FX Daily Strategy: Asia, February 19th

Australian Labor Market Stays Healthy

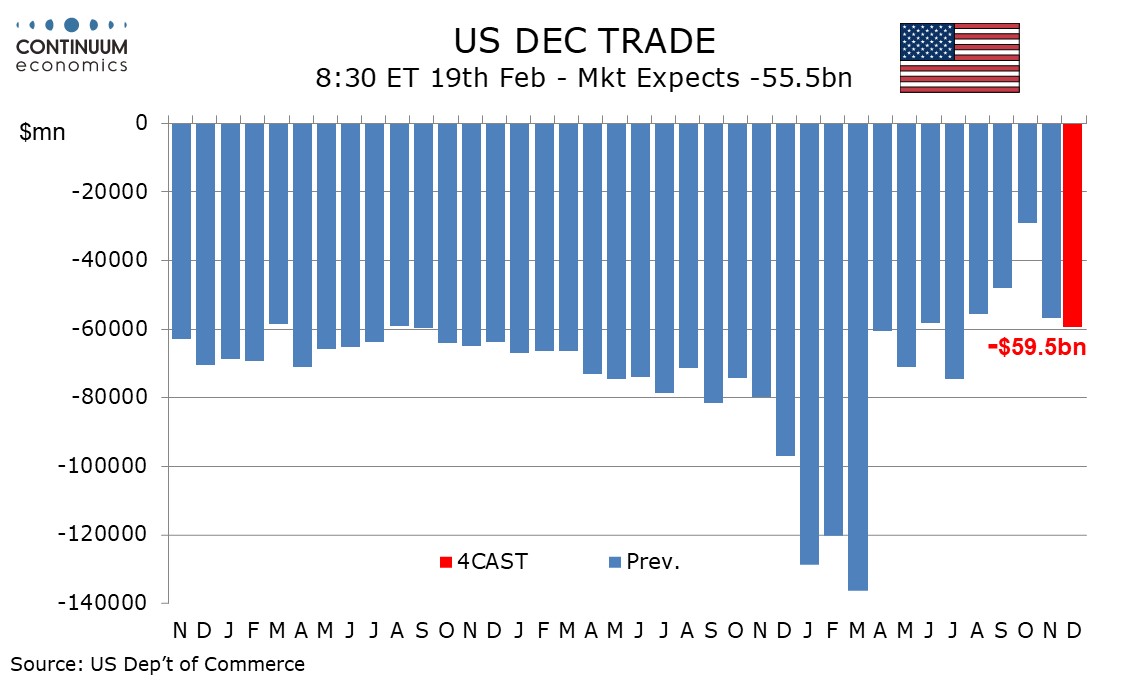

U.S. Trade Balance Despite volatility, 2025 will average similar to 2024

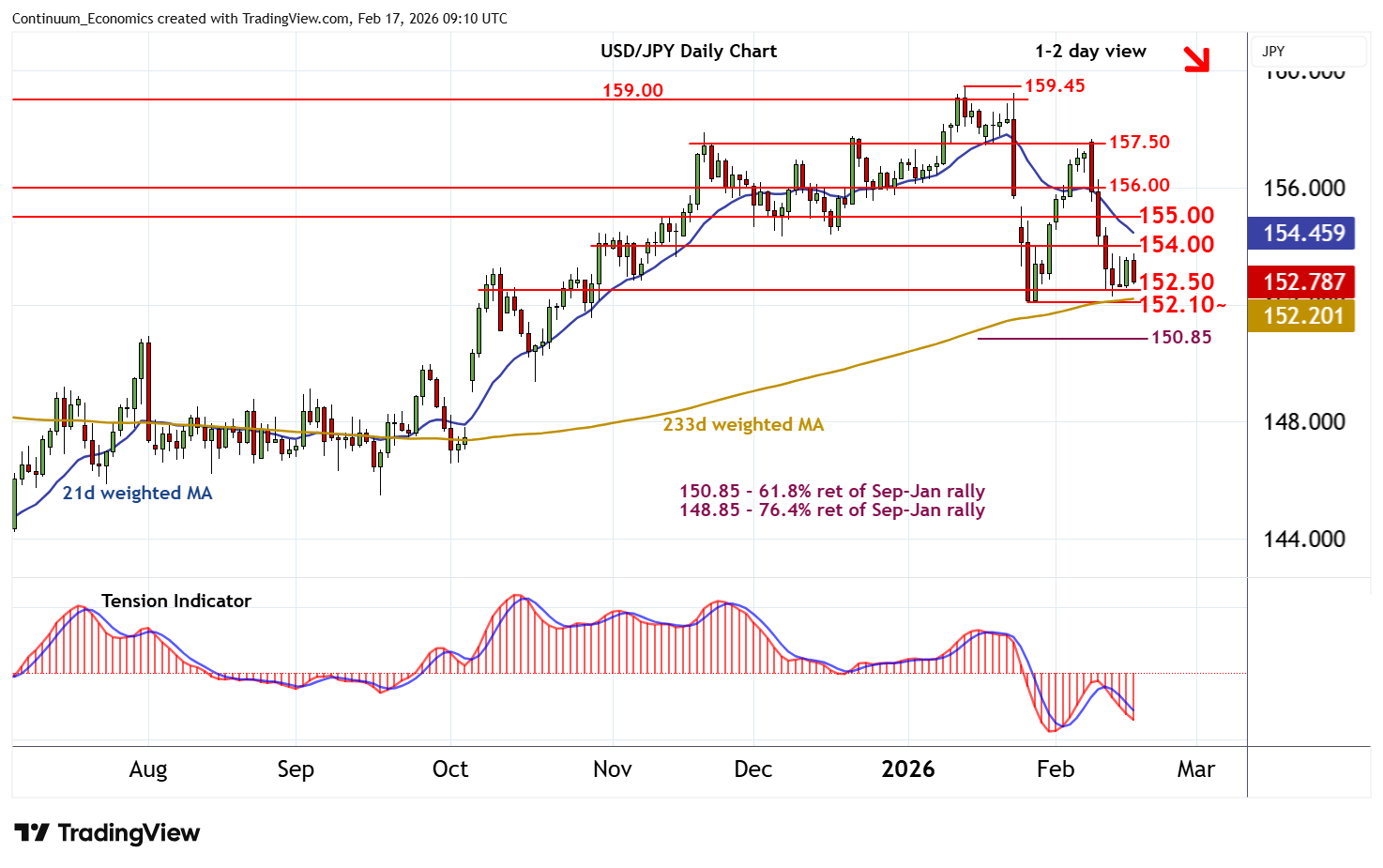

USD/JPY Could Correct Further

The Australian labor data will be released on Thursday morning and we are expecting both unemployment and participation rate to tick higher. Without substantial changes, we believe the Australian labor market remain healthy no matter what the headline may give in a month or two. Regardless, wage growth has proven solid labor market and the next critical read will return to CPI. With a hawkish RBA standing by, another high read will sway market participants in expecting an earlier hike.

On the chart, the fresh test below 0.7065 has posted a fresh bounce from 0.7045, as oversold intraday studies unwind, with prices currently trading around 0.7075. Continuation towards resistance at 0.7100 cannot be ruled out. But daily readings are falling and overbought weekly stochastics are flattening, suggesting renewed selling interest towards here. Following cautious/corrective trade, fresh losses are looked for. A close below the 0.7065 lows from 10-11 February will add weight to sentiment and open up congestion around 0.7000. Meanwhile, a close above 0.7100 will help to stabilise price action and prompt consolidation beneath strong resistance at 0.7147/55~.

We expect a December trade deficit of $59.5bn, which would be the widest since August and up moderately from November’s $56.8bn. It would be up sharply from October’s $29.2bn which was the lowest since June 2009 but heavily influenced by temporary factors. The data may bring some fine