FX Daily Strategy: Europe, April 8th

Focus on equities and tariffs rather than data

Hard to oppose equity weakness

FX moves to be mainly determined by risk characteristics

JPY remains the safest haven

AUD and NOK will struggle if equities continue to weaken

Some stabilisation in equities but it may be a false dawn

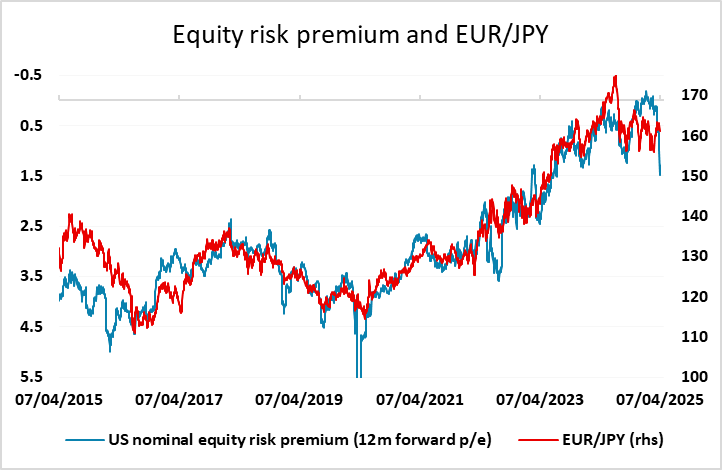

JPY dip may be a buying opportunity

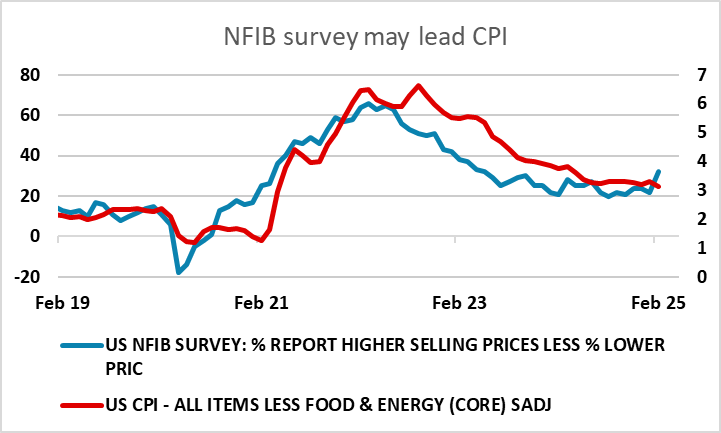

Interest in the NFIB survey

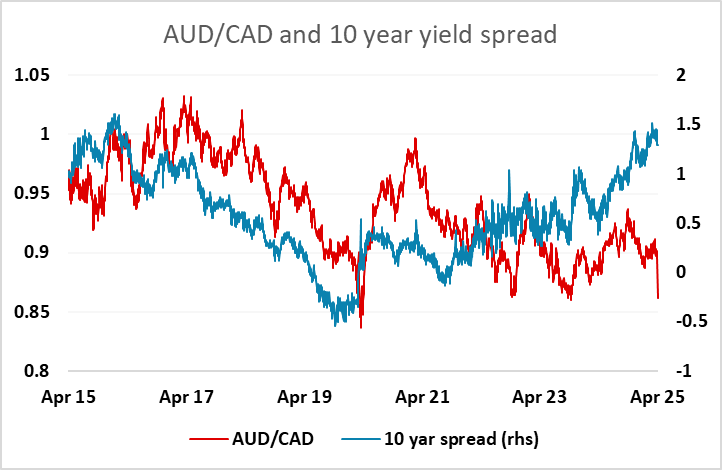

AUD and NOK look good value versus GBP and CAD

There isn’t a great deal on Tuesday’s calendar, and the market focus is going to be on any news on the tariffs rather than on economic news in any case. A decision is expected on Wednesday on whether to delay the “reciprocal” tariffs. There was a general rally in equity markets on Monday helped by reports of comments from White House economic adviser Kevin Hassett saying Trump is considering a 90-day pause in tariffs for all countries except China. This also helped trigger some moves out of the safe haven currencies, with USD/JPY rising back above 147 and EUR/CHF back above 0.94. We still see the damage that has already been done to equity markets justifying further JPY gains, but short term positioning may be adjusted away from the safe havens. A pause in tariffs would be welcome compared to the alternative, but also wouldn’t be ideal as it would preserve uncertainty. It might also mean a further big surge in imports to the US as firms try to build inventory before tariffs are imposed. In any case, the reports don’t seem to be well sourced, with the White House distancing itself from the idea of a pause.

