FX Weekly Strategy: Asia, March 18th-22nd

FOMC the main focus – some risk of a USD positive impact

BoJ may signal the start of the tightening cycle

BoE can start to turn more dovish

SNB has potential to weaken the CHF

FOMC the main focus – some risk of a USD positive impact

BoJ may signal the start of the tightening cycle

BoE can start to turn more dovish

SNB has potential to weaken the CHF

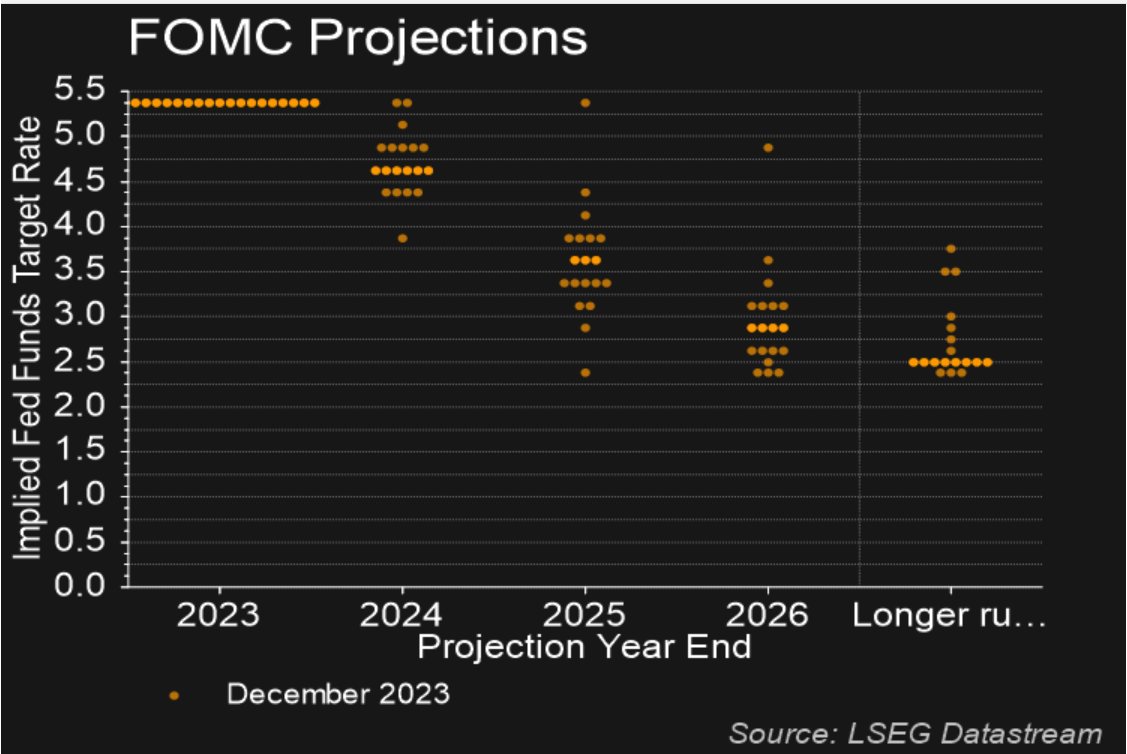

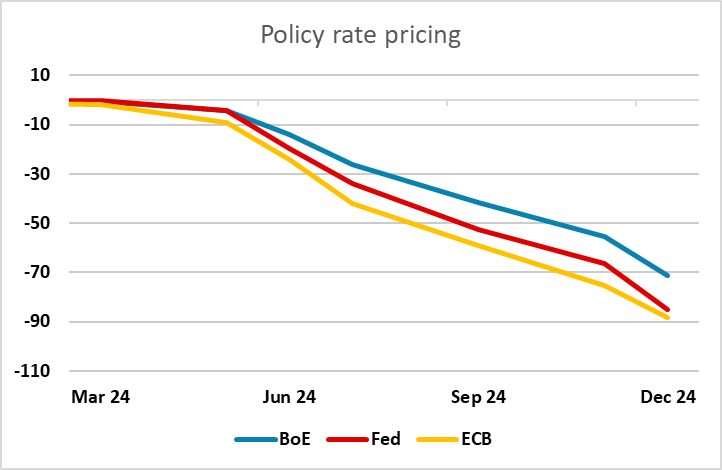

Central bank meetings will be the prime focus in the coming week with the FOMC meeting on March 20 taking centre stage. A change in rates from the current 5.25%-5.50% target range looks highly unlikely. Given recent disappointment on inflation the statement is likely to repeat that more confidence on inflation moving towards target is needed before easing. The dots may even become marginally more hawkish, seeing 50bps of easing in 2024 rather than the 75bps projected in December. The market is now pricing exactly 75bps of easing by the December meeting. There would therefore need to be a rise in the median expectation for Fed funds for any further impact on front end US yields and the USD. Ahead of the FOMC, there is therefore only very modest potential for further rises in US yields, and while the USD might get some support from some further corrective action in equity markets, we would expect EUR/USD to hold close to 1.09.

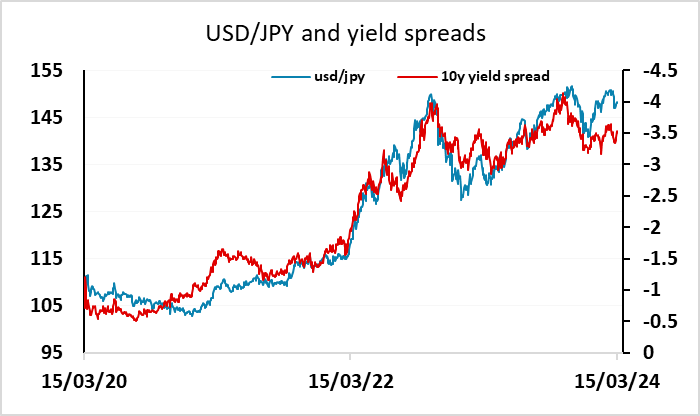

