginally stronger than the consensus, primarily because we look for a drop in the unemployment rate to 4.2%, but numbers in line with our forecast are unlikely to move the USD very much. Even so, combined with the positive bias in the USD since the Q2 GDP data last week, and the guidance from the USD’s performance in Trump’s first term, we tend to favour a stronger USD.

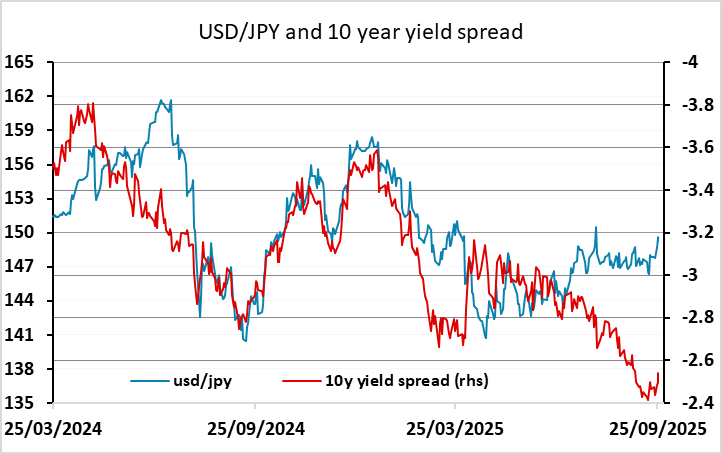

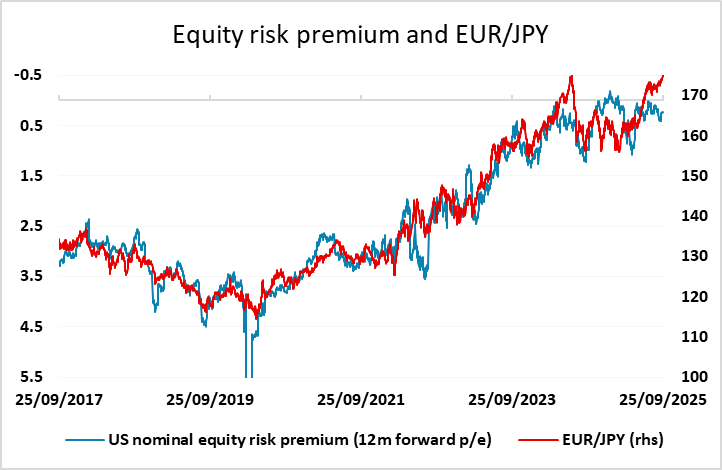

The case for USD strength is greater against the European currencies than against the JPY, even though the JPY has continued to underperform in the last week. EUR/JPY is edging up towards the all time high of 175.42 seen in July last year, and a break of this high now looks likely to be seen before there is any turn lower in EUR/JPY. Having said this, there is scope for a large correction lower in EUR/JPY based on the correlation with equity risk premia that has held up well in recent years, while the yield spread correlations already argue for a much stronger JPY.

