FX Daily Strategy: N America, November 15th

US retail sales to maintain impression of solid US growth

USD should hold firm but gains becoming harder to make

AUD to outperform EUR

JPY weakness unlikely to turn without weaker US data or equities

GBP may see short term dip on GDP but EUR/GBP remains well offered

US retail sales to maintain impression of solid US growth

USD should hold firm but gains becoming harder to make

AUD to outperform EUR

JPY weakness unlikely o turn without weaker US data or equities

GBP may see short term dip on GDP but EUR/GBP remains well offered

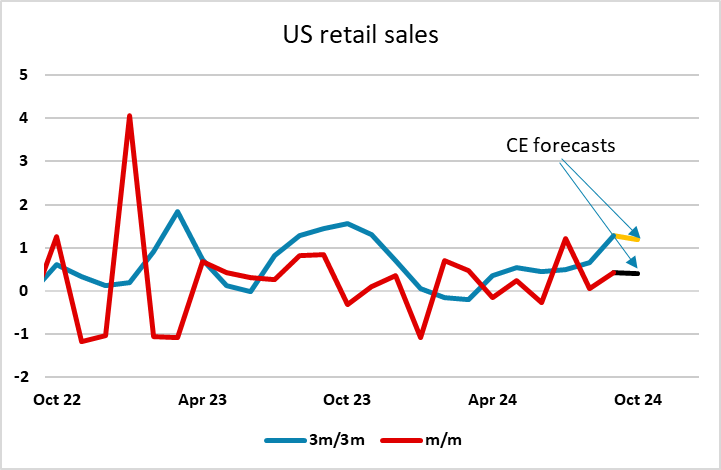

Friday sees US retail sales data for October and UK GDP data for September and (updated) for Q3. We expect US retail sales to maintain momentum in October, with a 0.4% increase overall matching that of September. However gains of 0.2% ex autos and 0.3% ex autos and gasoline would see some loss of momentum from surprisingly strong respective gains of 0.5% and 0.7% in September. But the underlying picture over recent months is still very solid, with nominal sales growth running at close to 5% annualised. As long as this is the case, it will be hard for any negative sentiment on the US economy to take hold, and equities and the USD will likely remain well supported.

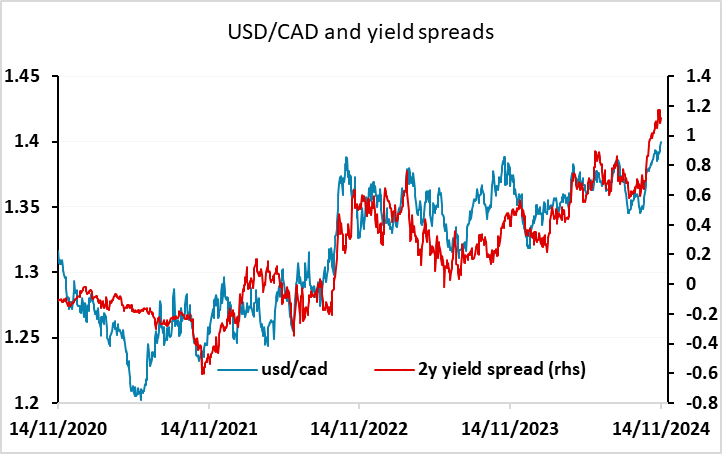

As it stands, yield spreads broadly justify recent USD gains. Front end yields if anything point to scope for further USD gains against the EUR and CAD. However, AUD and JPY look somewhat undervalued relative to their usual yield spread correlation. The AUD is likely being undermined by concerns about US tariff policy towards China and consequent impact on Chinese growth, but with the AUD already suffering significantly from weakness in Chinese equities this year, we would see scope for outperformance against the EUR and other currencies where monetary policy is likely to be easier.

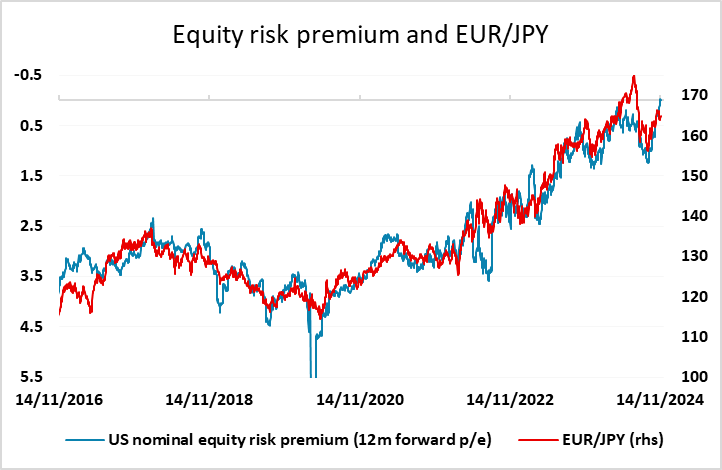

USD/JPY continues to approach extremes, and any sort of big picture evaluation suggests it is significantly overvalued, with yield spreads well below the peak and the real value of the JPY even weaker than the high nominal level of USD/JPY suggests. However, the JPY tends to suffer whenever there is extended positive equity sentiment, and US equity risk premia have turned negative in the last couple of days and are at their lowest since the early 2000s. This doesn’t look sustainable, but there is no obvious trigger for a turn at this point. Weaker US growth or some sort of negative equity reaction to rising bond yields looks necessary to turn the trend. Even so, Levels above 156 in USD/JPY are likely to prove heavy going, with the Japanese authorities also likely to be contemplating intervention as we approach 160. Friday's Japan preliminary Q3 GDP came in at 0.2% with private consumption seems to be performing better than estimate but will need confirmation from the final GDP figure.

We see some short term downside risks to GBP from the UK GDP data. Much has been made of the UK’s economy’s apparent solidity, if not strength, so far this year given sizeable q/q gains in the first two quarters of the year of 0.7% and 0.5% respectively. But this may have been something of a flash in the pan, not least as GDP growth has been positive in only two of the last five months of data with flat and pared-back readings in both June and July before a better August outcome. Even with a further small rise likely to September of 0.1% m/m (consensus 0.2%), we see Q3 GDP rising by no more than 0.1-0.2% q/q (consensus 0.2%), albeit with consumer spending perking up a little. But it will take more than marginally softer UK GDP data to reverse the recent downward trend in EUR/GBP, which is supported by the wide yield spread in favour of the pound.