There should be even less scope for gains in USD/JPY, as next week also has potential to see the BoJ start its tightening cycle, if not with an actual rate hike then with forward guidance in that direction for the April meeting, either towards a rise in the policy rate or an end to YCC (or both). There are around 4bps of tightening priced for this week’s meeting, suggesting a less than 50% chance of a rise in the policy rate. But Yield spreads are already at a level that suggests USD/JPY is stretched here, and there is more potential for a rise in JGB yields in the coming months than a rise in US treasury yields. USD/JPY and EUR/JPY are consequently looking toppy unless the BoJ decide to disappoint everyone and declare that policy is set to remain unchanged for some more months.

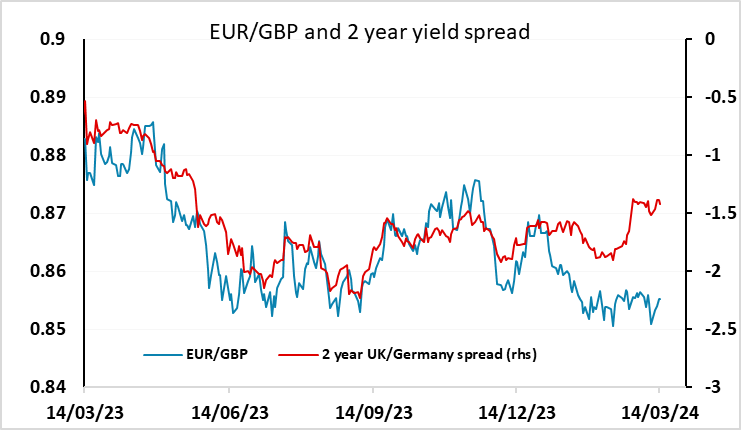

The Bank of England MPC meeting next week also has potential to move market expectations of policy. For the moment, the market still prices a more hawkish BoE stance relative to the Fed and ECB, encouraged by some continued votes for higher rates from the hawks on the committee and the evidence that the labour market is still tight. But this evidence is less convincing in recent data, with average earnings looking to be plateauing in recent months, while GDP remains essentially flat. However, while we see every reason for the BoE to be more dovish and GBP to weaken, governor Bailey was making some optimistic noises about the economy after the last meeting. He needs to change his tune if GBP bears like ourselves are to get any joy. The UK CPI data will provide some final information for the MPC. GBP looks vulnerable both because EUR/GBP is underperforming yield spreads and because CFTC dtaa shows extended net long speculative GBP positions.