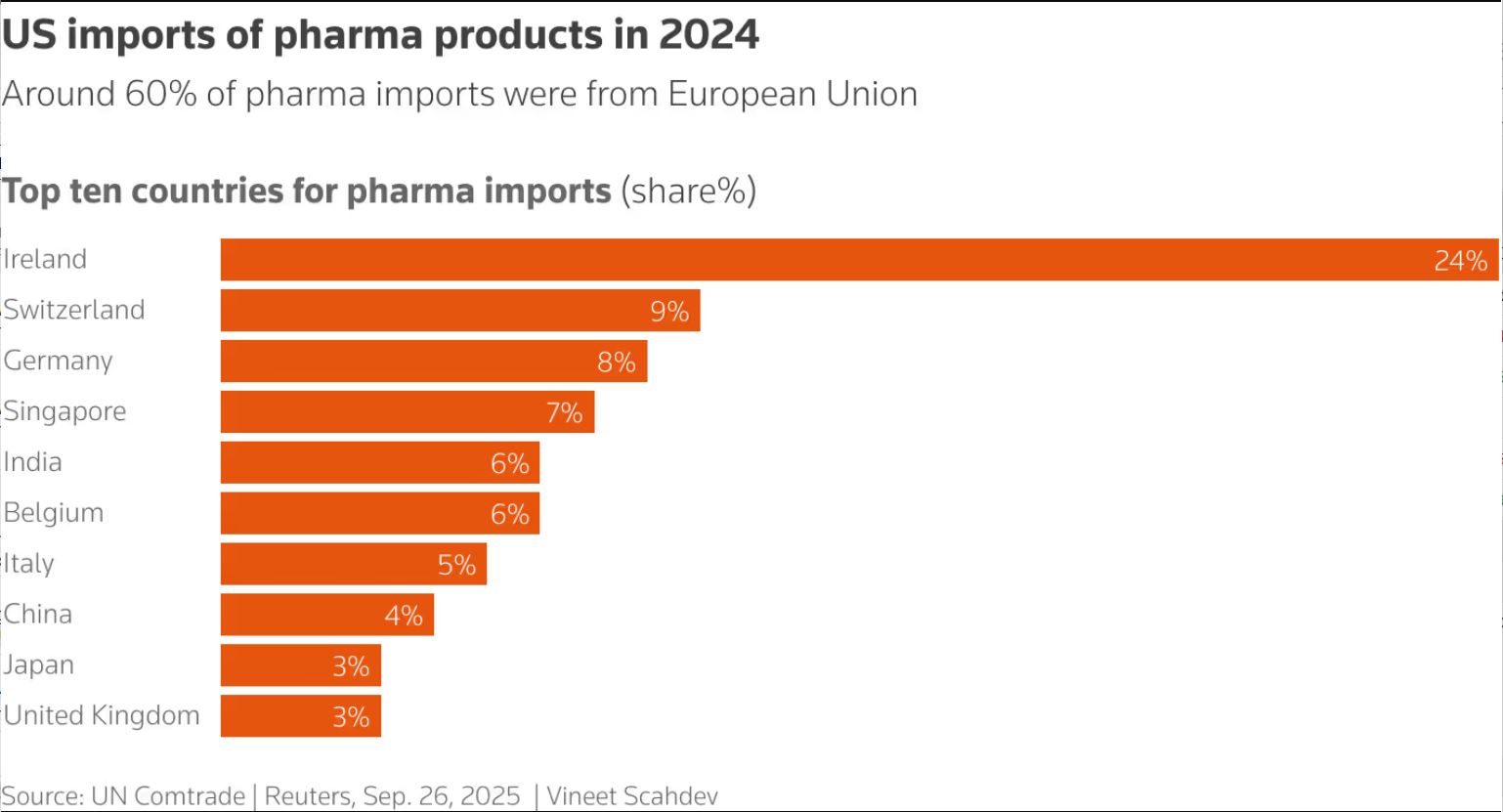

Markets will also be looking for a clarification on Trump’s comments from last week on tariffs on pharma. Europe is most vulnerable to any tariffs on pharma exports, and within Europe, Switzerland is the most vulnerable. However, the 100% tariff will only apply to patented pharma and firms not investing in the US, while those countries with trade deals may also have their tariffs capped. But with the SNB already indicating that the 39% tariff on Switzerland is a problem for the economy, there should be risks on the downside for the CHF.

As far as central banks are concerned, there is an RBA meting this week, but a cut is seen as unlikely. However, the market is pricing in a 60% chance of a cut in rates by the end of the year, and the question for the market is whether the RBA encourage or discourage this expectation. The risk might be slightly towards a more hawkish stance, given recent data, and this should allow some stabilization in the AUD after the AUD/USD decline last week. Bigger picture AUD/USD remains essentially in a 0.64-0.66 range, and we still slightly favour the upside unless we see a significant deterioration in risk sentiment.

Data and events for the week ahead

USA

The US economic calendar is under some uncertainty given risk that if an agreement is not reached by Wednesday, the US government could shut down. That could delay some economic data including the week’s key release, September’s non-farm payroll due on Friday. If released, we expect a rise of 45k, 50k in the private sector, with a dip in unemployment to 4.2% from 4.3% on a fall in the labor force, and an on trend 0.3% rise in average hourly earnings. Wednesday’s ADP estimate for September private sector employment growth, which we expect to increase by 45k, as a private sector release, will not be impacted by any government shutdown.

