FX Daily Strategy: Europe, December 12th

ECB likely to cut 25bps, mild EUR upside risks

SNB favoured to cut 50bps, suggesting CHF to decline, but maybe only short term

AUD recover on strong employment report

ECB likely to cut 25bps, mild EUR upside risks

SNB favoured to cut 50bps, suggesting CHF to decline, but maybe only short term

AUD has potential to recover if employment report shows strength

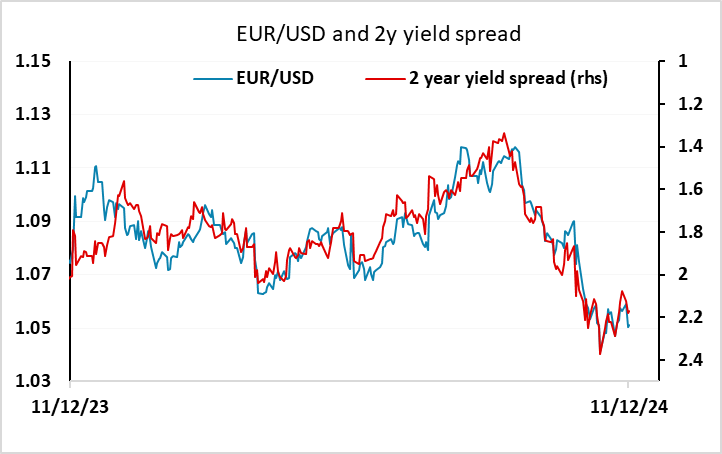

The highlights of a busy Thursday are the SNB and ECB meetings. The market is pricing a 25bp ECB cut as an 85% chance with a 50bp cut just a 15% chance, so there is only modest scope for EUR gains if the ECB act as expected. But if they only cut 25bps but sound more dovish than expected, the EUR could still decline, although the starting point for EUR/USD looks slightly low relative to 2 year yields spreads, so risks are modestly on the upside. This meeting may be as important for what may be a change in forward guidance in which the ECB accepts that on-target inflation is likely to be durable enough to end policy restriction in due course. In this regard, the first glimpse of 2027 economic projections may support this as they may point to a second successive year of around-target inflation. But with the growth outlook for 2025 also likely to be pared back, we think this transition will involve four 25 bp cuts in H1 next year, with an ensuing around-neutral 2% policy rate. However, the current market pricing already has a policy rate of 1.8% by June, so there doesn’t look to be much downside risks to rates or the EUR.