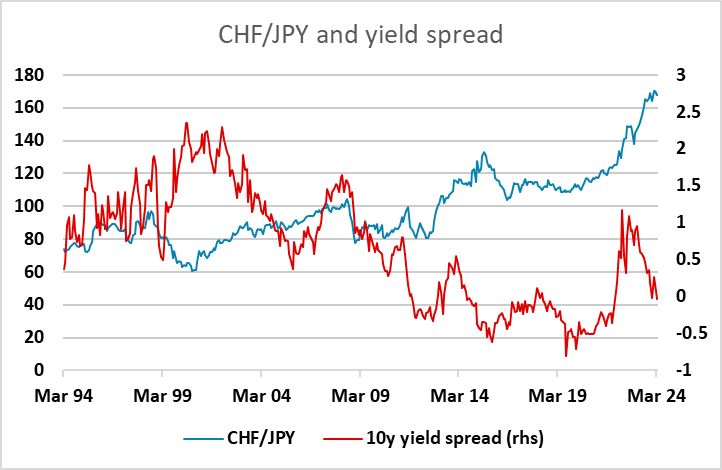

Norges Bank and the SNB are unlikely to change policy, but nevertheless have potential to move the market. Both have potential for a dovish shift from the previous meeting, given the softness of inflation. The SNB is perhaps the closest central bank to easing at this point, and there are 7bps of easing priced in for this week’s meeting, so a cut wouldn’t be a complete surprise. In any case, we see downside risks for the CHF, which is starting from very strong levels, with CHF/JPY looking the most vulnerable given the extreme valuation.

Data and events for the week ahead

USA

The clear highlight of the U.S. data calendar is Wednesday’s FOMC meeting, though a change in rates is very unlikely. After recent strong CPI data we expect the FOMC will continue to state that it needs greater confidence that inflation is moving sustainably to target before easing policy. We see risk of slightly more hawkish dots, with only 50bps of easing being seen this year rather than the 75bs seen in December, though expect Powell’s press conference to sound fairly balanced.

The data calendar sees no key releases. Monday sees March’s NAHB homebuilders’ index, where a pause is likely after recent gains. On Tuesday we expect February housing starts to rise by 18.0% to 1570k after a weather-depressed January, but permits to see only a modest 1.4% increase to 1510k. Thursday’s initial claims will cover the survey week for March’s non-farm payroll. March’s Philly Fed manufacturing survey is also due and we expect the Q4 current account deficit to fall to $198bn from $200.3bn in Q3. Later we expect slippage in March’s S and P PMIs, manufacturing to 50.5 from 52.2 and services to 52.0 from 52.3, and a 1.5% decline in February existing home sales to 3.94m. February’s leading indicator is also due. There is no significant data due on Friday but Fed’s Bostic is due to speak.

Canada

Canada’s most significant release is February CPI on Tuesday, which we expect to increase to 3.0% yr/yr from 2.9%, with only marginal progress lower on the core rates, following more significant slowings seen in January. Monday sees February IPPI/RMPI data and February existing home sales. Minutes from the March 6 BoC meeting are due on Wednesday and BoC’s Gravelle speaks on Thursday. Friday sees January retail sales, for which a preliminary estimate for a 0.4% decline was made with December’s report.