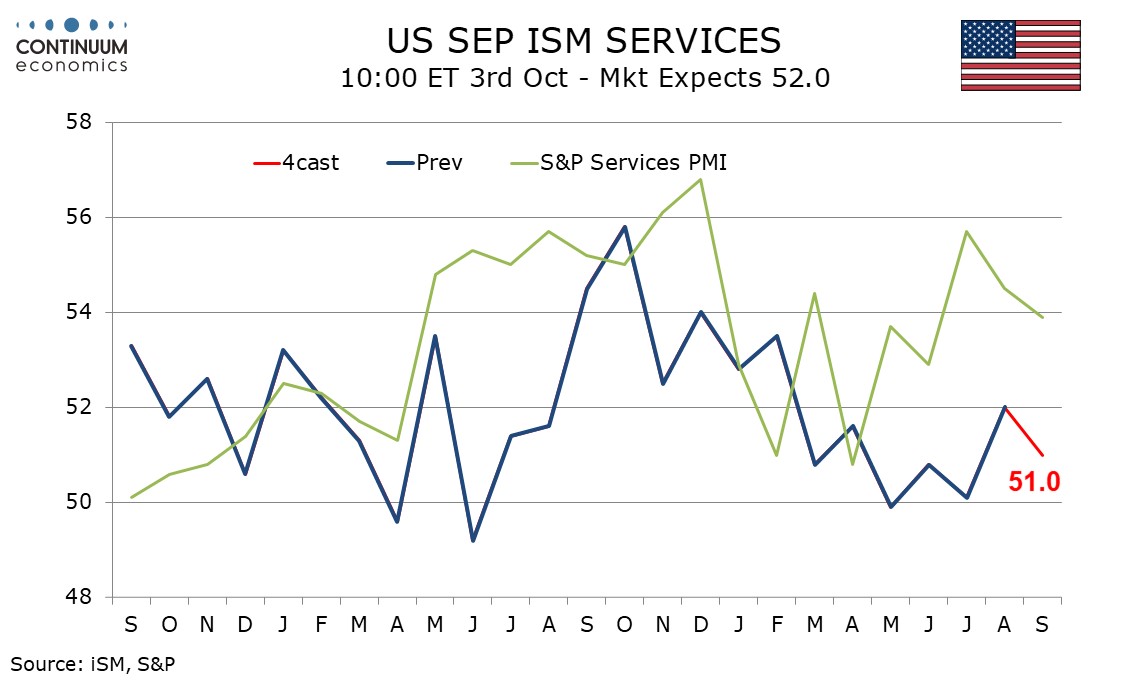

Tuesday sees August job openings, which would come before any government shutdown. Monday’s pending home sales release, Tuesday’s house price indices for July from FHFA and S and P Case-Shiller, and September consumer confidence on Tuesday are all private sector releases. So are September’s ISM indices. We expect Wednesday’s manufacturing index to rise to 49.0 from 48.7 but Friday’s services index to fall to 51.0 from 52.0. Wednesday also sees August construction spending and Thursday factory orders, should the government remain open. Weekly initial claims data due on Thursday did continue in previous shutdowns, with the information compiled by state governments.

Fed speakers scheduled include Hammack and Bostic on Monday, Jefferson, Goolsbee and Logan on Tuesday, Jefferson again on Wednesday, Logan again on Thursday and Williams on Friday.

Canada

It is a quiet week in Canada but September S and P PMIs are scheduled, manufacturing on Wednesday and services on Friday.

UK

The week ahead has moderately interesting data wise beginning with BoE money and credit data (Mon) where housing market volatility and distortions may again be the order of the day but with further signs of an underlying weakening as may be evident in Nationwide house price data due later in the week. Final Manufacturing PMI (Wed) will attract little interest as may final Services PMI (Fri) but with fresh survey messages coming from the BoE Decision Makers Panel numbers on Thursday. Tuesday sees final Q2 GDP for which no planned major revisions are scheduled. Alongside comes Q2 current account numbers where a deterioration from the 3.2% of GDP Q1 deficit is on the cards.

Otherwise an array of BoE MPC appearances are scheduled including Dep Gov Ramsden (Mon) and the Governor on Friday. There is also the Labour Party Conference (Sun-Wed) where policy measures could be mentioned, if not detailed.

Eurozone

Several important updates are due this week. The main focus will be the flash HICP for September (Wed). We see a 0.1 ppt rise in the headline to 2.1%, hinting that the ECB’s Q3 projection for both the overall and core figures could be undershot. This rise in the headline will again be food and energy base effect driven with services and the core both seen slowing a notch to a new cycle low below 3%, something already evident in adjusted m/m data. French and German CPI data precede on Tuesday and where are likely to be at work for the September preliminary numbers where the German headline may rise a notch but the core falls by the same amount. But Thursday’s labor market data may be even more important now that the ECB has started to acknowledge the increase in labor supply seen of late. Friday sees PPI and Q2 House Price numbers. In addition, Monday’s European Commission survey data may again paint a more downbeat picture of the EZ than the PMI have down of late.

There is an array of ECB speakers, this partly a result of Bank of Finland conference (Tue) preceded by a German Bankers conference (Mon)

Rest of Western Europe

There are a few key events in Sweden, most notably the minutes to this month’s Board meeting where there was one dissent to the far from widely expected cut. Otherwise, in Switzerland, Friday sees what may still be soft CPI figures for September, likely to stay around 0.2% y/y and thus hinting at a result in line with SNB thinking. Tuesday sees the currently below-par KOF survey

Japan

Kickstarting the week with Retail Sales on Tuesday, followed by manufacturing data on Wednesday and labor data on Friday. There are also scattered tier two data throughout the week.

Australia

The Key RBA decision will be released on Tuesday. We see the RBA to indicate they considered a 25bps cut but feel like a hold would be more appropriate. The next cut will be in the November meeting of 25bps. We also have trade balance on Thursday and PMIs later in the day.

NZ

Only Business Outlook and Confidence on Tuesday.