FX Daily Strategy: Europe, June 18th

GBP could slip if CPI dips

SEK can fall on Riksbank cut

USD to hold steady through FOMC

JPY weakness reaching extremes with risk premia likely close to lows

GBP could slip if CPI dips

SEK can fall on Riksbank cut

USD to hold steady through FOMC

JPY weakness reaching extremes with risk premia likely close to lows

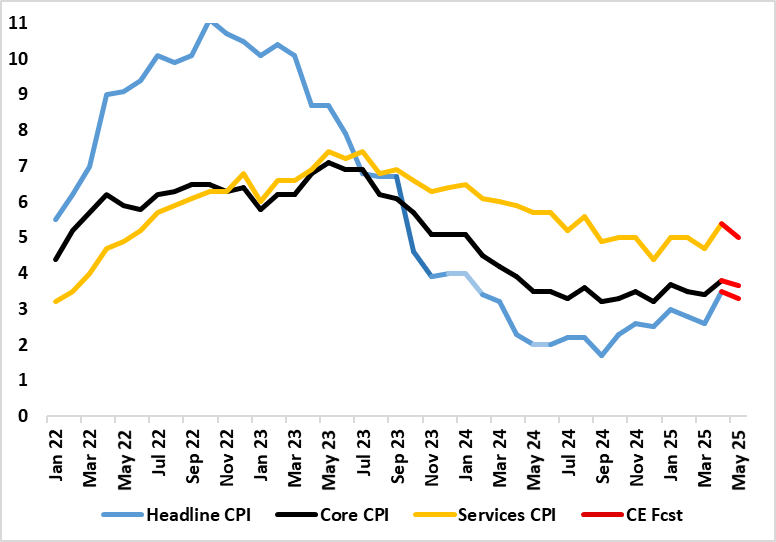

April CPI Inflation Jumped Broadly – Albeit Temporarily?

Source: ONS, Continuum Economics

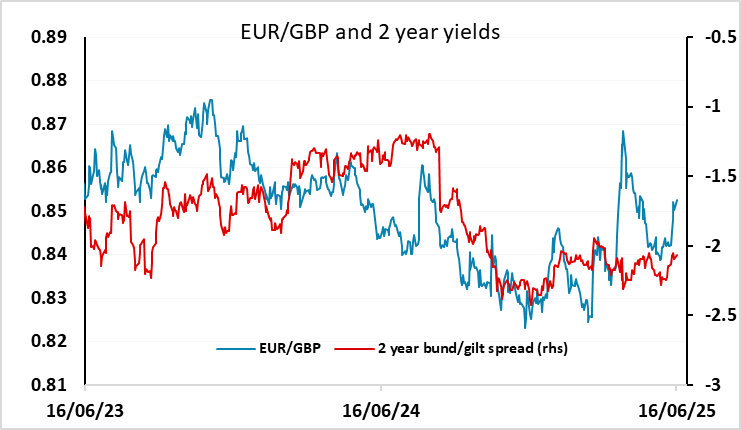

UK CPI will be the main data of the day in Europe on Wednesday. The UK and the rest of the DM world have been decoupling, at least in terms of inflation, where the UK has undergone a surge, (largely home-grown) just as W Europe sees their inflation fall back. In the April data a series of energy, utility, post office and some other regulated and service price rises produced a print a notch higher than the BoE expected with a jump to 3.4%. But the timing of Easter may have been a partial factor and this should unwind in the looming May CPI. Our forecast is in line with the consensus in expecting the headline rate to drop to 3.3% and the core to 3.5%. The risks for GBP looks to be slightly on the downside, as the market is only pricing around a 10% chance of a 25bp BoE rate cut on Thursday, and after the weak labour market data last week we would expect at least two votes for a cut. A weak CPI number could potentially increase that number, and at least weight towards a dovish statement. EUR/GBP has, however, traded higher in the last week already, beyond the level suggested by yield spreads, so there may be a slight retracement lower on neutral data.

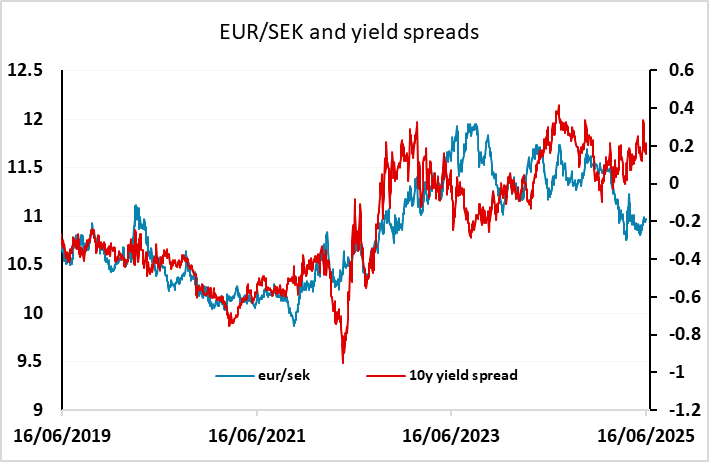

The Riksbank meeting will be the other focus in Europe. 14 of 16 forecasters expect a 25bp cut this time around, and we concur with this view. The Board may even then suggest that further moves are possible. This may seem stretched given that the Riksbank has virtually called a halt to the easing cycle, albeit most recently (May 8) suggesting downside risks to its inflation outlook might warrant a slight easing going forward. Our thinking has hitherto reflected both below par survey data (suggesting difficulties in predicting future business conditions) and better inflation outcomes. Indeed, a Riksbank business survey now suggests that what green shoots had appeared have fizzled out while the latest CPI numbers suggest an absence of inflation, and unemployment has come in higher than expected. The market is not fully priced for a cut, so we do see some downside for the SEK, especially since EUR/SEK has been trading below the level suggested by current yield spreads.

