FX Daily Strategy: Asia, February 10th

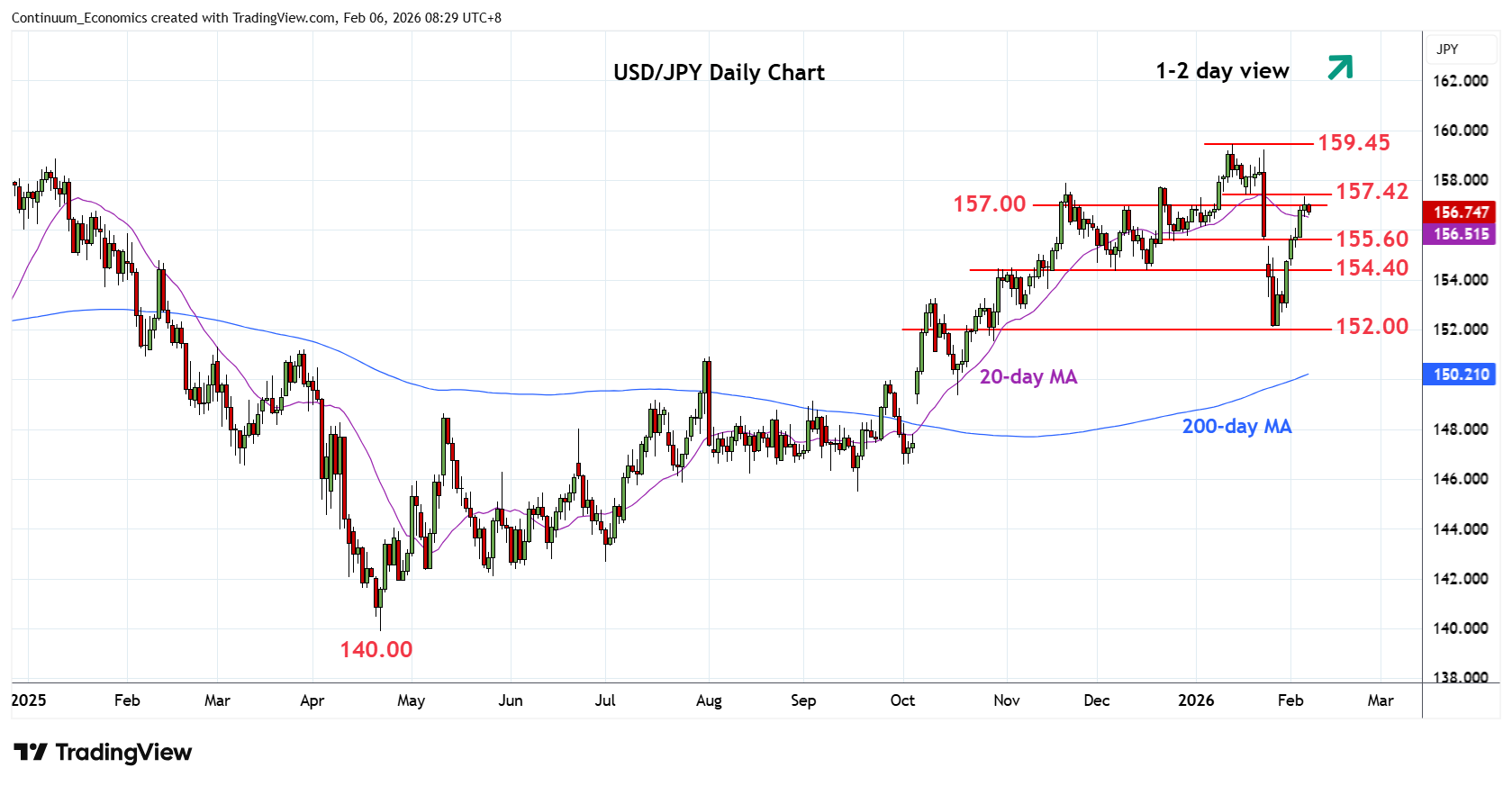

USD/JPY Selling the Fact

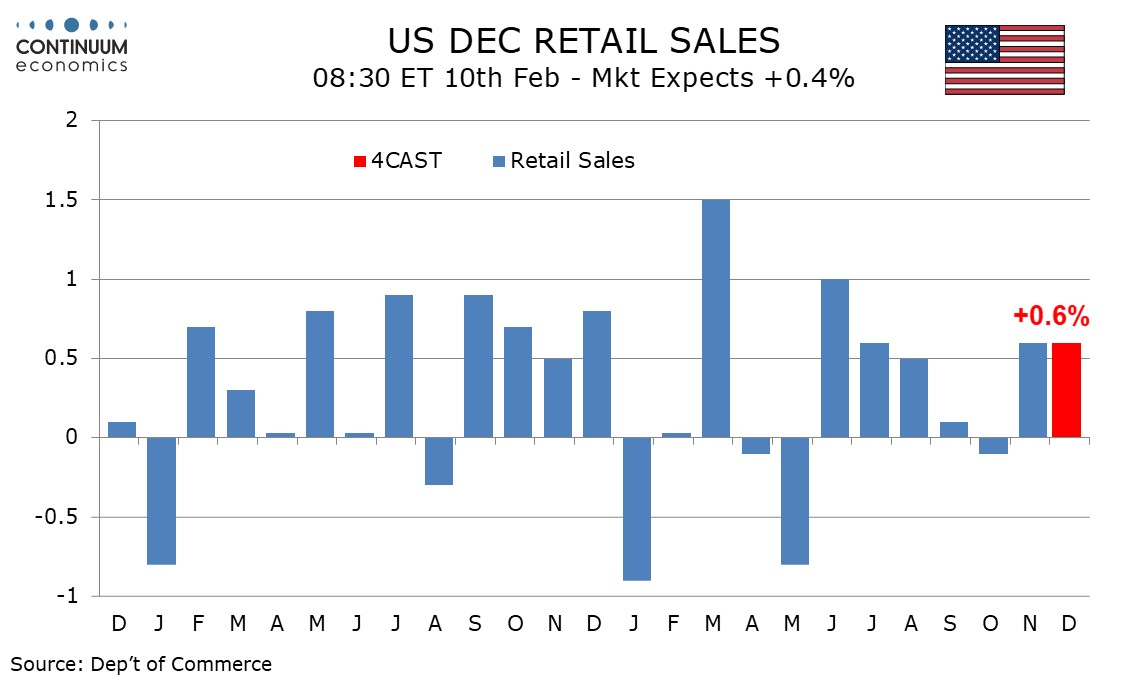

U.S. December Retail Sales Maintaining momentum

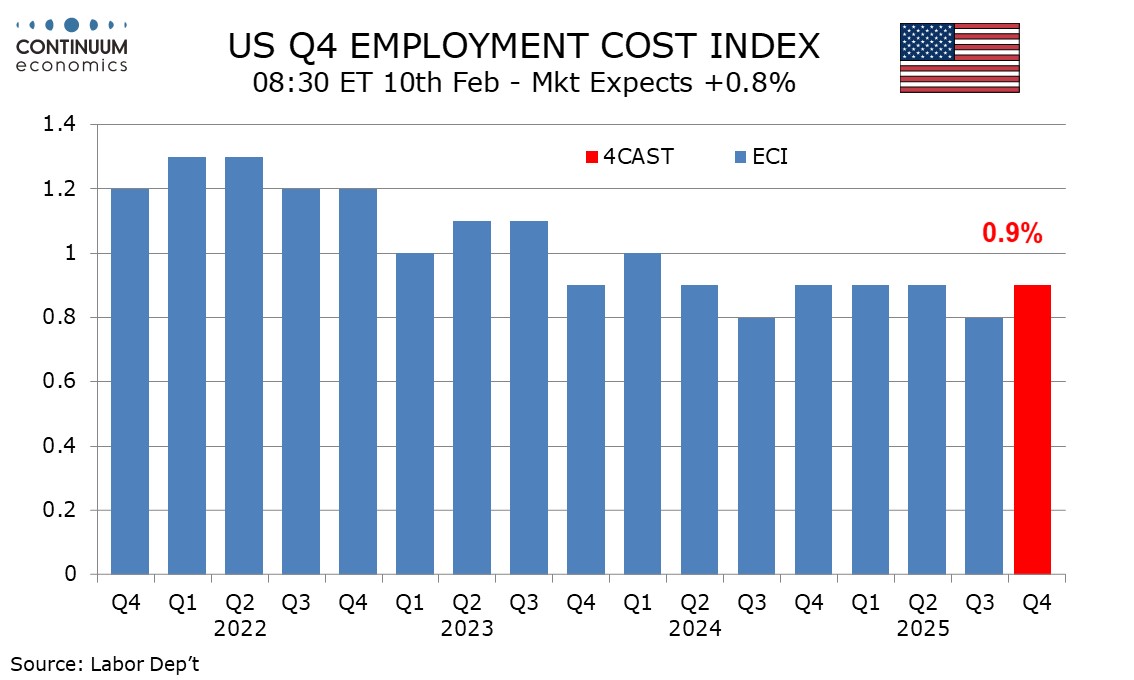

So as Q4 Employment Cost Index

After the landslide victory for Takaichi's LDP, there seems to be continuous speculation regarding her fiscal spending plans that would further worsen Japan's debt picture. While PM Takaichi is definitely pro-stimulus, the business price/wage setting behavior has already substantially changed from a decade ago and the momentum does not look like to be slowing in a short term. Thus, there is no need of Abe's era massive stimulus policy to jumpstart the economy. PM Takaichi seems to be considering market sentiment by shelving food tax cut that was promoted in her campaign, in sight of fiscal irresponsible sentiment and rising yield. These factors lead to our expectation that any potential stimulus wouldn't be COVID era and rather be more targeted at cost relieve and strategic investment. If the Japanese PM act as we forecast, market participant's speculation could unwind. Short end JGB yields are rising but we are seeing the far end moderates. Such push and pull will likely continue until we get more clarity from the PM.

