FX Daily Strategy: Asia, July 10th

NOK upside favoured if CPI data is at or above consensus

USD generally a little vulnerable

EUR limited by political uncertainty

JPY upside potential needs a trigger for it to be realised

NOK upside favoured if CPI data is at or above consensus

USD generally a little vulnerable

EUR limited by political uncertainty

JPY upside potential needs a trigger for it to be realised

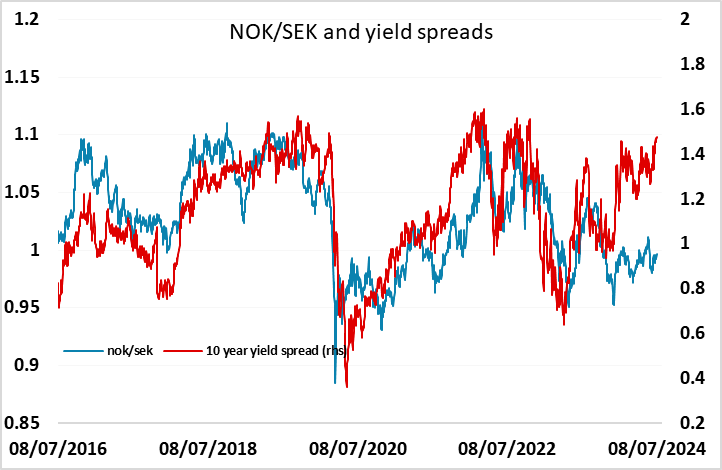

Wednesday looks set to be another quiet day ahead of the US CPI data on Thursday which is the main focus of the week. We do have Norwegian June CPI data, which could potentially impact the NOK, which has been persistently weak this year relative to its normal behaviour relative to yield spreads. NOK/SEK continues to look particularly clearly undervalued, and should have potential to move considerably above parity. The market is expecting a decline in the core CPY y/y rate to 3.6% from 4.1% this month, which is in line with the Norges Bank projections. NOK yields are already high enough to justify a NOK rise, so anything at or above this level should favour NOK gains.

The risks look to be generally on the USD downside at the moment, with US yields having slipped a little lower after softer US data last week, but individual factors in other currencies are limiting the USD downside.

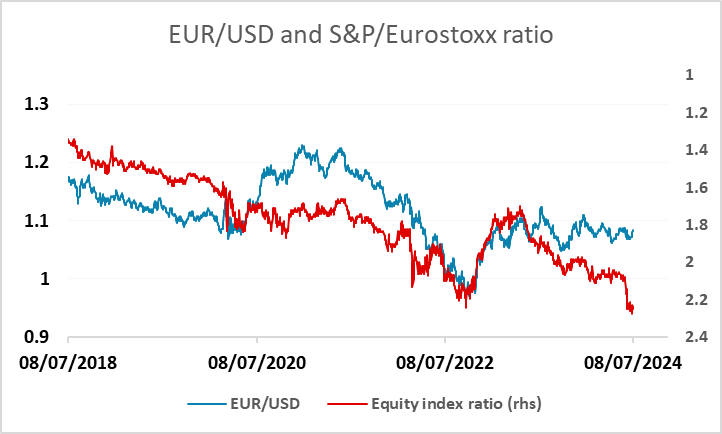

In Europe, there is still some risk premium associated with the French election result and the lack of an effective governing coalition that resulted. While yield spreads suggest there are some mild upside risks for EUR/USD, European equities have underperformed US equities in recent weeks, and this does tend to undermine the support for the EUR. It seems likely that some nerves around European politics will persist for some time, with the EU Commission also likely to proscribe several countries’ fiscal policies in the coming weeks. The hopes of a Eurozone recovery are also potentially fragile, with the dividend from lower gas prices and lower inflation likely to fade in the coming months. So even though there may also be some uncertainty around the US political situation, the upside for the EUR looks capped unless we see some increase in expectations of Fed easing in the short term.

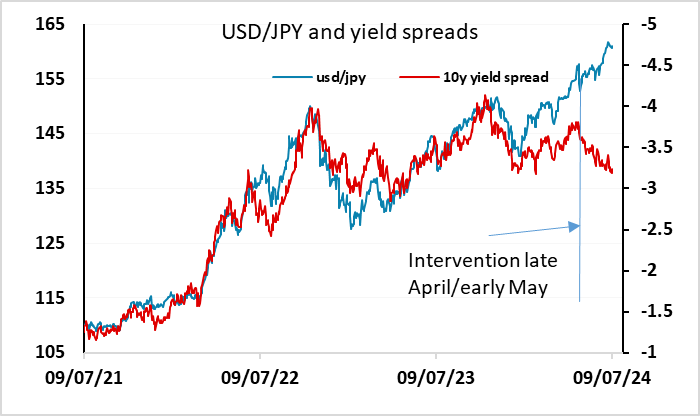

There is an even clearer case for a weaker USD against the JPY due to the decline we have seen in US yields, but the lack of a JPY recovery despite the narrowing of yield spreads we have seen is now well established, and without some other trigger it seems unlikely that the JPY bulls will gain any traction. BoJ intervention had been expected around current levels but it now looks as if the Japanese authorities are leaving the market to its own devices. We have a BoJ meeting at the end of the month, but as we saw in March, this is no guarantee of a JPY recovery. Weaker risk appetite looks like the most likely trigger for a JPY recovery, and US equity valuations are looking stretched, but it will take some more obviously poor growth or earnings news to trigger an equity decline. Equities could fall if we see a rise in US inflation, but if that also sees a rise in US yields there is no guarantee it will be JPY supportive. So for now although we have seen a pause in JPY weakness, the risks look to be on the JPY downside.