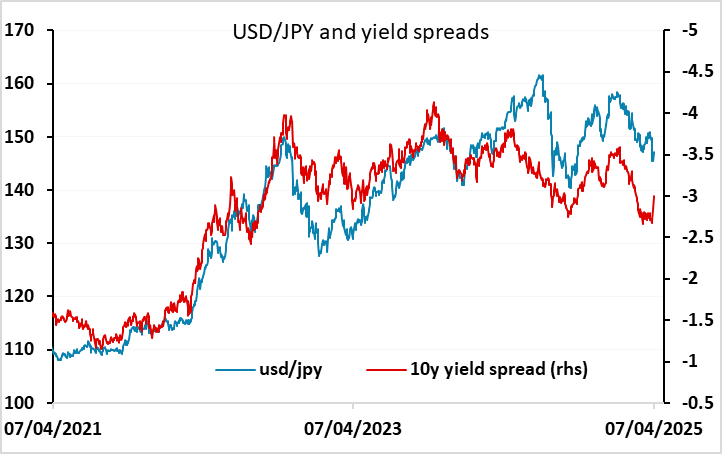

Remember also that the US market is still expensive relative to bond yields, and Europe no better than fair. To see this as a longer term equity market buying opportunity would require a belief that growth will be at or above trend, which seems a heroic assumption at this point. Similarly, even if we see some risk positive moves short term, we have already seen sufficient damage to equities and sufficient movement in yield spreads to justify substantial gains in the JPY.

Tuesday’s calendar does have the NFIB survey, which will be of interest both in terms of business optimism and prices. This survey may not be a great guide to activity, but notably rallied strongly after the election as it did after the previous Trump election in 2016. Then, the optimism boost lasted all the way up to the pandemic. It will be interesting to see if the optimism has already taken a hit in the March survey. The price survey will perhaps be of most interest, as it does have some track record in leading the CPI. There has already been some increase, and further gains could renew pressure on equities and provide some support to safe haven currencies.

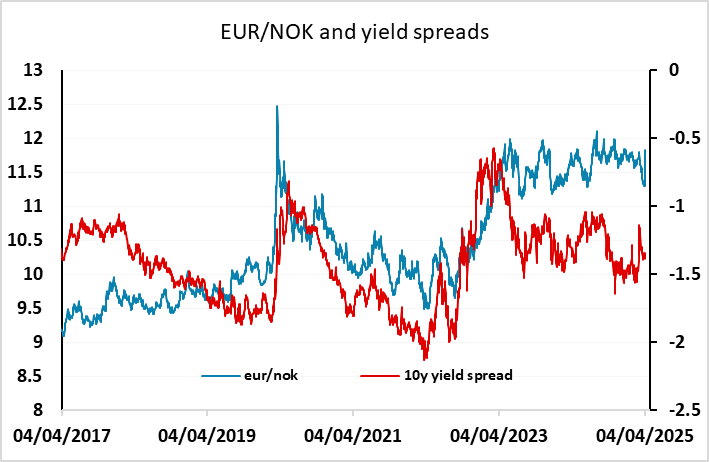

It’s notable how the AUD and NOK have been two of the worst performing currencies over the last year, underperforming yield spreads even before the latest drop in risk sentiment, despite solid economic performances and relatively attractive yields. Both are now at attractive levels relative to history, testing their pandemic lows. Of course, if we see further equity market weakness form here, they are likely to continue to struggle against the USD and the safe havens. But they look like good value against the better performing “risky” currencies like the CAD and GBP.

.