FX Daily Strategy: N America, March 20th

Some downside risks for GBP on BoE meeting

CHF/JPY could slip lower on SNB cut

SEK likely unmoved by Riksbank but some weakness could be seen versus EUR and NOK

AUD more driven by regional risk sentiment than domestic employment data

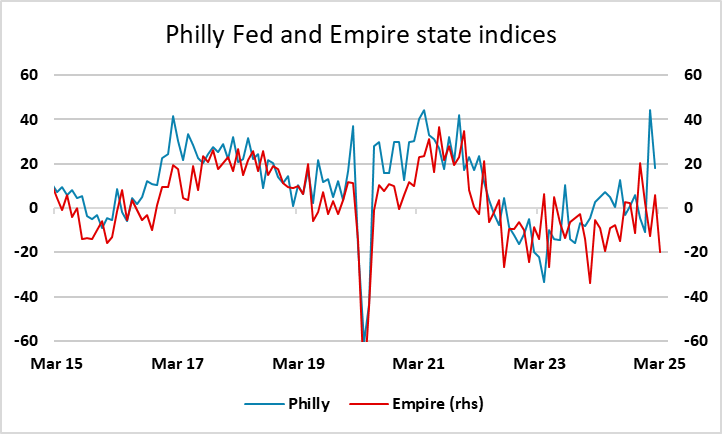

Philly Fed could hurt the USD if it echoes Empire manufacturing weakness

Some downside risks for GBP on BoE meeting

CHF/JPY could slip lower on SNB cut

SEK likely unmoved by Riksbank but some weakness could be seen versus EUR and NOK

AUD more driven by regional risk sentiment than domestic employment data

Philly Fed could hurt the USD if it echoes Empire manufacturing weakness

Thursday sees monetary policy decisions from the Bank of England, SNB and the Riksbank, as well as UK and Australian labour market data and the Philly Fed survey and jobless claims data in the US.

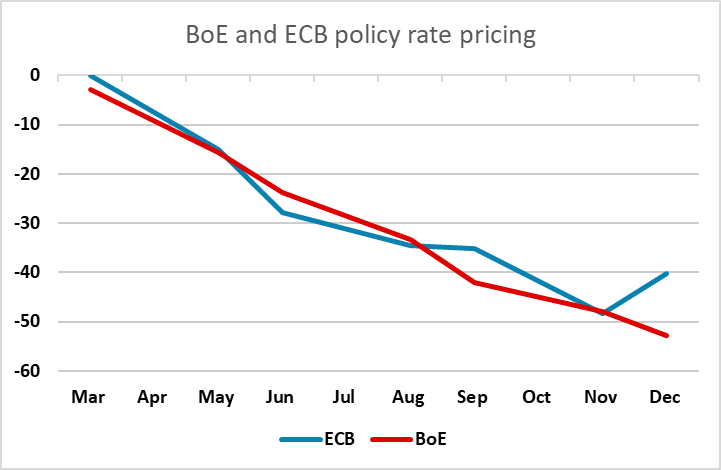

We expect stable UK policy (Bank Rate still at 4.5%) at the March meeting, and there is no significant risk of a move priced into the market. The MPC majority envisages rate cuts not faster than every quarter this year and a little further into 2026. But given what we think is a failing real economy backdrop, which growing global trade tensions may only accentuate, BoE easing may yet come faster and further as the BoE reassesses its optimism about growth and upgrades its estimate of the extent of slack – particularly in the labor market. We expect to see more weakness in employment but the market will be focused mostly on the average earnings data, which may show some small softening but still looks too high to justify significant cuts.

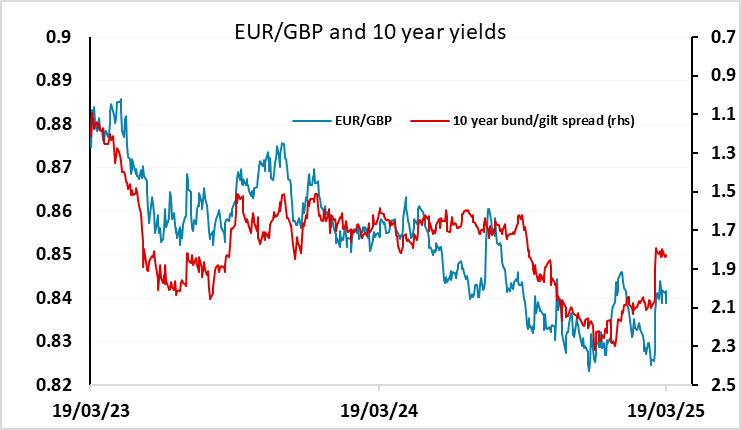

As it stands, the market is only pricing in a further 50bps of easing this year, thus missing out one quarter of cuts. While there are some concerns about higher short term inflation, this is being driven by administered energy prices and we still see core inflation weakening. The BoE will probably not be particularly forthcoming about future policy at this meeting, hampered as others are by the uncertainty surrounding US policy. But risks for UK yields look to be to the downside given the current modest easing priced into the market, and risks for EUR/GBP should consequently be on the upside.