UK

As for ever more important CPI data, Wednesday should see the recent downtrend resume in the February CPI numbers and clearly so, despite higher petrol prices, with food acting as a major offset. We see the headline rate down to 3.4%, a 29-month low and the core down to 4.7% a 23-month low, but there may be some rise in apparent core momentum as measured by adjusted m/m numbers. Thus may be something the BoE picks up in any assessment that comes alongside the almost-certain stable policy decision from Thursday’s BoE-MPC verdict – NB; the MPC will have early access to the February CPI. The MPC may also touch on better survey data, citing PMI numbers, even mentioning an update due earlier on Thursday, the key question being the extent to which it accentuates the implicit easing bias offered last time around

However, as for the flash PMI numbers for March, we see a stable to slightly lower reading. The composite was 53.0 in February, up fractionally from 52.9 in January but lower than the earlier flash reading of 53.3, the PMI data unable to show the extent to which recent actual GDP growth has been supported by the public sector rather than the private sector that the survey actually covers. CBI industry survey data (Fri) may provide an alternative survey insight, albeit to manufacturing.

Public borrowing numbers (Tue) will perhaps provide fewer signs of any undershoot of the OBR budget deficit target. Retail sales may see a fall of around 1% m/m, continuing the sharp saw-tooth pattern of late, partly a result of wild and unseasonable weather. GfK consumer survey data may show fresh weakness, a possible reaction to the Budget.

Eurozone

Datawise, the main event are PMI flashes on Thursday, where we see a small drop back in the composite. Indeed, having risen from 47.9 in January to an eight-month high of 49.2 last month, the index signalled an apparent near-stabilisation of the EZ economy. A rejuvenation in the service sector was evident, where activity levels rose for the first time since July last year. The downturn in the manufacturing sector, albeit cooling, continued to offset this, however.

Other business surveys are due, including the German Ifo figure (Fri) and the ZEW survey (Tue), both where some small correction may be in the offing. That may also be the case for the EU consumer confidence numbers (Wed) too. Tuesday also sees more comprehensive Q4 labor costs data, numbers that may be touched upon by either/both President Lagarde and Chief Economist Lane in appearances on Wednesday

Rest of Western Europe

There are key central bank meetings both on Thursday. In Norway, unlike, January’s Norges Bank meeting, the decision(s) due on Mar 20 will be far from a non-event. The Board will surely leave rates on hold for a second successive meeting, and may even retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhetoric. However, the updated Monetary Policy Report, which will incorporate a much lower than expected underlying inflation backdrop, alongside side less weak activity, may leave more clear scope (if not rationale) for a cut in rates in Q2, rather than in the autumn as existing Norges Board projections point to.

In Switzerland, no change in SNB policy is expected at the quarterly assessment, but It is noteworthy that the Board has already started to the reverse the policy course it initiated some two years ago, having dropped formally in December plans of further FX sales. But now it is seemingly doing the opposite to a degree that is seeing its balance sheet re-expand. Moreover, having also dropped any notion of further rate hikes in December that also saw a revised inflation projection envisaging an even clearer and sustained undershoot of the target out to 2026, it created a rationale for cutting the policy rate sooner rather than later, something that may help chime with its aspiration to stem Franc strength.

Japan

All eyes on BoJ’s interest rate decision next Monday to Tuesday. Our central forecast remains for a change in forward guidance and a chance to officially scrap the YCC protocol. They will state that they now see trend inflation’s target achievable and would be moving interest rate to 0% in April after ensuring wage growth for small and medium firms are consistent with the large names (Mar 22 and Apr 3 are the second and third round of negotiation for smaller firms). We also have trade data on Wednesday, Mar 20. It will be providing indicative data on domestic demand and global demand, which will be important to consider for Q1 GDP.

Australia

RBA interest rate decision is also on Monday but no fireworks are expected. Current inflation figure does not support RBA to cut as it is still way above inflation target, nor it needs further tightening for inflation has been moderating slightly faster than expected. Thus, it would be a surprise if RBA changes monetary policy. Else, we have slate of PMI and employment report on Wednesday, Mar 20. It is expected that we will see a minor rebound in the report after two consecutive month of disappointment but very likely the under momentum will be weak.

NZ

GDP on Wednesday, Mar 20 and Trade Balance on Thursday, Mar 21 are both unlikely to move markets with the RBNZ signalling no change to monetary policy in the latest forecast.