On the chart, the pair is settling back from test of strong resistance at the 157.00/157.42 area as prices consolidate strong gains from the 152.10 low. Intraday studies are unwinding overbought readings but bullish momentum keeps pressure on the upside. Break above the 157.42 resistance, if seen, will see scope for extension to strong resistance at 157.90/158.00 area. Meanwhile, support is raised to the 156.00/155.60 area which should underpin. Would take break here to fade the upside pressure and open up room to 154.40/154.00 support and lower.

We expect retail sales to maintain momentum in December, rising by 0.6% overall and by 0.5% ex auto, both matching their November increases. Ex autos and gasoline we expect a 0.5% increase, a modest pick-up from two straight gains of 0.4%. While consumer spending is running head of real disposable income, and is led by consumption at the upper end of the income scale, holiday shopping suggested continued momentum.

Industry data suggests a modest positive from auto sales, though January industry data suggests a significant dip in auto sales, more so that can be explained by bad weather late in the month. Gasoline prices look set to be a neutral in December retail sales but food prices picked up in December’s CPI.

We look for the Q4 employment cost index (ECI) to increase by 0.9%, slightly firmer than the 0.8% seen in Q3 but matching the gains of Q1 and Q2, as well as Q4 2024. We expect a 0.9% increase in wages and salaries, stronger than 0.8% gains seen in Q3 and Q1 but softer than gains of 1.0% in Q2 and Q4 2024. Non-farm payroll average hourly earnings increased by 1.0% in Q4, matching their increase of Q3.

There is some upside risk to benefit costs from rising health premiums, but this is probably more of an issue for Q1 2026 than Q4, which we expect to match gains of 0.8% seen in Q3 as well as Q3 and Q4 of 2024. We expect yr/yr growth of 3.5%, matching Q3’s, with wages and salaries and benefits both matching the overall pace. A recent slowing in trend may be stabilizing above the pre-pandemic trend that was slightly below 3.0% on a yr/yr basis.