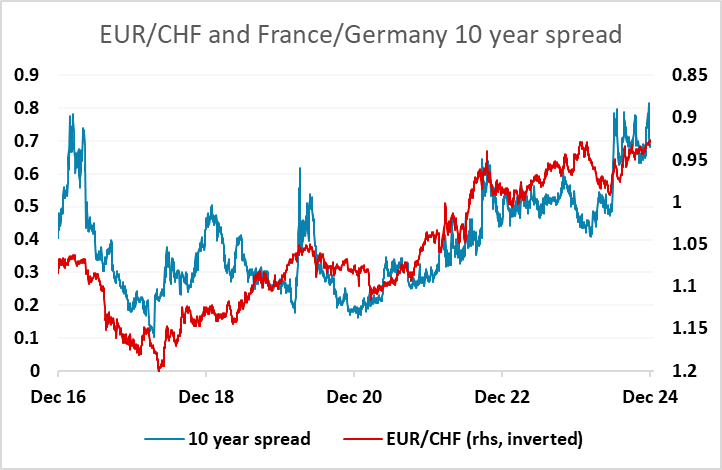

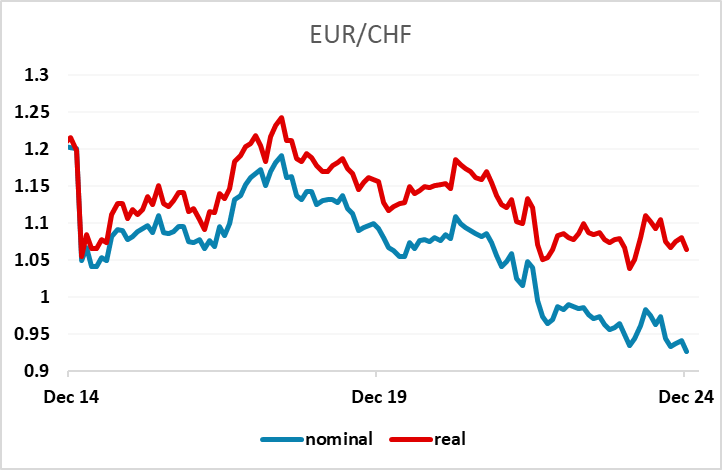

The SNB decision looks to be much more in the balance. The market is priced 60-40 in favour of a 50bp cut from the SNB over a 25bp cut. EUR/CHF can be expected to rise if they cut 50bps, fall if they cut 25bps, although the weakness of EUR/CHF in recent weeks suggests downside is more limited if there is no other clear EUR negative news. The SNB decision may be swayed by the weakness of EUR/CHF, with EUR/CHF now approaching the historic real terms lows. Whether that will be enough to prevent further EUR/CHF losses is nevertheless unclear. The CHF rarely responds much to interest rate moves in anything other than the short term. For EUR/CHF to recover, there may need to be some evidence of a better performance from the Eurozone economy and some political stability in France and Germany. France in particular remains a focus as widening France/Germany spreads will tend to put upward pressure on the CHF. But in the short run we favour a 50bp cut and a EUR/CHF move higher above 0.93.

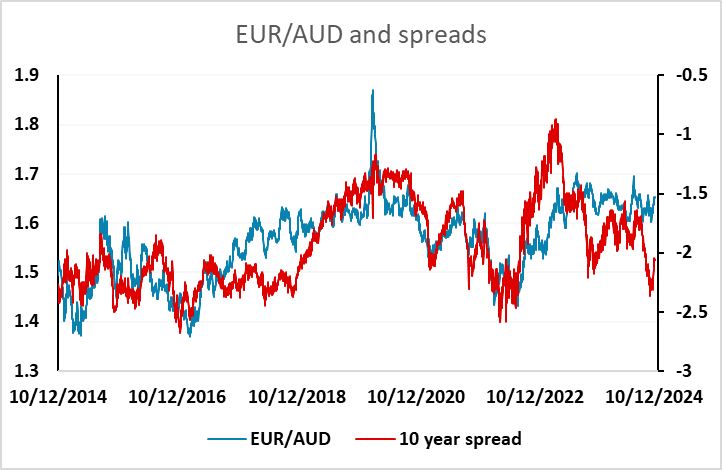

Ahead of the rate decisions in Europe there is Australian employment data. The AUD has been particularly weak of late, with AUD/USD hitting new lows for the year on Wednesday. This has been partly driven by some soft Australian data, with Q3 GDP disappointing, while the RBA were also seen as a little more dovish than expected. But the AUD has been much weaker than looks justified by these relatively minor domestic issues, with the RBA still likely to be less dovish than most going forward, and yield spreads suggesting the AUD is cheap against both the USD and the EUR. It was notable that GBP/AUD made a post-pandemic high on Wednesday, trading above 2.01, but this looks to be as much a GBP story as an AUD story, with UK yields remaining relatively attractive. In any case, here should be more scope for an AUD recovery on strong data than a decline on weak data after the recent weakness.

The headline unemployment rate fell to 3.9% from 4.2% and headline job growth is robust at 35.6k with a large chunk of it come from full time employment. It is a report RBA would be happy to see as they are pushing back early cut after such huge beat of expectation. However, the RBA had also acknowledged the dynamic between tighteness in labor market and wage grwoth has been weakened, add a pint of salt on this Aussie strength.