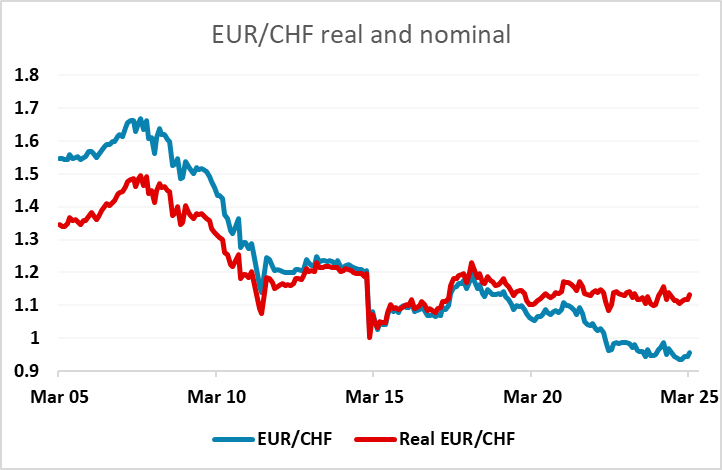

As generally expected, the SNB cut their policy rate to 25bp at today’s meeting. This was mostly priced in, but there were still some who were expecting no change so EUR/CHF has moved higher in response, gaining around 40 pips to 0.9570, although much of this gain reversed declines seen in early trading. EUR/CHF doesn’t have a strong correlation with yield spreads, so the cut will probably not have a major impact. EUR/CHF continues to be determined more by risk sentiment, particularly on the strength of the Eurozone economy. The recent rise in EUR/CHF reflects some improvement in sentiment due to the expectations of increased defence and infrastructure spending, and if Eurozone growth does pick up there is some scope for further EUR/CHF gains. However, the historically low nominal level of EUR/CHF is misleading in terms of real value. In real terms, EUR/CHF is essentially mid-range for the last 15 years, so we wouldn’t see scope for major gains.

We see more reason for the CHF to lose some ground against the JPY. CHF/JPY is much more clearly overvalued after the sharp gains seen in recent years, and the latest rate cut takes the Swiss policy rate below the Japanese policy rate for the first time since August 2022. Yield spread further out on the curve are already favourable for the JPY, and from a trading perspective, the similar risk characteristics of the CHF and JPY make CHF/JPY less vulnerable to shifts in risks sentiment.

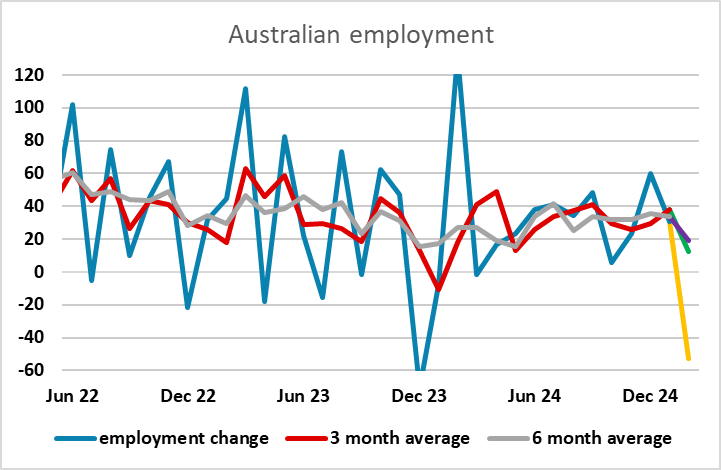

The Australia Feb headline Employment Change has missed estimate at -52.8K with employment unchanged but participation rate slumped. However, given the history of solid Australian labor market, one bad report does not guarantee the downfall of the labor market and will need further confirmation in the coming months. Yet, the poor employment report led to knee-jerk losses in the Aussie.

On the US data, there is some downside risk for the USD if the Philly Fed echoes the recent weakness of the Empire manufacturing survey, particularly if the initial claims data shows any rise.