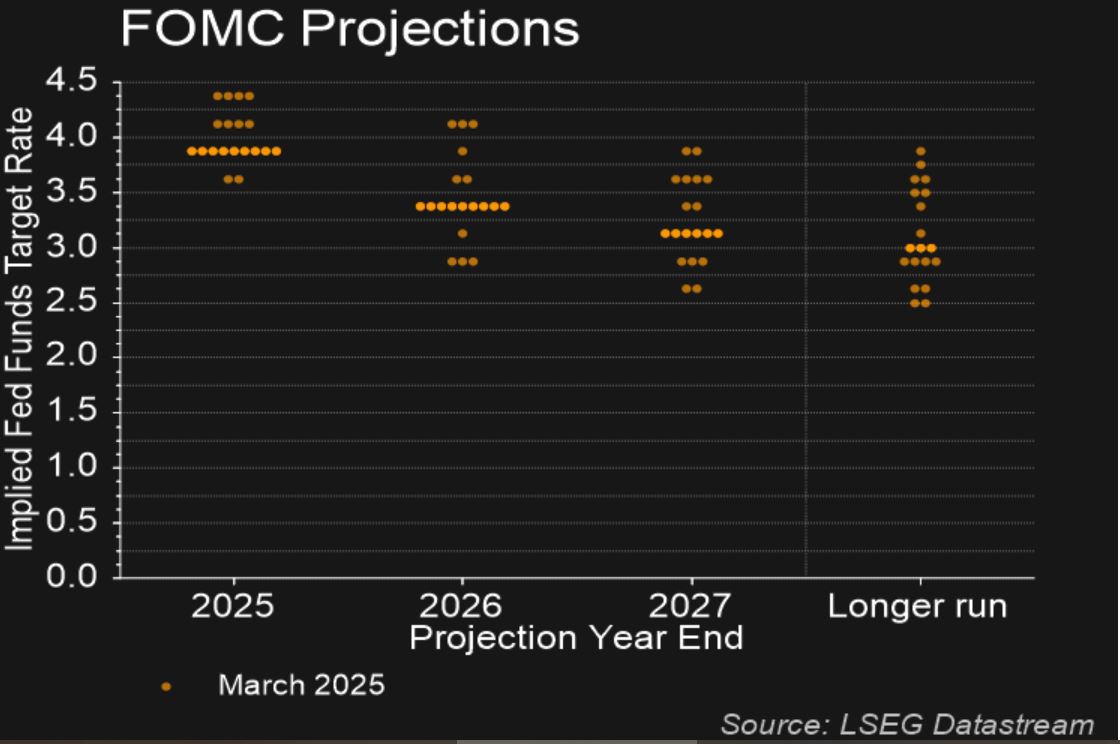

The FOMC decision will be the main US focus on Wednesday, although there is no real doubt that the Fed will leave rates unchanged. We expect only marginal changes to May’s statement and the Fed’s median forecasts from March, with no change at all in the median dots on rates. Chairman Powell at the press conference may welcome recent signals on inflation, but given uncertainty over tariffs, will state more information is needed before easing. As it stands, the market is pricing a 25bp Fed cut in either September or October, and the most that can really be expected from the meeting is for the market to be pushed to one or other of these. Inasmuch as the inflation data have been marginally on the soft side, the bias may be towards the cut being brought forward towards September. Even so, we wouldn’t expect any notable USD impact, with EUR/USD in particular quite in sensitive to movements in yields spreads of late. For the moment, with geopolitics having largely usurped tariffs as the main news and main focus of the US administration, economic news looks likely to play second fiddle. But even the Middle East news hasn’t tended to have a sustained market impact, so in the absence of more news on tariffs, broad USD stability looks likely to be the order of the day.

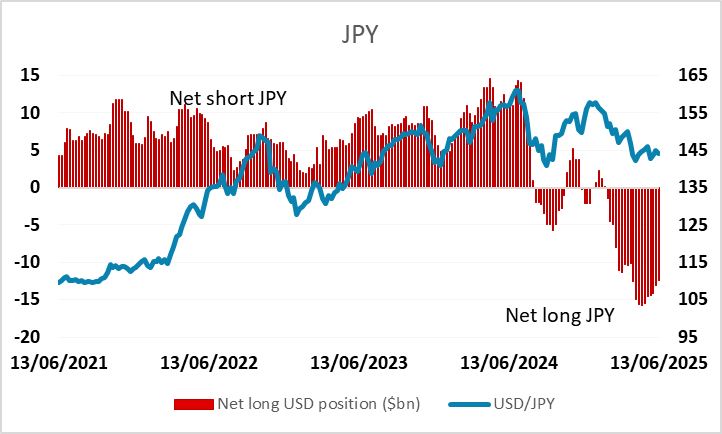

While we don’t see a big general move in the USD, there is scope for moves on the crosses, driven by risk sentiment. The JPY has been under pressure for some weeks, in part no doubt due to speculative positioning, which has been long JPY for some time according to the CFTC data, but mainly because of the resilience of risk appetite in the face of both tariff and geopolitical threats. But we see very limited scope for further equity market gains in the absence of a significant decline in yields, so JPY risks should now be shifting to the upside.

CFTC data on speculative USD/JPY positioning