JPY flows: More new lows, but getting overdone?

JPY hits another new low, Japanese authorities still inactive.

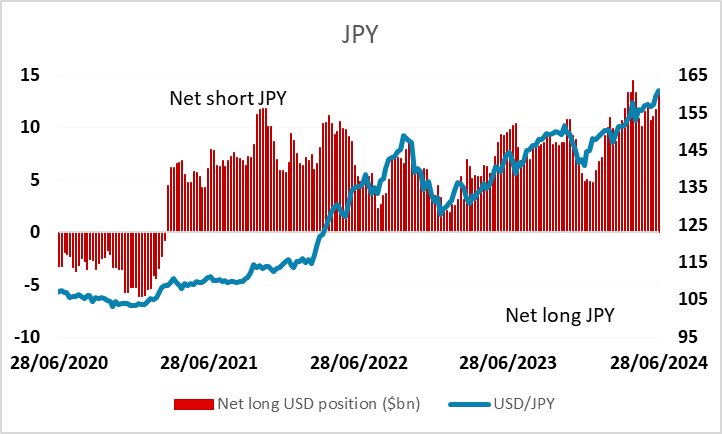

There’s little of interest in today’s calendar, so the themes of the last few weeks look likely to persist, notably JPY weakness, unless there is some action from the Japanese authorities to halt it. The lack of action thus far is surprising, given the new lows the JPY has seen almost every day in the last couple of weeks. Japanese Finance Minister Shunichi Suzuki said last Thursday that he would take necessary actions on currencies after the yen slid to a 38-year low against the dollar. He said Japanese authorities are "deeply concerned" about the effect of the yen's drop on the economy and are watching foreign-exchange moves with a high sense of urgency. But since then the JPY has lost another 1% and there has been no reaction. GBP/JPY is on its 12 consecutive day of gains – a run that has never been seen before, and net speculative short JPY positions on the IMM are approaching the pre-intervention highs.

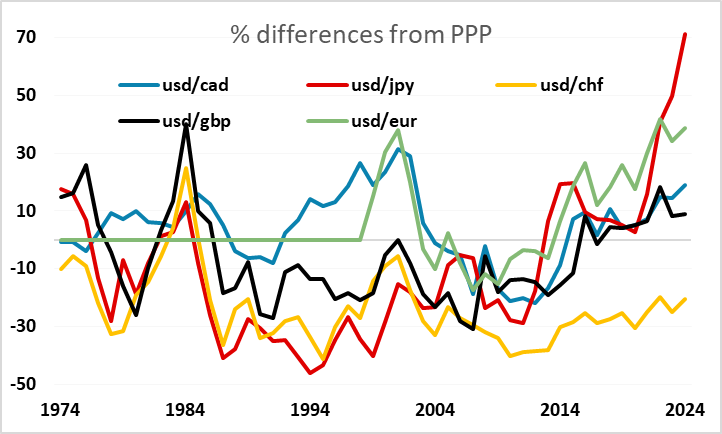

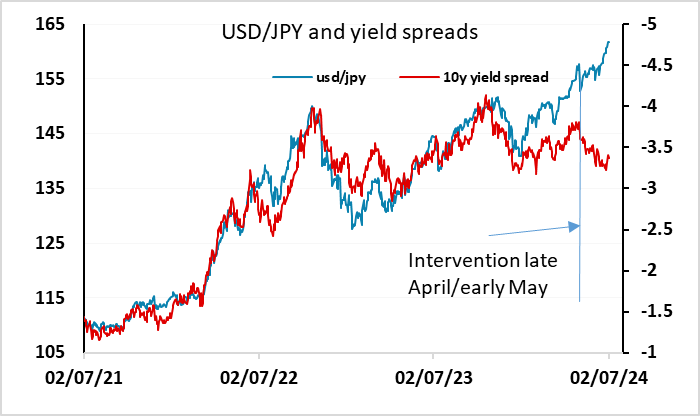

With the JPY at record lows in real terms and weaker than any major currency has ever been against the USD, it is also surprising that the Japanese authorities haven’t co-opted support from other G7 members – notably the US – to halt the JPY’s decline. US Treasury Secretary Yellen’s indication back in April that exchange rates should be market-determined, except in very rare circumstances, helped trigger sharp JPY losses, and was followed by BoJ intervention a few days later. With the JPY now even weaker, the case for intervention is strong, but there is also a concern about its lack of effectiveness, as since the intervention, the JPY has weakened even though yield spreads have moved in the JPY’s favour. So some reluctance is understandable, but sitting back and hoping the JPY stops weakening doesn’t look like a sensible strategy either, as the market will see it as a green light for more JPY losses.

IMM net speculative positioning