tuning to expectations for Q4 GDP which is due on February 20. Goods exports surged in September and October largely on strength in nonmonetary gold. Nonmonetary gold exports slipped back in November and further slippage is likely in December, leaving goods exports down by 2.9% in a second straight fall, but still above August’s level. Imports fell sharply in October led by a plunge in pharmaceutical preparations which rebounded in November and now seem to be at a sustainable level. November’s imports rise, which more than fully erased October’s decline, was further fueled by a surge in computers which will be difficult to sustain. We expect goods imports to fall by 1.0% to a level slightly above that seen in September.

USD/JPY has been consolidating after the relieve rally of JPY after the sweeping LDP win. Front end JGB yields are choppy while the very far end moderates. It seems market confidence in the Japanese government is slowly restoring and more corrective bids are to come. So far, we haven't hear about any new policy from Takaichi that requires extra spending and it will ease certain concern on fiscal irresponsibility.

On the chart, consolidation is giving way to a drift lower, as intraday studies turn down, with prices currently trading around 152.80. Daily readings are falling, putting focus on congestion support at 152.50. However, mixed/negative weekly charts highlight room for still deeper losses. A close below the 152.10~ current year low of 27 January would add weight to sentiment and confirm continuation of mid-January losses, as the 150.85 Fibonacci retracement then attracts. Meanwhile, resistance remains up to congestion around 154.00 and should cap any immediate tests higher.